By Hudson Sangree and Rich Heidorn Jr.

PJM must open Form 715 transmission projects to competitive bidding — with regional cost sharing for those projects involving high-voltage lines — FERC ordered Friday.

The directives came in two orders prompted by the D.C. Circuit Court of Appeals’ August 2018 remand that found FERC erred when it assigned all the costs for two Form 715 transmission projects proposed by Dominion Energy to the Dominion zone.

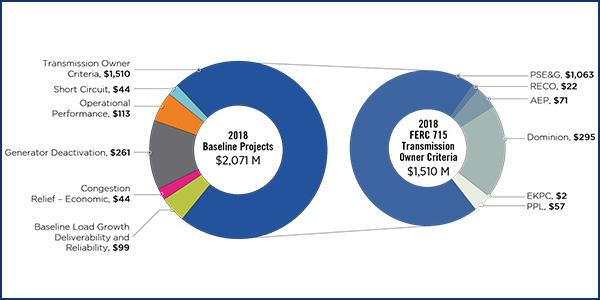

Owners of transmission at or above 100 kV must file Form 715 Annual Transmission Planning and Evaluation Reports that detail the planning reliability criteria that the transmission owners use to evaluate the strength and limits of their systems. About $1.5 billion of the $2.1 billion in baseline spending in PJM’s 2018 Regional Transmission Expansion Plan was for Form 715 projects.

In its order on remand Friday, FERC rejected a PJM Tariff amendment that had assigned all costs of projects included in the RTEP solely to address Form 715 local planning criteria to the respective TOs’ zones. It also directed PJM to refile the assignment of cost responsibility for transmission projects in its RTEP between May 25, 2015, and Aug. 30, 2019, “that solely address individual transmission owner Form No. 715 local planning criteria” (ER15-1387-004).

In a separate order, FERC opened a Federal Power Act Section 206 proceeding requiring PJM to revise its Operating Agreement, ruling that because the Tariff amendment is no longer applicable, neither is the provision that allows projects without competitive bids (EL19-61).

“Because the costs of projects needed solely to address individual transmission owner Form No. 715 local planning criteria will no longer be allocated 100% to the transmission zone of the transmission owner whose Form No. 715 local planning criteria underlie each project, we are instituting a proceeding pursuant to Section 206 of the FPA to require PJM to revise the PJM Operating Agreement to no longer exempt from the competitive proposal window process such projects, or to show cause why such changes are not necessary,” FERC said.

“We are still looking at these orders and we’ll be assessing the workload impact and identifying the appropriate action,” PJM spokeswoman Susan Buehler said Monday.

“This is a significant win for competitive transmission developers,” said Sharon Segner, vice president with LS Power. “This should increase the number of competition windows in PJM and bring the benefits of more transmission competition to PJM customers.”

“I think it is [a good order], but there’s a lot more to do,” Ed Tatum, vice president of transmission for American Municipal Power (AMP), said in an interview Monday. “This ruling gets us back on track to the structure and concept that was envisioned 22 years ago where transmission was planned by … the regional transmission organization.”

But Tatum said AMP will continue to push for PJM to assert control over TOs’ supplemental projects, which dwarf even Form 715 spending.

Supplemental projects are not required for compliance with grid criteria governing system reliability, operational performance or economic efficiency. PJM does not approve supplemental projects but does study them to ensure they won’t harm reliability.

Since 2015, PJM has evaluated more than $13.5 billion in supplemental projects, including $5.7 billion in 2018 alone. AMP says supplemental projects have tripled over the last 13 years, accounting for 62% of the submitted RTEP project costs since January 2017.

Dispute over Cost Allocation for Dominion Projects

The D.C. Circuit’s ruling stemmed from two Form 715 transmission projects by Dominion; the first one, Elmont-Cunningham, was proposed in 2013. PJM’s rules then required that half of the cost of high-voltage projects be assessed on a pro rata basis to all 24 utilities in the RTO based on customer demand, with the remainder allocated to zones based on benefits, as determined by a distribution factor (DFAX) analysis.

Dayton Power & Light objected to using the 50% pro rata allocation for the Elmont-Cunningham project, prompting PJM to propose a Tariff amendment that would prohibit cost sharing for projects proposed to satisfy TOs’ own planning criteria.

FERC initially rejected the proposal, saying it violated Order 1000 and was inconsistent with the commission’s earlier finding that high-voltage transmission lines provide “significant regional benefits that accrue to all members of the PJM transmission system.”

After a technical conference, however, the commission reversed its decision, ruling that projects such as Elmont-Cunningham belonged in a new category of projects included in the RTEP for coordination but not selected for cost allocation. The commission then used the amendment to reject regional cost sharing for the Elmont-Cunningham and a subsequent Cunningham-Dooms project.

Commissioner Cheryl LaFleur dissented, saying that the commission should preserve regional cost allocation “for certain high-voltage projects, even if those projects are selected solely to address local planning criteria.”

The D.C. Circuit agreed, saying FERC’s approval of the Tariff change was “arbitrary” and would result in a “severe misallocation of the costs” of high-voltage projects. It noted that the Dominion zone would receive less than 50% of the benefits of each of the two projects.

“High-voltage power lines produce significant regional benefits within the PJM network, yet the amendment categorically prohibits any cost sharing for high-voltage projects like those at issue here,” Judge Gregory Katsas wrote for the three-judge panel. (See DC Circuit Rejects PJM Tx Cost Allocation Rule.)

In its Friday orders — issued on LaFleur’s last day at the commission — FERC rejected the Tariff amendment it had previously accepted and ordered PJM to make all Tariff corrections necessary to reflect the rejection within 30 days. It also gave PJM 30 days to amend its OA to eliminate the competitive exemption for Form 715 projects or make a show cause filing.

Most of the Form 715 projects in 2018 were proposed by Public Service Electric and Gas ($1.1 billion), Dominion ($295 million), American Electric Power ($71 million) and PPL ($57 million).

Efforts to obtain comments from Dominion, PSE&G and PPL were unsuccessful. An AEP spokeswoman said the company was “still digesting the orders” and had no immediate comment.

It was unclear from FERC’s order whether the commission expects PJM to open all Form 715 projects to competition or only those that are subject to regional cost sharing.

In 2016, the commission approved PJM’s proposal to exempt reliability upgrades on facilities below 200 kV from competitive windows under Order 1000 (ER16-1335).

PJM said such projects are almost always assigned to incumbent developers, and the change would enable its engineers to focus on problems more likely to result in a competitive greenfield project. The commission limited the exemption to projects within a single transmission zone, saying those involving two or more zones must be opened to a proposal window. (See FERC Orders PJM TOs to Change Rules on Supplemental Projects.)