By Michael Kuser

Adjusted EBITDA for the quarter was $333 million, a slight decline from 2018.

The drop in income from continuing operations was “driven by retail gains and partially offsetting generation losses on mark-to-market hedge positions in 2018 as a result of ERCOT heat rate expansion and increases in electricity prices,” the company said.

“Our integrated platform delivered strong first-quarter results,” CEO Mauricio Gutierrez said. “We are preparing for summer operations and executing on our capital allocation priorities, including returning capital to shareholders.”

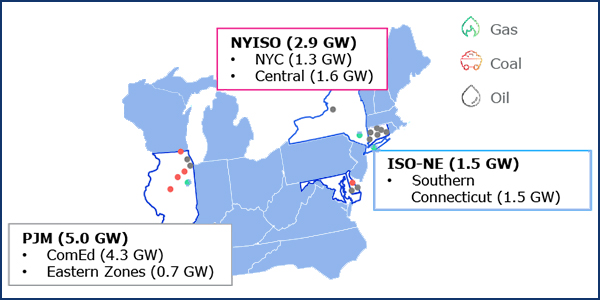

NRG east generation fleet | NRG

The company highlighted having completed $500 million of its $1 billion share buyback program, as well as the planned June 2019 return to service of its 385-MW Gregory combined cycle plant in Corpus Christi.

In an ERCOT market update, the company said it sees reserve margins continuing to tighten as new builds lag demand growth, and that its retail business is prepared for summer volatility. The company is relying on enhanced demand management programs, hedges on “priced load,” expanded maintenance and excess generation to see it through the summer.

NRG said it also plans to complement its fleet with power purchase agreements.

PJM, ISO-NE

In its Eastern markets, the company highlighted that FERC Orders Fast-start Rules for PJM, NYISO.)

The company said it views current ISO-NE fuel security proposals as insufficient.

The RTO in March filed an interim proposal with FERC to address winter energy security for the commitment periods covered by Forward Capacity Auction 14 (2023/24) and FCA 15 (2024/25), a voluntary two-year program to “provide incremental compensation to resources that maintain inventoried energy during cold periods when winter energy security is most stressed.” (See ISO-NE Filing, Whitepaper Address Energy Security.)

NRG said it completed the sale of its Renewables Platform and its interests in NRG Yield on Aug. 31, 2018, and the South Central Portfolio on Feb. 4, 2019.

“As a result, 2018 financial information for the South Central Portfolio, NRG Yield, the Renewables Platform and Carlsbad Energy Center was recast to reflect the presentation of these entities as discontinued operations,” NRG said. The South Central Portfolio ($1 billion) and Carlsbad Energy Center — sold to Global Infrastructure Partners on Feb. 27 for $385 million — were also treated as discontinued operations through their dates of sale this year.