NEWPORT, R.I. — A new effort by the New England Power Pool could give ISO-NE’s most “senior” board members a longer shot at keeping their positions rather than aging out of eligibility.

The NEPOOL Participants Committee on June 25 approved a motion to ballot all members on a proposal to amend the Participants Agreement to allow people older than 70 to serve on the RTO’s Board of Directors.

Members will specifically vote on authorizing the Joint Nominating Committee to waive the current 70-year-old age limit for candidates to stand for election or re-election, just as it now is authorized to waive the limit on three consecutive full terms.

According to a memo from PC Counsel Pat Gerity, RTO representatives told NEPOOL officers that the age limit reduces the pool of qualified candidates, risking the loss of “highly qualified and broadly supported board members” who turn 70. Without a waiver, Director Roberto Denis would age out next September after serving only two terms.

Janice Dickstein, ISO-NE vice president for human resources, said that while corporate boards increasingly rely on age limits rather than term limits, the RTO’s age cap is more restrictive than 90% of organizations. She noted that most people serve on boards in their retirement, and that it takes time to get new board members up to speed on the issues specific to the region.

The PC approved the motion to issue the ballots with 76.88% of sectors in favor (Generation, 11.19%; Transmission, 16.79%; Supplier, 13.59%; Alternative Resources, 16.04%; Publicly Owned Entity, 16.46%; and End User, 2.81%).

For the PC to approve the amendment, the returned ballots need to represent at least half of fixed voting shares in each of a majority of NEPOOL sectors and achieve an overall 70% vote in favor.

The PC also approved balloting members on changing a sector definition, with Gas Industry proposed to become Fuels Industry. Subject to a positive vote and FERC acceptance, the American Petroleum Institute may apply to join NEPOOL as a Fuels Industry participant.

No Easing of Credit Requirements

The PC voted down a motion to change ISO-NE’s Financial Assurance Policy (FAP) to allow market participants to use affiliate parent guarantees to obtain “an unsecured market credit limit or transmission credit limit” or use surety bonds “as an acceptable form of financial assurance.”

The vote was 45.13% in favor (Generation, 16.79%; Transmission, 0%; Supplier, 11.55%; Alternative Resources, 9.44%; Publicly Owned Entity, 7.35%; and End User, 0%).

The proposal was sponsored by Calpine Energy Services, Direct Energy Business, Dominion Energy Generation Marketing, Exelon, Massachusetts Municipal Wholesale Electric Co., NextEra Energy Resources and PSEG Energy Resources & Trade.

The PC in 2004 voted to eliminate surety bonds from the FAP and in 2010 to eliminate parent guarantees.

ISO-NE opposed the proposal mainly as a threat to its ability to clear the markets because of reduced liquidity. It also feared that introducing weaker forms of financial assurance could result in substantial or even catastrophic losses to the RTO and its market participants.

Nested Capacity Tariff Changes Approved

The PC unanimously approved Tariff changes to accommodate the new modeling concept of nested export-constrained capacity zones in the Forward Capacity Market, starting with Forward Capacity Auction 14 to cover the one-year capacity commitment period beginning June 1, 2023.

The revisions address those cases where it’s necessary to distinguish between a parent and nested zone (which represents a sub-zone within a parent zone), such as when capacity clearing price calculations differ slightly between the two.

Most of section III.13 of the Tariff already recognizes nested capacity zones, while other sections do not specify the type of zone when dealing with reconfiguration auctions or many settlement provisions.

The first set of changes accommodate nested export-constrained capacity zones in the FCM, while the remainder clarify certain data submittals of costs and revenues for static delist and export bids in the FCM.

The RTO developed the changes, which were recommended by NEPOOL’s Markets Committee.

ISO-NE CEO/COO Reports

ISO-NE CEO Gordon van Welie told the PC that the grid operator recognizes the market has to be adapted to the changing power system.

He said the region is rapidly catching up with California and Europe in the deployment of energy storage resources, but that there are few places as constrained as New England. Nonetheless, the region has a good track record in solving problems, he said.

COO Vamsi Chadalavada reported that the RTO has so far received a record “show of interest” for FCA 14: more than 700 applications, compared to 250 for the last auction.

