By Christen Smith

FERC gave PJM stakeholders just 90 days to settle all disputes about how to best liquidate financial transmission rights left over from the GreenHat Energy default before kicking off a paper hearing on the RTO’s request to clarify a previous ruling related to the debacle.

In an order issued Tuesday, FERC encouraged conflicting parties to hammer out disagreements ahead of the hearing under the guidance of a settlement judge, who will report progress on the discussions to the commission at the 45- and 90-day marks (ER18-2068). A one-time extension may be granted for 30 days, FERC said.

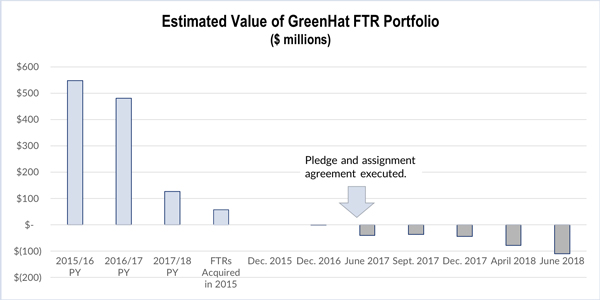

The order also granted PJM’s motion for clarification on its denied petition to waive its liquidation rules, which has complicated the RTO’s efforts to minimize the damage of the default and potentially increases costs to members by $300 million. (See PJM: FERC Order Could Boost GreenHat Default by $300M.)

In the absence of a rehearing, PJM had requested clarification on six different issues arising from the rejected waiver order that would force the RTO to unwind five months of FTR settlements and rerun the cleared July 2018 auction.

“The issues raised in the PJM motion for clarification and the subsequent answers demonstrate that there are multiple complexities associated with implementing the waiver order directive that should be addressed in a paper hearing where all parties will have an opportunity to present written evidence and argument,” the commission wrote.

Apogee Energy Trading and Elliot Bay Energy Trading both filed answers to PJM’s motion, with the former urging the RTO to follow Tariff provisions as closely as possible when rerunning the July auction using uncleared bids that do not violate the simultaneous feasibility test. The company argued the RTO’s motion favors one group of stakeholders over another “in terms of the allocation of the GreenHat default and by misrepresenting and potentially overstating the impact of the GreenHat default on the PJM market.”

Elliot Bay likewise complained that PJM’s proposed implementation steps would violate the filed rate doctrine and the related rule against retroactive ratemaking. “The PJM motion for clarification raises numerous issues of material fact that should be addressed in a technical conference, hearing or stakeholder process,” the company wrote in its March 13 filing.

PJM said, “There’s nothing simple about rerunning an auction and settling market positions” and contended that the accusations of discrimination were unsupported.

“While we are setting these matters for a paper hearing, we encourage the parties to make every effort to settle their disputes before the paper hearing commences,” FERC wrote, noting the paper hearing will be delayed to give enough time for negotiations. “Although the paper hearing is limited to PJM’s motion for clarification, we are not establishing similar limitations on the scope of the settlement discussions, and the parties are encouraged to address all disputes arising out of this proceeding.”

“We’re pleased that the commission set the matter for settlement,” PJM spokesperson Jeff Shields said Wednesday. “And we are hopeful that we will reach a resolution of the issues.”