The New England Power Pool Participants Committee on Friday voted narrowly not to approve ISO-NE’s recommended installed capacity requirement (ICR) values for Forward Capacity Auction 14 in February 2020.

The motion to support the ICR values including Mystic Units 8 and 9 fell short with 59.97% in favor, just below the 60% threshold for approval (Generation 0%; Transmission 16.79%; Supplier 3.36%; Alternative Resources 9.29%; Publicly Owned Entity 16.79%; and End User 13.74%).

The motion to support the ICR values excluding Mystic Units 8 and 9 failed with a 59.66% vote in favor (Generation 0%; Transmission 16.79%; Supplier 3.05%; Alternative Resources 9.29%; Publicly Owned Entity 16.79%; and End User 13.74%).

NEPOOL rules prohibit RTO Insider from quoting stakeholders’ comments during the meeting. However, Margo Caley, the RTO’s senior regulatory counsel, confirmed after the meeting that ISO-NE will file the ICR values with FERC on Nov. 5 without NEPOOL support.

Excluding Mystic 8 and 9, ISO-NE is proposing a net ICR of 32,495 MW for FCA 14 (2023/24), a reduction of 1,255 MW from FCA 13.

COO Vamsi Chadalavada reported that Exelon has until Jan. 20 to decide whether to retire Mystic 8 and 9 for FCA 14, which will acquire resources for delivery year 2023/24.

The Reliability Committee on Sept. 25 had also rejected the proposed ICR calculations, with unanimous opposition from the Generation and Supplier sectors. (See Supply Side not Buying ISO-NE’s ICR Numbers.)

In related business, the PC approved by a show of hands a 941-MW value for the Hydro-Québec interconnection capability credit (HQICC) for FCA 14, including the capacity associated with Mystic, and a 943-MW HQICC excluding it.

Nautilus Power proposed amendments to recalculate the HQICC and ICR values without the RTO’s gross load forecast methodology, but the proposals all failed on a show of hands.

Energy Market down for September

ISO-NE CEO Gordon van Welie had nothing to report, but Chadalavada did report on monthly operations results and other items.

The energy market value in September, through Sept. 25, was $182 million, down $139 million from August 2019 and down $221 million from September 2018, Chadalavada said.

September natural gas prices over the period were 2.6% higher than August average values, he said.

Average real-time hub LMPs ($20.97/MWh) over the period were 11% lower than August averages, while average natural gas prices and real-time hub LMPs for the month were down 29% and 49%, respectively, from September 2018 averages.

The average day-ahead cleared physical energy during the peak hours as percent of forecasted load was 99.6% during September, down from 101.3% during August, with the minimum value for the month of 95.4% recorded on Saturday, Sept. 7.

ISO-NE Draft 2020 Work Plan

Chadalavada presented a memo on the RTO’s draft 2020 Work Plan, which takes account of FERC’s Aug. 30 ruling granting ISO-NE another six months, until April 15, 2020, to file a long-term fuel security mechanism (EL18-182). (See FERC Extends ISO-NE Fuel Security Filing Deadline.)

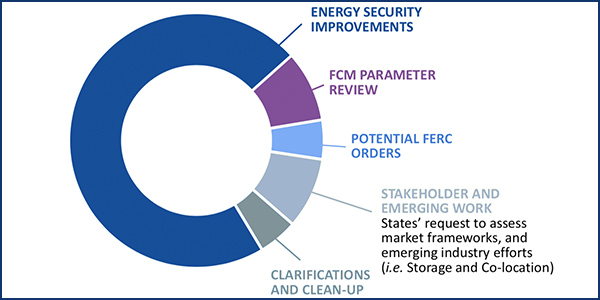

The RTO plans to devote most of its planning resources to the Energy Security Improvements (ESI) project from October 2019 through April 2020, with a focus on:

- core day-ahead ancillary services design;

- impact assessment of day-ahead ancillary services;

- conceptual framework for mitigation of day-ahead ancillary services; and

- forward market construct.

Additional work, such as changes to net commitment period compensation rules, will be needed beyond the initial filing to enhance the mechanism, he said.

Energy Security Improvements dominate the RTO’s markets-related priorities for 2020. | ISO-NE

Chadalavada said the RTO would work closely with stakeholders on day-ahead ancillary services design but that changes to the core design would require extra time.