New capacity resource qualification is ongoing, and approximately 336 MW are available for the renewable technology resource exemption, he said.

The existing capacity resource qualification is complete, with about 258 MW of retirement delist bids and 21 MW of permanent delist bids received on March 15. Static delist bids were due June 13.

Chadalavada said the region has enough resources to replace the 690-MW Pilgrim nuclear plant, which retired at the end of May, largely with new resources coming into the market in southeastern Massachusetts.

FERC Update

FERC Commissioner Cheryl LaFleur, who is leaving the commission at the end of August, spoke of three broad themes facing the commission: resources for reliability, how to pay for them and needed infrastructure. She said the commission has the choice of regulating in a planned way by giving authority back to the states, or in an unplanned way by letting the market be cannibalized.

LaFleur said she looks forward to seeing NYISO’s carbon pricing proposal when it is submitted and also suggested to the industry that now is not the time to submit filings containing open-ended legal questions, but rather agreements that parties have worked out among themselves.

She congratulated NEPOOL on being vital to the region, but she noted that the organization was not without controversy, mainly concerning its transparency, as evidenced by congressional hearings earlier in June, when Rep. Joe Kennedy III (D-Mass.) told her that “unless you are a member, you can’t even observe any meetings or proceedings, let alone talk about it publicly.” (See FERC Probed on RTO Governance, Market Issues.)

Jette Gebhart, deputy director of FERC’s Office of Energy Market Regulation, told the PC that commission staff are busy now working through energy storage compliance filings.

EMM Report

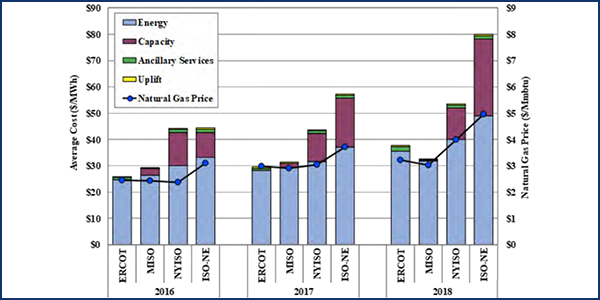

ISO-NE last year had the highest energy prices of any RTO because of high natural gas costs, as well as the highest net revenues because of higher capacity revenues, External Market Monitor David Patton said, highlighting his still unpublished 2018 assessment of the ISO-NE markets.

The assessment shows ISO-NE had about one-tenth the congestion of other RTO markets because of substantial transmission investments over the past five years. However, transmission service costs were more than double the average rates in other RTO markets, Patton noted.

The first 13 FCAs reflect the retirement of nearly 5 GW of nuclear, coal and older steam turbine capacity, with increased reliance on gas-fired capacity. Fuel security concerns are heightened by the potential retirement of Exelon’s Mystic Generating Station and the Distrigas LNG facility, Patton’s report noted.

The EMM’s baseline scenario fuel security evaluation for a two-week severe winter period shows very high utilization of oil inventory capacity and the need for LNG import capability, while load shedding would occur in a scenario with major reductions in natural gas availability.

The RTO’s operational fuel security analysis (OFSA) last year also found tight fuel supply margins that could result in load shedding in the winters of 2022-2023 and 2023-2024, and in March ISO-NE filed an interim proposal with FERC to address winter energy security for those commitment periods. (See NEPOOL MC Debates Energy Security Models.)

Consent Agenda

The PC approved four rule changes on the consent agenda, following unanimous approvals at lower committees:

- OP-14 Appendix B (Reporting Requirements for Asset Related Demands and Dispatchable Asset Related Demands): Revisions to establish reporting requirements and cleanup changes to improve document flow. Recommended by the Reliability Committee.

- Tariff Section III.1.5.3: Revisions to include all dynamic resources in reactive capability audit requirements and specify criteria for such resources to perform such audits. Recommended by the Reliability Committee.

- Tariff Section I.2.2, OP-23 and OP-23G: Revisions related to reactive resources required to perform reactive capability auditing. The PC approved them with the understanding that two additional Tariff definitions would go back to the Reliability Committee, which recommended the measure.

- Revisions to Tariff Section II Schedule 2 to accommodate introduction of energy storage facilities and other administrative changes. Recommended by the Transmission Committee.

— Michael Kuser