By Rich Heidorn Jr.

External Market Monitor David Patton and Internal Market Monitor David Naughton both endorsed major portions of ISO-NE’s Energy Security Improvements (ESI) plan before the New England Power Pool Markets Committee on Tuesday, with Naughton also spelling out his concerns for policing market power.

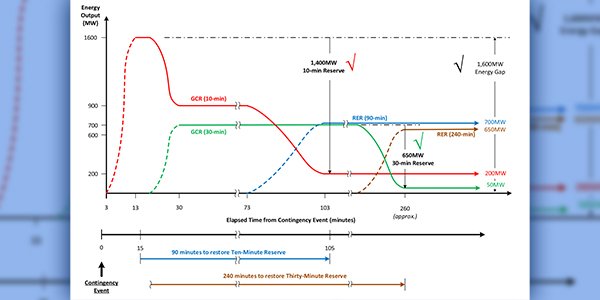

ISO-NE’s proposal includes day-ahead generation contingency reserve (GCR) and replacement energy reserve (RER) ancillary services.

“We’ve been recommending the ISO implement day-ahead reserve products for a number of years,” said Patton, president of Potomac Economics. “We’ve seen that they have significant value in other RTOs.”

[Editor’s Note: In compliance with NEPOOL rules, all quotes in this article were taken from speakers’ written materials or approved by them after the meeting.]

Potomac Economics’ “2018 Assessment of the ISO New England Electricity Markets” report found about 4,000 hours of commitments made through the day-ahead market to meet spinning reserve requirements last year. But those commitments are essentially out-of-market commitments, Patton said, “because while the physical constraints are embedded in the day-ahead market, there’s no market product associated with them, so they are not priced.”

The result: “understated” day-ahead prices relative to the system’s needs and increased net commitment-period compensation (NCPC) uplift payments.

“These [new] products will allow those requirements to be recognized and priced through the market,” he said.

Patton said the proposed day-ahead energy option component, while not essential, will provide additional incentive for scheduled resources to be available when called upon.

“It’s critical that [the day-ahead products] have a physical obligation to be available and have the ability to supply the product that the ISO is procuring — that they not be purely financial.”

Energy Imbalance Reserves

Patton said the proposed energy imbalance reserves are “probably the most innovative component” of the RTO’s plan, allowing the day-ahead market to “fully reflect” the system’s physical needs. He said it could allow ISO-NE to procure the resources through the market and “allow the day-ahead prices to fully reflect the system’s requirement.”

Allocating the cost of the forward energy procurement to negative deviations will create an incentive for load to be “more fully scheduled day-ahead” and should reduce the reliance on the reliability unit commitment (RUC) process, he said.

Patton said the current allocation of NCPC to deviations should be eliminated or changed to be based on cost causation. “It is very important in this design to stop [allocating] inefficient costs to virtual load so it will efficiently arbitrage differences between the day-ahead and real-time LMPs,” Patton said in his presentation.

Day-ahead Replacement Reserves

Patton also endorsed procurement of day-ahead replacement reserves, saying it should help ensure reliability in the operating day by incentivizing resources to be physically prepared to operate if needed in real time while reducing the need for out-of-market actions.

He said the requirement should be dynamic to reflect operators’ determination of the system’s needs. During cold spells, the replacement reserve quantity could be high, while on most days the need would likely be zero. “The Tariff should describe the process for determining the quantity,” he said.

Because uncertainties and risks change as operators move from the day-ahead market into the operating day, Patton said, “we do not believe it is desirable to require procurement of the same product in real time.” Instead, the RTO should procure in real time the operating reserves that are actually needed during the operating day, he said.

Multiday Market

Patton was more skeptical of the value of a multiday-ahead market, saying most of its benefits would likely be limited to cold weather events when firm fuel constraints are binding.

Patton said he had concerns about “unintended consequences” and the need for liquidity in such a market to ensure prices reflect the expected real-time prices for each day. Liquidity in the day-ahead market is driven by virtual trading, and ISO-NE has “probably … the least liquid set of virtuals” of any market, partly because of “the mindless allocation of real-time NCPC,” he said. Moreover, he said, it would entail running a market 52 weeks a year to realize a week or two of significant benefits.

