By Christen Smith

The Independent Market Monitor last week fired back at PJM’s request that FERC dismiss its complaint about the RTO’s default market seller offer cap (MSOC), saying the grid operator lacks understanding of the core problem.

In an April 30 filing with the commission, the Monitor scoffed at PJM’s defense that its initial complaint, filed in February, didn’t prove that current rules encourage abuse of market power (EL19-47). The RTO had also argued that it is unlikely that previous Base Residual Auctions “suddenly became unjust and unreasonable” after FERC’s approval of its Capacity Performance construct just four years ago. (See PJM: Dismiss Monitor’s Offer Cap Complaint.)

“The assertion that the system conditions have not ‘drastically changed’ since 2015 has no basis in fact and would surprise any objective observer of PJM markets,” the Monitor wrote.

In PJM’s capacity auctions, the default MSOC functions as the “mitigated” offer level, with offers coming in above that level automatically prompting a review for market power by the Monitor. The IMM’s longstanding complaint remains that PJM’s default MSOC has been inflated by the “unreasonable and unsupported” expectation of 30 performance assessment hours (PAHs) annually. As a result, the Monitor said, it has been prevented from effective mitigation of market power, able to subject only a small number of very high offers to unit-specific cost reviews.

The timespan for measuring performance was changed from PAHs to five-minute performance assessment intervals (PAIs) in compliance with FERC Order 825 in 2018. PJM triggers a PAI when it determines a supply reliability issue exists, providing credits for generators that overperform their capacity commitments and penalties for those that underperform.

So far, only one load shed event has occurred within PJM since the CP overhaul in 2015. The event spurred stakeholder action to revise the MSOC calculation, with four proposals failing to garner enough support for inclusion in the Tariff. PJM subsequently dropped the issue, insisting no further investigation was required. (See PJM MRC/MC Briefs: Oct. 25, 2018.)

“Stakeholders’ role is not to make evidentiary determinations,” the Monitor wrote. “That a stakeholder body with divergent financial interests could not agree on another number to use for the expected PAI, with its significant implications for the market seller offer cap and/or the penalty rate, is not justification for PJM’s inaction.”

In August, the Monitor concluded that ratepayers were overcharged by $2.7 billion (41.5%) in the 2018 BRA because of economic withholding encouraged by the inflated MSOC.

“That an overstated MSOC interferes with effective and efficient market power mitigation is undisputed,” the Monitor wrote, noting that PJM “knows the exact details” of which companies and units asserted market power in the 2021/22 BRA.

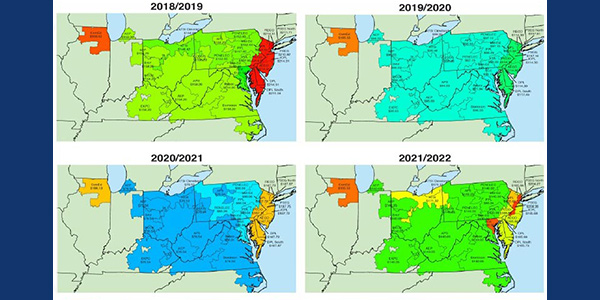

Further, the Monitor referenced commission directives that instruct PJM to submit five-year informational reviews to evaluate existing rules and reassess the PAHs after gaining experience using the new market design. Auctions “repeatedly” clearing “well below” the default MSOC and with installed reserve margins well above target provides sufficient evidence of a problem.

“The 30 PAH was clearly overstated at the time, even based on the polar vortex experience, and the evidence since 2014 shows that the Capacity Performance model and incentives have resulted in a significant reduction in forced outages, an improvement in incentives and performance, an increase in reserves, and that the 30 PAH is even more overstated today,” the Monitor concluded.

The MSOC issue remains just one of seven outstanding PJM-related dockets with FERC. The Monitor reiterated its belief that the RTO should hold off on all future BRAs until the commission rules on the MSOC — despite PJM’s commitment to move forward with the August auction as planned.