The Analysis Group will delay the release of a carbon pricing study previously expected to be completed this month in order to perform additional analysis at the request of the NYISO Board of Directors, CEO Rich Dewey told the Management Committee on Wednesday.

The board wants to ensure the study captures all the impacts of the Climate Leadership and Community Protection Act (A8429) signed by New York Gov. Andrew Cuomo last month, Dewey said.

The new law requires 70% of the state’s electricity to be generated by renewable resources by 2030, nearly quadruples the state’s offshore wind energy goal to 9 GW by 2035 and targets making the electric system carbon-neutral by 2040. It also doubles distributed solar generation to 6 GW by 2025 and targets deploying 3 GW of energy storage by 2030. (See Carbon Pricing Study Navigates Shifting NY Landscape.)

Several stakeholders pressed Dewey on whether completion of the study is now open-ended or whether it would be delayed a few weeks or six months.

Dewey confirmed the study will be delivered within a few weeks, then taken to the board before being delivered to stakeholders, which he promised to make happen “as soon as possible, because I understand the intense interest for stakeholders.”

“Our carbon pricing proposal is the most effective way to meet the state’s clean energy goals,” Dewey said. “We won’t do it without the state on board, but we don’t have a deadline, except for the NYISO budget,” adding the ISO will decide on related funding in the six weeks remaining before its 2020 budget and project portfolio finalized.

A study released last month by the nonprofit Resources for the Future (RFF) indicates a $63/ton carbon price could drive clean energy penetration to as high as 64% of the state’s resource mix by 2025, “well on the way” to the 70% requirement for 2030. (See Study: Carbon Adder Supports NY Clean Energy Goals.)

In response to a question from the MC, Dewey said NYISO does not plan to bring the RFF study to the stakeholder group, explaining that an earlier version “was in front of stakeholders about a year ago.”

Generation and Tx Perform Well in Heat

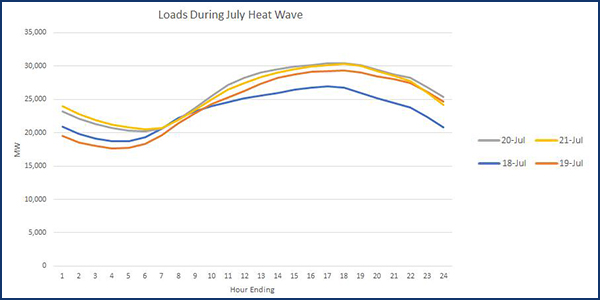

New York’s generation and transmission infrastructure performed well during the July 18-21 heat wave, Operations Vice President Wes Yeomans said.

“Heat indexes in New York state were very high over those days,” Yeomans said. “So far, this summer we’ve had five days over 30,000 MW … and so far the peak load was on a Saturday, which would be unique and unusual if it holds.”

NYISO said in May that it expected to have adequate resources on hand this summer to meet slightly above-normal demand, with 42,056 MW of capacity available to meet a forecasted peak of 32,382 MW. (See NYISO Reports Grid Ready for Summer.)

The ISO’s projected summer peak is 1.5% above the 10-year average and exceeds last summer’s actual peak of 31,861 MW, recorded on Aug. 29 (and the 2017 peak of 29,677 MW), but it is down from the 2018 peak forecast of 32,904 MW.

Yeomans said that since adding low-voltage facilities, “there have been far fewer out-of-merit actions in western New York.”

No New Cost-of-service Study

As it has in the previous two years, the MC voted not to conduct a new cost-of-service study later this year that would have informed a decision on whether to modify the 72% withdrawals/28% injections cost allocation formula in Rate Schedule 1 (RS1).

NYISO staff recommended a new study in order to consider the impact of the most significant market design changes to be implemented since 2005, including the integration of renewable resources, the adoption of a distributed energy resource roadmap and the effort to integrate and optimize energy storage.

The current RS1 allocation, with rebates provided for recoveries from non-physical transactions, is based on a consultant study that garnered about 67% support from the MC in July 2011 and was scheduled to be effective for a minimum of five years, from January 2012 to December 2016.

— Michael Kuser