The RTO is working with Analysis Group to assess the market impacts of ESI and anticipates having a draft impact analysis available for stakeholders in February.

Chadalavada said the RTO will provide stakeholders information about the prospective mitigation design approach before April 2020 but that a detailed mitigation design and market rules will require a later filing.

The RTO will also explore whether a forward market construct would improve the region’s energy security needs, but a detailed review will not be complete before the April filing, he said.

Consent Agenda

The Participants Committee voted to approve in a single vote three items on the consent agenda:

- A revision to Market Rule 1 section III.13.2.5.2.5A (Fuel Security Reliability Review) that limits the retention of resources needed for fuel security to a two-year maximum, removing a provision that could extend a resource’s retirement beyond the two-year fuel-security retention period.

- Clean-up revisions to Market Rule 1 section 13 were identified during the price-responsive demand implementation process. They remove the requirement for the RTO to publish the quantity of demand capacity resources at the end-of-round price for each capacity zone as the FCA is being conducted. The revisions also clarify the energy market offer requirements of demand response resources that participate in the FCA.

- Changes were approved for operations manuals M-11, M-20, M-35, M-REG, M-RPA and M-36 to comply with FERC Order 841, which is intended to encourage electric storage participation in the wholesale markets. The manual changes pertaining to enhanced storage participation became effective upon PC approval. Changes related to Order 841 compliance will take effect in December, while those related to setting the maximum discharge limit of an electric storage facility when it has less than one hour of available energy would be effective in two phases in December and March 2020.

The PC also approved two items concerning FERC Order 1000 compliance and intraregional planning that would have been on the consent agenda but for time constraints:

- The first item was revisions to the ISO-NE Tariff: Attachment K, Schedules 12 and 12C of section II, the Selected Qualified Transmission Project Sponsor Agreement, and sections I.2.2 and I.3.9, as recommended by the Transmission Committee.

- The last item approved was revisions to Market Rule 1 section III.12.6 and section I.2.2 (Definitions), as recommended by the Reliability Committee.

Chadalavada said that 21 companies have achieved qualified transmission project sponsor (QTPS) status, and that one company is currently moving through the QTPS application process.

Based on the results of the Boston Needs Assessment to date, the RTO will release its first request for proposals for a competitively developed transmission solution in late 2019 or early 2020, and anticipates a Tariff filing by Oct. 11, he said.

Draft RFP templates are being updated based on stakeholder feedback and will be reposted for Planning Advisory Committee comment in mid-October.

Price-responsive demand energy market activity by month | ISO-NE

ISO-NE and NESCOE Budgets OK’d

The PC unanimously supported the RTO’s proposed 2020 operating and capital budgets, as well as the 2020 budget of the New England States Committee on Electricity.

Kenneth Dell Orto, chair of the Budget and Finance Subcommittee, led the presentations.

ISO-NE’s 2020 operating budget of $201.7 million, including depreciation and excluding the true-up, is an increase of 1.9% or $3.7 million compared to this year’s operating budget. Including the true-up, the budget results in a 5.4% increase to the revenue requirement compared to 2019. The RTO’s 2020 capital budget remained unchanged at $28 million.

NESCOE’s 2020 budget is $2,421,056, up from $2,350,787 this year, and conforms to the five-year pro forma planning, he said.

Litigation Report

NEPOOL Secretary David Doot, an attorney with Day Pitney, highlighted three items from the monthly litigation report.

First, FERC on Sept. 19 launched a rulemaking to overhaul its regulations under the Public Utility Regulatory Policies Act, the 1978 federal law enacted to spur competition in the U.S. electricity sector (RM19-15, AD16-16). (See FERC to Reshape PURPA Rules.)

Second, the commission ruled that a New Hampshire law requiring the state’s utilities to purchase power from biomass and waste generators encroaches on federal jurisdiction under the Federal Power Act and PURPA (EL19-10). (See FERC: NH Bill Encroaches on Fed. Powers.)

Finally, the results of FCA 13 became effective “by operation of law” in September because FERC was unable to muster a quorum (ER19-1166). (See FCA 13 Results Stand Without FERC Quorum.)

— Michael Kuser