By Christen Smith

As PJM stakeholders anxiously await FERC’s ruling on expanding the minimum offer price rule (MOPR), a new analysis says the policy could increase capacity market prices $5.7 billion annually.

The estimated 60% spike would add $6 to the typical ratepayer’s monthly bill, with consumers in Virginia and West Virginia seeing prices rise $7 or more, according to the report published by Grid Strategies last month.

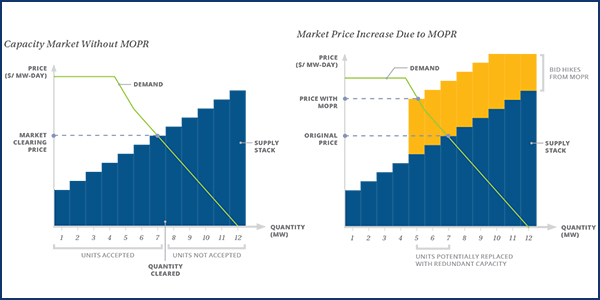

The report attempts to estimate the cost of FERC’s June 2018 order requiring PJM to expand its MOPR to include all new and existing capacity receiving out-of-market payments, such as renewable energy credits and zero-emission credits for nuclear plants. FERC said the change was needed to counter price suppression in the capacity market. The RTO’s MOPR currently covers only new gas-fired units. (See FERC Orders PJM Capacity Market Revamp.)

Report authors Michael Goggin and Rob Gramlich called it “a major policy shift” that was first signaled in a March 2018 ruling on ISO-NE, in which the commission said “we intend to use the MOPR to address the impacts of state policies on the wholesale capacity markets” unless it is shown an alternative to address price suppression. (See Split FERC Approves ISO-NE CASPR Plan.)

Estimated annual cost to states of the MOPR in PJM | Grid Strategies

“For better or worse, Congress has reserved to states the authority to regulate generation, so long as those regulations are not inappropriately tethered to or aiming at matters within FERC’s jurisdiction,” they wrote. “If states continue to enact policies influencing the generation resource mix, as they have shown increasing interest in doing, and federally regulated RTOs impose cost increases each time, costs to consumers will rise.”

The authors’ staggering estimates generated much debate on Twitter, and some state officials have reportedly renewed threats to leave PJM if capacity costs rise as a result of the FERC ruling.

Regulators from New Jersey and Illinois have previously threatened to leave PJM or called for the end of the capacity market. (See Illinois: End PJM Capacity Market?)

Although none have taken any steps to do so, Maryland Public Service Commission Chair Jason Stanek told Politico: “If one state in the 13-state PJM pulls out resources, you’ll see other states follow.”

But others have faulted the firm’s methodology and rejected the predictions of the RTO’s destruction as a misunderstanding of how the markets work.

“The Grid Strategies report cherry-picks a 2018 PJM Market Monitor report to find the highest possible capacity price increase — produced in a completely unrelated analysis — and applies it as justification for its conclusion that a potential policy by FERC could increase costs $5.7 billion annually,” said Todd Snitchler, CEO of the Electric Power Supply Association, which represents independent power producers and marketers. “The report conflates two completely different policies that results in an apples-to-oranges comparison and a startling cost estimate that is both incorrect and disingenuous.”

Snitchler’s response came in a Sept. 6 letter addressed to 10 Democratic senators, who had cited the Grid Strategies report in a letter to FERC Chairman Neil Chatterjee. The senators asked the commission to “reconsider this policy shift,” which they said was unjustified and could “frustrate state efforts to address climate change.”

Grid Strategies’ report used data from the Independent Market Monitor’s study of the capacity market impact of PJM’s resource-specific fixed resource requirement policy, which the RTO has submitted to FERC as an alternative to the MOPR. In that report, the Monitor determined that 23,741 MW of accredited capacity supply would be removed from the auction, increasing prices $94.67/MW per day for a total of $5.7 billion annually.

“Because the IMM has access to confidential information about the shape of the capacity supply curve and which resources have cleared the capacity market, the IMM’s estimate of the relationship between supply and price is likely to be more accurate than any estimate from an outside party,” Goggin and Gramlich wrote. “As a result, the IMM’s estimate … is a reasonable proxy for the impact the MOPR could have in the next PJM capacity auction.”

The authors cautioned that the results “likely underestimate” the actual increase because the MOPR would increase energy costs in New Jersey and other states subsidizing nuclear resources and future offshore wind. While capacity prices will eventually level out as federal tax credit programs sunset, Grid Strategies predicts long-run costs to consumers could still reach $2.5 billion per year.

IMM Response

“We do not agree with the Grid Strategies extrapolations from our report, but our report reached a similar conclusion about the impact of the PJM repricing proposal,” Monitor Joe Bowring said in an email to RTO Insider. “PJM’s proposal would increase capacity market prices substantially. PJM’s plan would create noncompetitive barriers to entry. PJM’s plan should be rejected.

Comparison of capacity market prices with and without the MOPR | Grid Strategies

“But there is no indication that FERC will adopt PJM’s plan, which they have previously rejected. FERC has viable options that will not result in dramatic price changes in either direction but will protect competitive markets.”

Bowring said the Grid Strategies report ignores the Monitor’s proposed sustainable market rule (SMR), which would allow all nonmarket resources to participate in the energy market but use the capacity market as a “balancing mechanism” to provide incentives for entry and exit based on competitive offers.

“SMR provides a straightforward way to harmonize federal and state approaches to the provision of power while respecting the distinction between federal and state authority,” Bowring said. He maintains his plan wouldn’t impact capacity prices at all.

He said states’ threats to leave PJM over the MOPR ruling suggest a misunderstanding of the benefits of wholesale power markets and presuppose specific FERC actions. The narrative incorrectly suggests that states would be better off outside PJM markets, ignoring the substantial benefits PJM’s markets have brought to customers over the last 20 years, he said.

PJM Weighs in

PJM, for its part, said that EPSA’s letter gives “worthwhile perspective” on the issue and said that maintaining a level playing field among generators is paramount to creating “a fair market that achieves reliable electricity at the lowest cost.”

“When one type of generation is subsidized over another, that is an advantage, and we have seen subsidies targeting not just renewable energy but also coal and nuclear,” said Jeff Shields, a PJM spokesperson. “We’re not about disadvantaging any particular resource type — the minimum offer price rule is meant to maintain the integrity of a market that includes subsidized resources, not any specific fuel type. At the same time, we respect states’ authority to shape their own fuel mix.”

Shields said balancing different state policies creates a complex scenario — one that PJM thinks its plan addresses while still ensuring fair market outcomes. “We look forward to FERC addressing these issues on their merits,” he added. (See related story, Glick Recusal May Mean No MOPR Ruling Before December.)