Patton said the proposed day-ahead product, while extremely helpful, will not address the entire fuel security issue because it will not coordinate limited fuel inventories when the demand for secure fuel spikes.

He said a “more targeted” solution would be to procure a firm energy product that is coordinated over a five- to seven-day time frame only when needed — a few weeks each winter when a cold spell occurs. It would be optimized with commitments and schedules in the day-ahead market.

Seasonal Procurement

Patton reiterated his call for eliminating the forward reserve market, saying it should not be modified to address fuel security.

He said “an efficient forward market” that procured products that settle against the same product in the operating time frame — while not essential — could help facilitate seasonal fuel procurement decisions.

“We do not support proposals to procure products forward (three years ahead or seasonally) that do not exist in the operating time frame,” he said.

IMM Memo

Later in the meeting, IMM David Naughton expanded on a memo outlining his review of the ESI. Naughton said the ESI proposal correctly seeks to value the “missing product” of energy security and said it could obviate the need for out-of-market interventions such as capacity market retentions and having oil-fired generators on standby during the operating day.

He said it seeks to provide a means for physical supply to recover the fixed costs of a call option for LNG or the delivery of fuel oil. But he said the RTO should spell out clearly in the rules the types of costs intended to be included in the “unrecovered fixed cost” component of the option offer.

He also said the rules should explicitly require resources to physically provide energy to cover their ancillary service obligations.

“We understand the potential efficiency benefits over time of allowing speculative participation. However, we believe that the design is more likely to provide the secure energy when needed if participation is predicated on physical capability to provide secure energy, a clear expectation of meeting dispatch instructions in real time and a financial consequence for non-delivery that will deter speculative participation,” Naughton said.

The IMM stressed the importance of the seasonal forward component, saying it may become the primary market for clearing ancillary service obligations. “In practice, many of the actions to secure fuel are taken — and costs incurred — well in advance of the operating day. Relying on spot market revenue from the ESI products alone may entail significant cost-recovery uncertainty for participants who incur costs well in advance of the operating day.”

He warned that “any differences between the fixed costs included in the forward market and in the day-ahead ESI market” would undermine price convergence and incentives.

Market Power

Naughton said ESI must be carefully evaluated for market power issues in an analysis that considers “a broad range of future scenarios.”

He noted that the proposal is intended to address supply shortages that imply “potentially some degree of market power in the periods when secure energy is most needed. This can be compounded by the significant increase in (explicit) capacity reservation in the [day-ahead market] clearing, as a result of the new ancillary service requirements, and the level of ownership concentration of physical assets available to meet the reservation requirements.”

The increase in capacity reservations from the day-ahead market will reduce residual supply and “increase the likelihood that one or more participants will have market power, especially in the ancillary service products with a vertical demand curve,” he said.

He said the impact of market power could be magnified if it is exercised with respect to the new ancillary services products or the existing energy product. “To the extent market power can be exercised in one of these products to increase the price, it is likely that the price of the other products (including energy) being co-optimized will also increase.”

The IMM said it should address market power vulnerabilities through ex ante reviews to mitigate uncompetitive offers as part of the market clearing. “The ex ante approach protects price formation from the exercise of market power and does not introduce uncertainty about final prices via ex post correction, redistribution of rents through resettlement and/or lengthy regulatory enforcement activities,” he said. “The ESI market design should not rely on ex post measures, such as claw-back, enforcement action and/or [Federal Power Act Section] 206 filing for unjust and unreasonable rates.”

He opposed the proposal that participation in the day-ahead market for ESI products be voluntary, saying it would open the market to physical withholding.

He also called for consideration of a must-offer requirement for capacity resources with the physical ability to provide the ancillary services products. Capacity resources have such a requirement for energy in the day-ahead market and for both energy and reserves in the real-time energy market.

Naughton’s memo included concerns that key portions of the ISO-NE proposal would not be completed until after the RTO made its first planned FERC filing to meet an October deadline. Those concerns became moot when the commission last week extended the deadline by six months. (See FERC Extends ISO-NE Fuel Security Filing Deadline.)

ISO-NE Principal Analyst Andrew Gillespie delivered a presentation and answered questions on the proposal during most of the rest of the daylong meeting, the first of two scheduled this week.