By Christen Smith

Shell Energy and Old Dominion Electric Cooperative failed to make their case that they belong at the GreenHat Energy settlement table, FERC said in denying the companies’ rehearing requests Thursday.

FERC said the companies’ argument that they are “uniquely situated” in the proceeding and that their late intervention would not “unduly burden or prejudice any party” was “unpersuasive” (ER18-2068).

“We do not find that failing to grant late intervenors party status will necessarily result in a settlement that is not ‘fair and reasonable and in the public interest,’” FERC said. “Should the parties reach settlement in this proceeding, the commission will review the terms of that settlement and determine whether such settlement meets the relevant standard.”

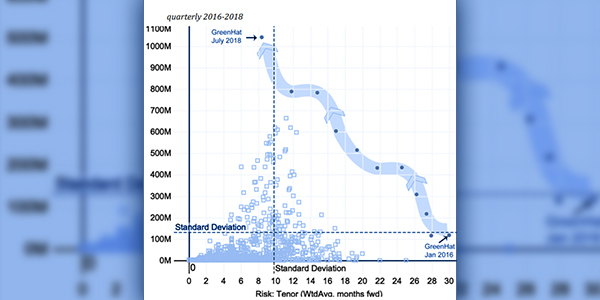

Shell’s request for rehearing argued that FERC erred when it dismissed more than a score of late-filed motions from intervenors seeking to participate in the unwinding of GreenHat’s financial transmission rights portfolio. GreenHat was declared in default in June 2018 after it failed to make good on its mounting losses. (See Shell Demands Seat at GreenHat Settlement Table.)

On June 5, the commission gave FERC: PJM Settle Disputes Before GreenHat Hearing.)

Shell was among more than 20 petitioners that filed after the comment period for PJM’s request passed. FERC rejected the late filings, saying none demonstrated “requisite good cause for late intervention.”

Shell said a PJM Tariff provision caused its tardiness, a circumstance that it says none of the other petitioners faces. It had explained that it entered into three bilateral contracts with GreenHat that involved transferring FTRs back and forth between the two companies. Liquidating the GreenHat portfolio “could substantially affect the amount sought by PJM from Shell for the guarantee and indemnification claim” the RTO placed on the portion that was transferred. (See Shell Energy Seeks to Avoid Liability in GreenHat Trades.)

“Shell Energy knew at the time PJM filed its waiver request that it had transactions with GreenHat that a commission ruling might affect,” FERC said. “Regardless of whether Shell Energy agreed with PJM’s request for waiver, it could have intervened timely to protect its interests.”

ODEC had said its late filing was nothing more than an “oversight” — an explanation the commission found lacking. It said ODEC’s interests in the case, which could set a precedent for financial defaults in RTOs, could be “sufficiently” represented by other timely intervenors.

“Old Dominion does not explain in seeking late intervention how other participants will not sufficiently represent this generalized interest, and there are, in fact, others who timely intervened on the basis they too would be impacted by the outcome of the proceeding,” FERC said. “Moreover, concern that adverse precedent may be created is not a persuasive basis for late intervention.”