By Rich Heidorn Jr.

NEPOOL’s Reliability Committee on Wednesday rejected ISO-NE’s proposed installed capacity requirement (ICR) calculations, with unanimous opposition from the Generation and Supplier sectors.

Needing a 60% majority to recommend them to the Participants Committee, the ICR values including and excluding Mystic Units 8 and 9 failed with only 49.65% support.

With the Generation and Supplier sectors unanimously opposed and the Transmission and Publicly Owned sectors unanimously in support, the vote hinged on a split in the Alternative Resources sector (8.71% in favor, 11.78% opposed). The End User sector lacked a quorum and was reported 0.98% in favor and 0% opposed.

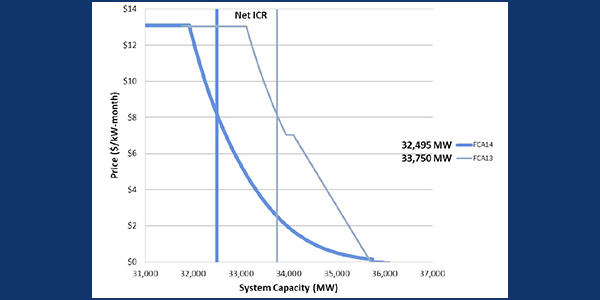

Excluding Mystic 8 and 9, ISO-NE is proposing a net ICR of 32,495 MW for Forward Capacity Auction 14 (2023/24), a reduction of 1,255 MW from FCA 13.

The committee did approve a 941-MW value for the Hydro-Québec interconnection capability credit (HQICC) for FCA 14 including the capacity associated with Mystic, and a 943-MW HQICC excluding it.

NEPOOL rules prohibit RTO Insider from quoting stakeholders’ comments during the meeting. However, Bruce Anderson, vice president of market and regulatory affairs for the New England Power Generators Association, explained the generators’ objections after the meeting. He said the reduced net ICR from FCA 13 “will undoubtedly put downward pressure on prices if accepted by FERC.

“NEPGA has raised a number of concerns with how the ISO modified its load forecasting methodology, which drove the decrease in NICR, including that it was done based in part on only a handful of days in summer 2018. We also believe that ISO-NE may not properly recognize that the peak-load hour is moving farther out due to solar penetration, and thus there may be actual less peak load shaving coming from the behind-the-meter solar than is shown in the load forecast,” Anderson said in an email.

“In addition, ISO-NE has changed the load forecast methodology for purposes of calculating demand (the NICR) but not for purposes of calculating the cost of new entry (for which the load forecast is a significant variable). This inconsistent application of the change in load forecast methodology will cause the FCA to price capacity below its economic price.”

Other stakeholders who criticized the RTO’s calculations declined, or did not respond to, requests for comment.

“Developing the installed capacity requirement is a complex calculation involving many factors. The ISO develops the ICR according to national and regional power system reliability standards and requirements,” ISO-NE spokeswoman Marcia Blomberg responded. “For stakeholders, there may be other considerations.”

Opposition in 2018

It is at least the second year in a row that ISO-NE has faced opposition to its ICR calculations.

Last September, the committee approved an ICR value of 34,719 MW without Clear River Unit 1 for FCA 13, with more than 65.% support. But the RTO’s 34,739-MW ICR with Clear River failed with only 50.01% support. In October, the Participants Committee voted likewise on the two values.

In January, FERC approved the 34,719-MW ICR after accepting the termination of Clear River’s capacity supply obligation for 2021/22 (ER19-291).

FERC approved the ICR values over protests from NEPGA, FirstLight Power Resources and the New England States Committee on Electricity (NESCOE).

NESCOE complained that the filing by ISO-NE and NEPOOL failed to justify increasing system reserves to 700 MW from 200 MW, the level it had been at since 1980. NESCOE contended that ISO-NE was trying to justify its ICR value rather than determining the amount needed to support resource adequacy.

FERC defended the 700-MW reserve level as “a matter of engineering judgment.” It noted that the system’s peak load had nearly doubled since 1980 from about 15,000 MW to 28,000 MW today. The single largest contingencies in 1980 were two nuclear units of 800 to 900 MW each. “Today, New England can experience a single credible contingency of up to 2,000 MW associated with the Phase II interconnection with Hydro-Québec and three other large credible contingencies ranging between 1,250 [and] 1,650 MW each,” FERC said.

FirstLight and NEPGA objected that the ICR-related values used in ISO-NE’s ICR study are based on lower outage rates and higher tie benefit assumptions than those used in the RTO’s fuel security study.

The commission said the generators’ request to calculate ICR using the assumptions from the fuel security study would violate the Tariff.

“These two study processes are distinct and seek to achieve different objectives,” the commission said. “While ISO-NE uses the ICR-related values to address an installed capacity problem, it uses the fuel security study to address a different problem: whether capacity procured in the Forward Capacity Market has sufficient fuel necessary to produce energy needed to meet demand and maintain required operating reserves. That is, a region may have sufficient installed capacity but insufficient fuel to produce energy from that capacity.”

FCA 14 vs. 13

The new ICR values show a 1,065-MW reduction in the load forecast from FCA 13, including a 965-MW drop in the gross load forecast and a 105-MW reduction from updated estimates for behind-the-meter PV generation. The load also was affected by changes to the load forecast methodology, including the addition of a second weather variable (cooling degree days), the separation of the July and August peak load model, and the shortening of the historical weather period from 40 to 25 years.

Also reducing the ICR were improvements to system outage rates.

Those reductions were partially offset by a reduction in tie benefits (+70 MW) and the load relief assumed obtainable from implementing a 5% voltage reduction (+150 MW).

Other Action

In other action Wednesday, the Reliability Committee approved a number of projects, including Exelon Generation’s plan to replace the excitation controllers and automatic voltage regulators (AVRs) at Mystic 8 and 9. The company will install ABB UNITROL Static Excitation Systems at each generator to provide excitation current to the exciters and replace the existing AVRs. They are expected to be in service in October.

Members also approved revisions to:

- Operating Procedure 19 to allow adjustments to phase-shifting transformers or reactive flow to maintain system reliability.

- the reactive capability audit request form to clarify the types of tests that can be selected on the form.

- Planning Procedure 10 to delete provisions related to interconnection service adjustments (Sections 7.7 and 7.8), which are being moved to a new section in the Open Access Transmission Tariff. The change won’t take effect until FERC approves the Tariff amendment.

- Sections I.2.2 and III.12.6 of the Tariff to allow the inclusion of competitively developed transmission solutions into the FCM network model.