CRR Auction Revenues vs. Payments Improve

By Hudson Sangree

A huge spike in natural gas prices drove up the cost of wholesale electricity in CAISO by more than 40% in the first quarter of 2019 compared with the same period a year ago, the ISO’s Department of Market Monitoring reported.

However, the disparity between income and payments for congestion revenue rights dramatically improved since the first quarter of 2018, lessening costs for ratepayers, the department said.

The Monitor reported the mixed first-quarter results in a July 2 web conference.

Amelia Blanke, CAISO manager of monitoring and reporting, said it cost about $2.7 billion — or $55/MWh — to serve load in the ISO’s territory during the first three months of this year. That was a 42% increase from Q1 2018.

Gas prices were 73% higher in the first three months of 2019 than they were in the first quarter of 2018, the Monitor reported. Lower temperatures, high heating demand, and supply constraints led to gas prices that more than doubled from January to February of this year.

“High natural gas prices in February 2019, at both SoCal and PG&E Citygate, were the main driver of high system marginal energy prices across the ISO footprint,” the Monitor said in its Q1 Report on Market Issues and Performance.

As a result, average day-ahead electricity prices increased “by around $17/MWh (almost 50%), 15-minute by about $15/MWh (45%) and five-minute market prices by $13/MWh (35%) in comparison to the same quarter in 2018,” it said.

The Monitor noted that natural gas units are often the marginal source of generation in CAISO and the rest of the West.

The Northwest Sumas gas hub in the Pacific Northwest saw record high gas prices during the winter months of 2019.

“The price spike comes amid limited supply deliverability and unseasonably cold temperatures, which drove up demand in the Northwest,” the Monitor said. “Prices at the Sumas gas hub have been volatile since the Oct. 9, 2018, Canadian gas pipeline explosion reducing imports into hubs in the Northwest.” (See NW Price Spike a Wake-up Call,’ Ex-BPA Chief Says.)

The high gas prices were offset by increased generation from wind and hydroelectric resources.

“Compared to 2018, hydroelectric production in the first quarter increased by roughly 47%,” the report said.

The extremely wet winter in California increased snowpack to 175% of normal on April 1, compared to 58% of normal on the same date in 2018.

Compared to the first quarter of 2018, wind production increased while solar production dropped slightly, despite increased solar capacity. “This was likely due to greater curtailments resulting from high hydro and wind production,” the Monitor said. “In March 2019, renewable curtailment reached record levels, roughly 125,000 MWh.”

“The ISO became a net exporter on average during peak solar hours [noon to 3 p.m.] over the entire quarter, as imports fell and exports increased in these hours relative to prior quarters,” the Monitor added.

Closing the Gap in CRRs

The first-quarter 2019 results also suggested that changes CAISO implemented last year to CRR auctions are working.

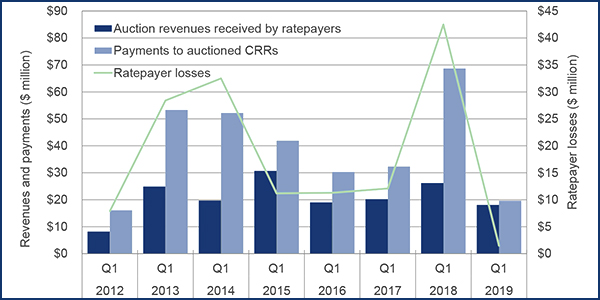

The Monitor reported that income from the auctions fell short of payments to purchasers by $1.5 million in the first quarter of 2019 — a sharp drop from the $43 million difference in the first quarter of 2018.

Payments and revenues were closer to parity than in any first quarter since 2012, the Monitor reported.

Ratepayers have been covering big losses in the CRR auctions since they were implemented in 2009. The total loss is now about $860 million, the Monitor said in its report. (See CAISO Q4 CRR Revenues Falling Short After Summer Surplus.) The main beneficiaries have been financial entities that purchase the CRRs, betting on profits.

“The decrease in losses to transmission ratepayers from sales of congestion revenue rights is due in part to changes to the auction implemented by the ISO in 2019, which limit the source and sink of congestion revenue rights that can be purchased in the auction,” the Monitor said.