By Amanda Durish Cook

CARMEL, Ind. — A key annual capacity report issued by MISO and the Organization of MISO States predicts the RTO is now unlikely to face a near-term shortfall in generation — a welcome reversal of last year’s more worrisome findings.

Credit the change to expectations for flat demand and the promise of ample resource additions.

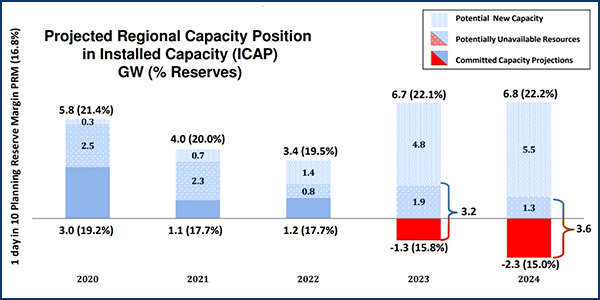

The survey released Friday forecasts a generation surplus of about 3 to 6 GW in 2020, though the RTO says “continued action will be needed to ensure sufficient resources are available going forward.” Last year’s survey forecasted a possible 0.1-GW shortfall in 2020.

Unsurprisingly, OMS and MISO say the future through 2024 could bring a “range” of resource amounts, but the survey no longer predicts any regional shortfalls in generation before 2022.

Using this year’s 16.8% planning reserve margin as a baseline, the survey predicts a 1- to 4-GW surplus in 2021. By 2022, that excess dwindles to 1 to 3.4 GW. The range of possibilities in 2023 and 2024 varies the most, with the forecast indicating anything from a 1.3-GW shortfall to a 7-GW surplus in 2023, and a 2.3-GW shortfall to another 7-GW surplus in 2024.

MISO said more than 97% of its load-serving entities and additional non-LSE market participants responded to the survey.

Last year’s survey showed MISO’s footprint could see anything from a 7.5-GW surplus to a 4.5-GW shortfall from 2020 to 2023 and predicted spare capacity ranging from 0.6 to 6.6 GW this year. (See OMS-MISO Survey Reveals Dimmer View of Future Supply.) The newest survey results are also a far cry from the 2016 iteration, where MISO said a generation shortfall was possible in 2018.

But during a call Friday to discuss the results, MISO staff cautioned that the 2019 survey results will differ from future realities. MISO Executive Director of Resource Planning Patrick Brown stressed that capacity deficiencies could occur “if no action is taken.”

MISO said certain Midwestern zones could develop the greatest resource adequacy risks, including Southern Illinois’ Zone 4, Indiana and western Kentucky’s Zone 6, and Lower Michigan’s Zone 7. MISO said it foresees “lower resource commitments” in those areas in 2020 and beyond, including a possible 0.2- to 0.7-GW deficit in downstate Illinois and a potential 0.9-GW shortage in Lower Michigan in 2020.

But a possible capacity shortfall isn’t an immediate concern even in those areas, Brown said.

“Zones with deficiencies don’t automatically have a resource adequacy risk as they can use surplus resources outside of their zone … taking advantage of MISO’s footprint diversity. … They do have the option to import capacity into their zones to meet their local needs,” Brown said.

Brown also said those areas have ample time to adjust to ensure appropriate capacity. Contrary to OMS-MISO results, the Michigan Public Service Commission has said that state will have sufficient capacity in place to meet obligations through 2022, he noted.

As with prior reports, MISO’s demand growth rate is set to decline again, with the five-year annual rate adjusted to 0.2%, down from a 0.3% projection in 2018.

“Fewer resources are needed to serve load,” Brown said.

MISO has only expected “modest” changes in peak load over the next five years, anticipating a 4.4-GW variance in expected system peak, with electric vehicles adding about 1 GW in demand by 2023. The RTO doesn’t expect its current approximate 120-GW peak predictions to be “radically different” within five years, market design team member Dustin Grethen said at a June 6 Market Subcommittee meeting.

As of May, MISO’s generator interconnection queue consisted of 640 projects totaling 100.7 GW, nearly 30 GW of which (210 projects) are solar generation.

Brown also said this year’s survey shows significant amounts of generation retirements, with “a mix of wind, solar storage and gas” as well as load-modifying resources lined up in the interconnection queue set to replace them. MISO does expect emergency declarations to become more frequent as a result, he said.

The RTO plans to post and discuss the survey results in more detail, including a zonal breakdown, at its July Resource Adequacy Subcommittee meeting.