FERC last week ordered settlement judge procedures for four challenges regarding Emera Maine’s proposed transmission rate, summarily deciding on four other challenges and ordering the utility to make a compliance filing within 30 days (ER15-1429).

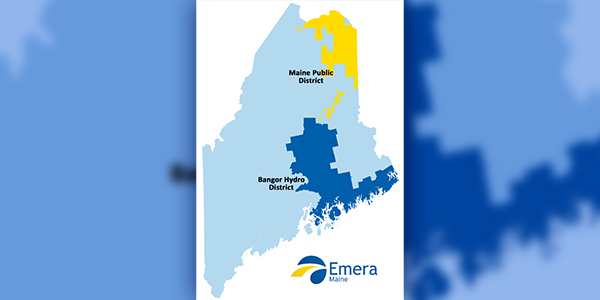

The commission’s April 30 order accepted in part the challenges to Emera Maine’s annual update filed in May 2018 by the Maine Public Utilities Commission and a customer group. The update proposed transmission service charges to take effect June 1, 2018, under the company’s Open Access Transmission Tariff (OATT) for the Maine Public District, which includes Aroostook County and a small piece of Penobscot County. (Emera Maine provides service under a separate OATT to the Bangor Hydro District: Hancock, Piscataquis and Washington counties and most of Penobscot County.) The customer group included Eastern Maine Electric Cooperative, Houlton Water Co., the Office of Maine Public Advocate, and Van Buren Light and Power District.

The order summarily decided on the correction of certain acknowledged errors in the 2018 annual update, the exclusion of certain costs for land associated with a project not in service, the exclusion of some distribution costs equipment from transmission rates, and the flowback of excess accumulated deferred income taxes (ADIT).

Settlement Issues

The commission said the remaining issues raise questions of material fact that it could not resolve based on the record before it and should be decided at a hearing if not resolved through settlement. The commission directed the chief administrative law judge to appoint a settlement judge within 15 days of the order.

Among those issues are excluding certain regulatory expenses that the complainants say were improperly allocated or directly assigned to Maine Public District transmission customers and excluding costs that may constitute a double-recovery for amortization of merger-related losses.

Two remaining issues are whether to exclude costs attributed to a rebuild of Line 6901 (which opponents say were incurred prior to MPUC authorization and should be considered as a canceled project) and whether some costs attributed to the rebuild should be attributed to other projects.

New Owner

On March 25, ENMAX Corp. announced it had reached an agreement to purchase Emera Maine for $959 million ($1.286 billion CAD) from parent Emera Inc.

The sale is part of Emera’s plan to reduce corporate debt and fund its three-year capital investment plan. Emera said the deal, and the previously announced sale of its New England gas generation portfolio will raise about $2.1 billion CAD.

ENMAX, based in Calgary, Alberta, owns and operates transmission, distribution and generation facilities throughout the province, with 669,000 electricity, natural gas and renewable energy customers.

The deal is expected to close late this year.

– Michael Kuser