By Christen Smith

PJM will pay two trading firms $12.5 million to end a dispute over the 890 million MWh GreenHat Energy default under a settlement agreement filed with FERC on Thursday.

Apogee Energy Trading and Boston Energy Trading and Marketing (BETM) will accept credits of $5 million and $7.5 million, respectively, to resolve the firms’ claims of economic harm that resulted from PJM’s decision to not liquidate GreenHat’s entire portfolio of financial transmission rights during the 2018/19 planning period (ER18-2068). After the company defaulted in June 2018, PJM reran only the July FTR auction — a decision the RTO says kept costs to members down and avoided a cascade of market violations that would increase uncertainty for years to come.

“Those payments are integral to an overall package that allows payors in PJM to avoid the risk of the additional default allocation assessments that might result if the proceeding were litigated to conclusion,” the RTO’s attorneys wrote in the settlement. “PJM and many settling parties also attach considerable value to the settlement’s removal of a cloud over the July auction and subsequent FTR auctions in the same planning period, and in avoiding the possibility of disruption to such auction results.”

Apogee and BETM had opposed PJM’s request to waive existing rules to settle the remainder of GreenHat’s portfolio. PJM sought the waiver to reduce the impact on the monthly FTR auctions throughout the rest of the year. After FERC denied the request, the firms protested the RTO’s subsequent motions for rehearing and clarification.

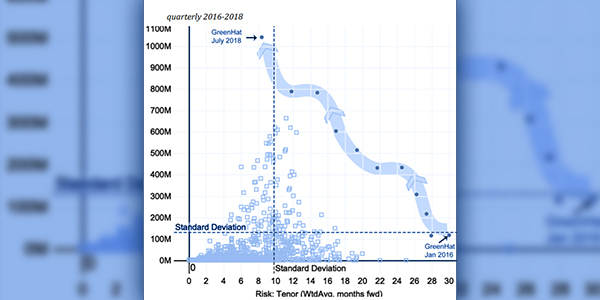

Size and tenor of GreenHat’s portfolio | PJM

In June, FERC gave PJM stakeholders 90 days to settle all disputes before kicking off a paper hearing on the clarification request. (See FERC: PJM Settle Disputes Before GreenHat Hearing.) On Sept. 9, PJM confirmed a settlement in principle had been reached but declined to give further details. (See GreenHat Energy Settlement Outlined to MIC.)

Throughout discussions, PJM and the two firms disagreed over how much economic harm the original auction results caused. In the agreement filed Thursday, the RTO said the payments serve as a proxy for rerunning the July auction.

“When sophisticated parties reach such a settlement, the resulting compromise value can be expected to reflect the parties’ efforts to protect their respective interests, based on their separate assessments of adverse litigation outcomes, the cost of litigation, impacts on market viability and the value of preserving settled market outcomes,” PJM wrote. “Such is the case here. Rather than engage in complex and extended litigation about each method, practice and assumption that might be used to rerun or resettle the July auction, Apogee, BETM and the payor settling parties explored whether they could reach agreement on payment levels, informed by the differing estimates of economic harm by PJM and Apogee, and by PJM and BETM.”

In addition to Apogee and BETM, the settling parties were American Electric Power Service Corp., American Municipal Power, Buckeye Power, DC Energy, Direct Energy Business, Direct Energy Business Marketing, Dominion Energy Services, Duke Energy Kentucky, Duke Energy Ohio, East Kentucky Power Cooperative, EDF Trading North America, EDF Energy Services, EDP Renewables North America, Elliott Bay Energy Trading, Exelon, FirstEnergy Service Co., LS Power Associates, Mercuria Energy America, Mercuria SJAK Trading, NextEra Energy Marketing, NRG Power Marketing, the PJM Industrial Customer Coalition, the PSEG Companies and Southern Maryland Electric Cooperative.

Although PJM did not describe the settlement as uncontested, it said “none of the settling parties shall seek rehearing of an order approving or accepting this settlement without modification or condition.” The other settlers aren’t asking for money because they believe they benefited from the way PJM ran the July 2018 auction and settled the remainder of GreenHat’s portfolio.

PJM members are funding the credits to Apogee and BETM through default allocation assessments. PJM said it will establish another $5 million fund for additional claimants, though it anticipates there won’t be any, based on the limited protest filings it received during the proceeding.

After receiving their credits, Apogee and BETM will be subjected to the same default allocation assessments that other members face. PJM spokesperson Jeff Shields told RTO Insider on Monday the default will cost members $177.5 million — substantially less than the cost of rerunning the July auction.

“The settlement is the product of intensive good faith negotiations among the participants to this proceeding,” he said. “It brings to a close open issues around the treatment of defaulted GreenHat portfolio. The settlement is supported by a broad array of stakeholders, there has been no indication that it is opposed by anyone, and it is in the public interest.”

PJM said it will rerun the July auction for the sole purpose of supporting the credit payments established in the settlement. The simulation will liquidate the entirety of GreenHat’s portfolio, which would impact FTR auctions in any month between September 2018 and May 2019. If any of the FTRs offered for liquidation would set price, then the simulated auction is rerun after removing 50% of the total defaulted FTR positions, regardless of path or period. PJM would waive all applicable Tariff rules concerning simultaneous feasibility test violations; prohibitions on selling FTRs not owned by an auction participant; FTR forfeitures; and requirements for participants to post additional credit based on tentative clearing results.

“The agreement not to apply the Tariff rules listed above is a key benefit of the ‘black box’ approach to settling this case,” the RTO’s attorneys wrote. “If PJM actually reran the auction, the referenced rules could cause cascading deviations from actual settlement results in other auctions conducted for the 2018/19 planning period, likely creating additional Tariff violations, further disrupting the market and undermining market participants’ faith in the finality of the FTR auctions.”

PJM asked FERC to waive both the reply comment period and the regulations necessary to effectuate the settlement. The RTO and the settling parties will answer questions on the deal in a meeting at FERC from 1 to 3 p.m. Oct. 17. The meeting will be available via teleconference (Phone: 800-375-2612; Meeting Access ID: 379441).