By Robert Mullin

CAISO secured the largest chunk of the Western Energy Imbalance Market’s $86 million in gross benefits during the second quarter as the solar-heavy ISO exported nearly 2.16 million MWh to its neighbors during the period — more than seven times the volume of the market’s next biggest exporter.

The quarterly benefits report released by CAISO on Wednesday showed the market’s estimated benefits rose 21% compared with a year earlier and just slightly from the first quarter. (See Cold Forces NW to Dip More Deeply into EIM as Avista Joins.)

The report illustrates a continuation of a trend in which CAISO exports large amounts of surplus solar energy to fellow market participants during the spring as California demand recedes because of mild weather. The ISO’s exports were up nearly 14% compared with the second quarter of 2018. (See EIM Benefits Surge to $71.2M in Q2.)

But despite that boost in exports, CAISO’s benefits declined by almost 16% year over year to $23.53 million, the result of competition from lower-priced exports. The Arizona Public Service balancing authority area (BAA), which also boasts strong solar capacity, saw its net exports surge by more than one-third to 305,752 MWh, while its overall benefits declined slightly to $8.55 million.

The EIM defines benefits as cost savings from serving load, increased merchant profits and the avoided curtailment of surplus low-cost renewable energy.

Following the pattern of previous springs, PacifiCorp once again absorbed the largest share of the cheap power, taking about 1.88 million MWh of net imports into its PacifiCorp-East (PACE) and PacifiCorp-West (PACW) BAAs, up 27% from a year earlier. The utility’s benefits surged 30% to $15.15 million.

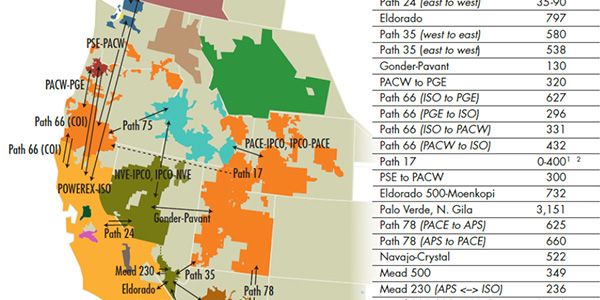

Map shows the transfer paths available among Western EIM participants. | CAISO

Powerex doubled its year-over-year net imports to 360,341 MWh, signaling that a relaxation of EIM local market power mitigation rules — which had previously forced the hydro-rich company to bid energy into the market when it actually intended to buy — had freed its hand to engage in its customary practice of buying heavily during periods of oversupply. (See CAISO Board OKs Market Power Mitigation Remedy.) The Canada-based marketing arm of BC Hydro saw its benefits jump 37% to $3.06 million.

Portland General Electric earned the third-largest share of market benefits at $10.89 million, followed by the EIM’s newest member, Balancing Authority of Northern California at $8.81 million. Trailing APS in the benefits roundup were Idaho Power ($8.33 million), NV Energy ($4.62 million) and Puget Sound Energy ($3.06 million).

NV Energy maintained its position as the BAA with the largest volume of wheel-through transfers at 659,897 MWh (far outpacing its combined 382,167 MWh of exports and imports), followed by APS at 514,915 MWh and PACW at 252,686 MWh, showing the various paths California’s solar exports followed to serve the coal-heavy PACE territory.

The EIM helped its participants avoid curtailment of 132,937 MWh of renewable energy during the quarter, displacing about 56,897 metric tons of CO2 emissions. The market has reduced CO2 by 403,546 metric tons since 2015.

The ISO estimates the EIM has yielded $736.26 million in gross benefits since it was launched with PacifiCorp as its first member in November 2014. Future participants include Salt River Project and Seattle City Light, scheduled to join in April 2020; Los Angeles Department of Water and Power, NorthWestern Energy, Turlock Irrigation District and Public Service Company of New Mexico (2021); and Tucson Electric Power and Avista (2022).