The NYISO Business Issues Committee on Wednesday approved revisions to Manual 4 (Installed Capacity) for external capacity suppliers, with a focus on imports from Ontario’s Independent Electricity System Operator and ISO-NE.

Section 4.9.1 was amended to add detail to the requirements for qualifying as an external capacity supplier. It requires a demonstration of deliverability to the New York Control Area border and execution of a letter certifying the supplier’s control of the resource if it does not own it.

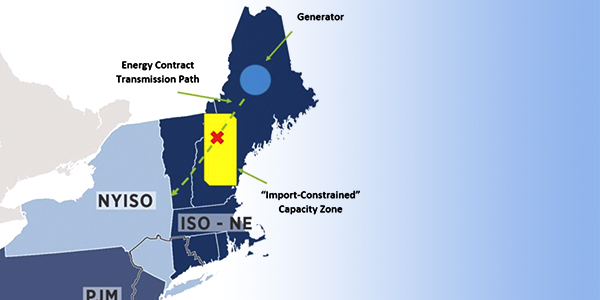

Because the yellow ISO-NE capacity zone was identified as “import-constrained,” ISO-NE transmission is not able to accommodate the generator delivering to the New York border. Without an export delist bid, the generator would not be eligible to sell capacity in NYISO auctions. | NYISO

Section 4.9.3 was changed to add delivery requirements for imports from Ontario and New England. Suppliers from Ontario must provide written proof that IESO has approved their exports of power. Suppliers in New England must provide proof that they have an approved export delist bid in the ISO-NE Forward Capacity Market, or that it is not located in a capacity zone that does not permit exports.

FERC Updates

Presenting the Broader Regional Markets report, Robb Pike, director of market design and product management, provided updates on two recent FERC rulings, including one on external capacity.

On July 30, the commission accepted the ISO’s proposal to implement new requirements for external installed capacity suppliers responding to a supplemental resource evaluation (SRE), effective Aug. 12. Any external resource that fails to meet delivery criteria will be subject to a penalty of 1.5 times the applicable spot price multiplied by the number of megawatts of shortfall and the percentage of the SRE call hours to which a supplier fails to respond (ER19-2104).

On Aug. 28, FERC accepted revisions to the NYISO-PJM Joint Operating Agreement, effective on Sept. 26, to address a previous waiver approved by FERC regarding coordination of certain types of flowgates.

NYISO and PJM asked FERC to waive the JOA to permit the grid operators to add the East Towanda-Hillside Tie Line as a market-to-market flowgate. The requested waivers enable PJM to conduct redispatch operations to control flows to the more restrictive rating on the NYISO side of the tie line without violating the PJM Tariff for a limited period of time while NYISO and PJM develop a permanent solution.

Other Manual Changes

The BIC also approved changes to Manual 14 (Accounting and Billing) that replaces the terms “meter service provider” and “meter service data provider” with “meter authority.” It also revises Section 4.3.3 to clarify the methodology for certain calculations.

The committee also approved changes to Manual 27 (Revenue Metering Requirements) to add definitions of “member systems” (the eight transmission owners that comprise the New York Power Pool) and “meter services entity” (an entity registered with the ISO and authorized to provide metering and meter data services to an aggregator, responsible interface party or curtailment service provider).

LBMPs Decline 16% in August

NYISO locational-based marginal prices averaged $27.83/MWh in August, down approximately 16% from July and nearly 35% from the same month a year ago, Pike said in delivering the monthly operations report. Year-to-date monthly energy prices averaged $34.96/MWh, a 25% decrease from a year ago.

Day-ahead and real-time load-weighted LBMPs came in lower compared to July. Average daily sendout was 487 GWh/day in August, lower than 539 GWh/day in July and 537 GWh/day in the same month a year ago.

Transco Z6 hub natural gas prices averaged $1.85/MMBtu for the month, down over 15% from July and 38.3% from a year ago.

Distillate prices were down 15.1% year over year and down slightly from the previous month, with Jet Kerosene Gulf Coast averaging $13.32/MMBtu, compared to $14.18/MMBtu in July, while Ultra-low Sulfur No. 2 Diesel NY Harbor dropped to $13.02/MMBtu from $13.71/MMBtu in July.

August uplift decreased to -20 cents/MWh from -6 cents/MWh in July, while total uplift costs, including the ISO’s cost of operations, came in lower than those of the previous month.

The ISO’s 25-cents/MWh local reliability share in August was down from 44 cents/MWh the previous month, while the statewide share climbed to -45 cents/MWh from -50 cents/MWh in March.

The Thunderstorm Alert cost was 33 cents/MWh.

— Michael Kuser