By Hudson Sangree

FERC on Wednesday ordered energy firm Vitol and one of its senior traders to show cause why they should not be fined for manipulating CAISO’s market to limit losses on the company’s congestion revenue rights (IN14-4).

The trader, Federico Corteggiano, had helped create software for CAISO’s CRR market and had engaged in similar market manipulation before while at Deutsche Bank, FERC’s Office of Enforcement said.

In the more recent instance, he sold power at a loss of about $4,500 to save Vitol more than $1.2 million on its CRRs, FERC’s enforcement staff alleged.

In its ruling, FERC proposed ordering Vitol to return the savings, with interest, and fining it $6 million. The commission proposed fining Corteggiano $800,000. The commission gave Vitol and Corteggiano 30 days to respond.

Vitol and Corteggiano disputed FERC’s findings in testimony and prior filings, saying the trades were intended to take advantage of high prices, not to benefit Vitol’s CRRs. FERC found the arguments unpersuasive.

In their report, FERC enforcement staff said that during five days in the fall of 2013, Vitol “sold one product — electric power — at a financial loss in CAISO’s day-ahead market to benefit its separate financial product — respondents’ congestion revenue rights. Corteggiano, co-head of Vitol’s financial transmission rights trading operation, was the architect of this scheme.”

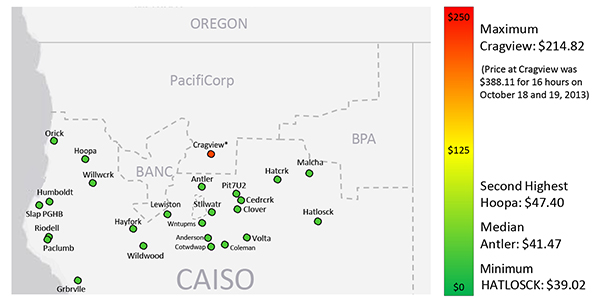

In 2013, Corteggiano purchased CRRs through CAISO’s auction for the Cragview node, the point where CAISO transfers power from the PacifiCorp-West balancing authority area in far Northern California.

The LMP at Cragview reflects 100% of the congestion on the Cascade intertie, the FERC report noted. “Vitol’s CRRs would earn money from import congestion on the Cascade intertie and lose money from export congestion,” it said.

In mid-October 2013, CAISO partially derated the Cascade intertie — limiting exports while still allowing imports during portions of late October, November and December. In October, Cragview’s LMP hit an unusual high of more than $388/MWh. Export congestion accounted for about $350/MWh of that price, FERC said.

Vitol’s export CRRs would lose money every hour. The firm was able to buy counter-flow CRRs for November and December, mitigating its losses and flattening its position, FERC said. “However, because the monthly CRR auction for October had closed, it was too late to flatten Vitol’s CRR position for the last week of October.”

Corteggiano, who holds a Ph.D. in power system engineering, found a way to get around that problem — one he’d used before, FERC staff alleged.

“Corteggiano knew that he could likely eliminate the problematic export congestion for that week by importing physical power in the day-ahead market at Cragview. Working with other Vitol employees, Corteggiano arranged to buy [5 MW of] physical power in the Pacific Northwest and successfully offered it for import at Cragview. Vitol’s imports over the Cascade intertie achieved their intended purpose, preventing export congestion from occurring during the period of Vitol’s imports. …

“Respondents lost money on the imports, but by making them, [they] were able to eliminate the export congestion and thereby avoid the far larger financial losses they otherwise would have incurred on the CRRs at Cragview.”

‘Phantom Congestion’

While at Deutsche Bank, Corteggiano had figured out how to manipulate congestion costs at another partially derated intertie linking CAISO to northern Nevada, FERC staff said. He had bought CRRs that profited Deutsche Bank when there was export congestion on the Silver Peak intertie but lost money when there was import congestion.

“In January 2010, CAISO partially derated the Silver Peak intertie to 0 MW in the import direction and 13 MW in the export direction. Import congestion appeared on the intertie, and Corteggiano’s CRRs began to lose money. Corteggiano found that he could substantially alter or eliminate what he called ‘phantom congestion’ by trading small quantities of physical power in the opposite direction of the derate,” FERC enforcement staff said.

“Corteggiano testified that ‘phantom congestion’ is ‘congestion that is not triggered by market behavior or by physical flows in the system,’” the report said. “‘Phantom congestion’ is Corteggiano’s own description of a pricing outcome rather than an industry-recognized term.

“Corteggiano admitted to Enforcement in 2010 that he made unprofitable physical trades on behalf of Deutsche Bank to benefit CRR positions that otherwise would have been harmed by the congestion associated with partial derates at Silver Peak. This was the only time in his career that Corteggiano traded physical power, until he did so at Cragview in late October 2013,” FERC said.

Enforcement staff investigated Corteggiano’s conduct at Deutsche Bank, resulting in the settlement of manipulation allegations with Deutsche Bank, a civil penalty of $1.5 million and disgorgement of $172,645, plus interest, in January 2013 (IN12-4).

At the Cragview node, “Respondents’ manipulative trading enabled Vitol to avoid paying CAISO $1,227,143 on Vitol’s CRRs,” the report said. “Moreover, respondents caused $2,515,738 in market harm consisting of (a) $2,429,385 in reduced funding of CAISO’s CRR balancing account, and (b) $86,353 in losses suffered by the holders of CRR counter-flow positions at Cragview.

“Although Corteggiano was not identified by name in the Order to Show Cause in the Deutsche Bank enforcement matter, the public Enforcement staff report attached to the order explained his central role in the trading scheme and referred to him by name,” the report said.

CAISO’s CRR auction has cost ratepayers $860 million because of the difference between revenues and payments to CRR holders, the ISO’s Department of Market Monitoring has found. The ISO has tried to stem the losses through changes to its CRR auctions, which appeared to reduce the disparity between payments and income in the first quarter of 2019. (See Gas Spike Drove High CAISO Power Costs in Q1.)

Vitol was one of the companies that opposed those changes last year. (See FERC OKs Tighter Rules for CRR Auctions.)