The New England Power Pool Markets Committee last week continued to discuss impact assessments of ISO-NE’s proposed energy security improvements (ESI).

Analysis Group’s Todd Schatzki gave a presentation on additional preliminary results of a study on the risk premium on day-ahead energy option offers, as well as on two scenarios for the winter of 2025/26: a current market rules case, and one reflecting proposed ESI rules and expected market responses. (See “Assessing ESI Impacts,” NEPOOL Markets Committee Briefs: July 8-10, 2019.)

Unrecovered cost of actions taken to secure energy inventory will be compared to the change in net revenues associated with taking each action, Schatzki said, reading from the slides.

The risk premium depends on factors that affect the riskiness of the option position, including the expected marginal cost of production given a resource’s fuel inventory; the option strike price; and LMP volatility.

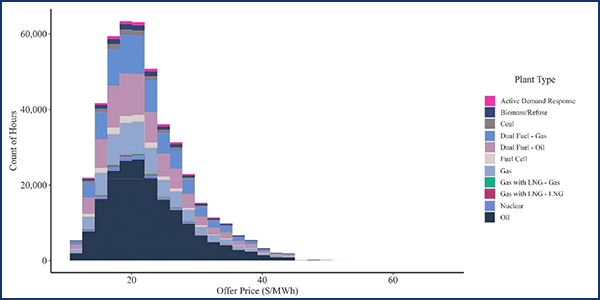

Estimated cleared prices for day-ahead energy options under the high future case | Analysis Group

The analysis will consider three different winter scenarios for model year 2025/26: mild (based on 2016-17), moderate (2017-18) and severe (2013-14).

Analysis Group’s production cost model does not capture every market feature, such as congestion; commitment/start-up and min-load costs; and full EIS calculations, he said.

Schatzki said the results provide reasonable estimates of impacts, although they are preliminary, with some ESI elements and assumptions still being refined.

Analysis Group will present preliminary scenario results this month, and respond to stakeholder feedback and present a draft report in September, ahead of the RTO’s planned October compliance filing with FERC Denies ISO-NE Mystic Waiver, Orders Tariff Changes.)

Margin for Uncertainty

ISO-NE Principal Analyst Andrew Gillespie gave a presentation providing additional detail on energy imbalance reserves (EIR) and replacement energy reserves (RER), two of the three day-ahead energy call options being proposed.

EIR awards will fill “known and needed” energy, akin to energy to meet demand in real time. RER and generation contingency reserves (GCR), the third call option, will supply energy that might be needed if a major contingency occurs, the equivalent to operating reserves in real time.

Combined, the three provide the “margin for uncertainty” in an increasingly energy-limited system, Gillespie said, referring to the presentation.

The RTO plans to allow imports across external interfaces to receive EIR awards, but imports would not be permitted GCR or RER awards because Northeast Power Coordinating Council standards require balancing authorities to provide its reserves using its own resources.

The RTO said resources with an EIR award should expect to be committed to meet the forecast for the next day.

“A unit with an EIR option awarded to meet the day-ahead forecast energy requirement should expect to receive a commitment instruction, which would be consistent with its start-up and notification times,” it said. “But it might not always be committed, if it has only an EIR option award, that is, if it has no day-ahead energy schedule.”

The day-ahead co-optimization will seek the most economical solution, meaning a unit that offers both energy and options could receive a day-ahead energy schedule only; an EIR award/schedule only; both a day-ahead and call option award; or no award.

The sum of any EIR option award and any day-ahead energy schedule within the same hour will be at least equal to the unit’s economic minimum, and not greater than the unit’s economic maximum, according to the RTO.

No M-DAM in October FERC Filing

The RTO’s vice president for market development, Mark Karl, on July 29 sent a memo informing the MC that the grid operator will not include the multiday-ahead market (M-DAM) in its Oct. 15 compliance filing.

“The M-DAM design warrants further assessment and additional review with stakeholders before being proposed to the commission,” the memo said.

“While multiple day-ahead markets may have benefits to the region as the power system continues to evolve, we believe it would be prudent to spend the remaining time ahead of the Oct. 15 filing discussing the design and impacts of the new proposed day-ahead ancillary services,” Karl said.

The RTO plans to continue assessing the potential impacts of an M-DAM design and to discuss recommended next steps with stakeholders in 2020.

Time Limit on Fuel-security Resources

The RTO’s director of NEPOOL relations, Allison DiGrande, and its assistant general counsel, Christopher Hamlen, led a presentation on proposed Tariff changes to remove the potential for a fuel-security resource to be retained in the Forward Capacity Market for more than the two-year period allowed by FERC.

The proposed revision would clarify that a resource retained for fuel security will only be retained until the end of the fuel security need.

The RTO’s goal is to address reliability concerns through competitive solutions.

“When resource owners submit retirement bids and demand bids in the [Forward Capacity Auction], they are indicating their economic decision to exit the markets,” DiGrande said, reading from the slides. “Out-of-market retentions should be limited in scope and timing.”

Without a change, a resource retained for fuel security could be retained beyond the intended capacity commitment period, which further impacts the competitive processes in New England.

ISO-NE is requesting that the change become effective prior to the issuance of the Order 1000 request for proposals in December.

The RTO plans further discussion and final review of the proposed changes at the MC’s summer meeting in New Hampshire this month. The committee is expected to vote on the proposal in September before a vote by the Participants Committee on Oct. 4.

— Michael Kuser