By Christen Smith

VALLEY FORGE, Pa. — An unprecedented spell of hot weather across PJM earlier this month left stakeholders questioning whether the RTO’s operational decisions produced the unusual price signals some generators witnessed while complying with emergency load management instructions.

Rebecca Carroll, PJM’s director of dispatch, told the Operating Committee on Tuesday that an underestimated load forecast for Oct. 1, combined with typical maintenance schedules and unexpected line losses, triggered the RTO’s first ever generator-involved performance assessment interval (PAI) the following day.

Members, however, wondered aloud whether decisions PJM made before calling upon 725 MW of demand response contributed to unstable LMPs that, at times, dropped well below $0 and contradicted dispatch instructions during the event.

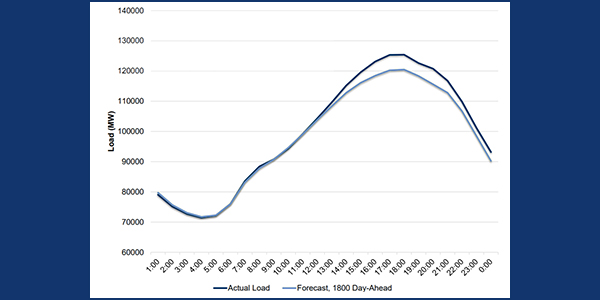

The trouble began on Oct. 1 when PJM’s peak load exceeded its forecast by 5,500 MW, knocking the RTO into a spinning reserves event and triggering shortage pricing for three five-minute intervals. Carroll said PJM also called upon 800 MW of shared reserves from the Northeast Power Coordinating Council to compensate.

Carroll said that on the following morning, the load was tracking well with forecasts — until a 765-kV line in the American Electric Power zone failed and 2,000 MW of generation called upon the day before failed to start. Those losses, in combination with a peak load forecast of 131,000 MW and anticipated congestion over the Hyatt transformer and the Peach Bottom-Conastone 500-kV line, prompted staff to call up 725 MW of long-lead DR resources for a pre-emergency load management event. The decision triggered a PAI that lasted from 2 p.m. until approximately 4 p.m. in the AEP, Dominion Energy, Pepco and Baltimore Gas and Electric zones.

What should have happened next, according to several stakeholders, was a rise in LMPs for those zones, set by DR operating during the PAI. Instead, prices in the AEP zone tanked, and 4,500 MW of anticipated load never materialized. The missing load meant that scarcity pricing was never implemented, Carroll said, because DR remained marginal and “never had the chance to set price.”

“This was a record-setting temperature for the month of October and much hotter than Oct. 1,” she said. “So for the load to come in only 1,000 MW higher on Oct. 2 really doesn’t make sense.”

Carroll said staff is reviewing its modeling, referred to as “back-casting,” and investigating other potential factors behind the discrepancy in the load forecasts.

“Our forecasting in Mid-Atlantic looked really good,” she said. “We are looking into what percentage of the load was not there because of the load management we called and what percentage was not there because of changes in weather.”

David “Scarp” Scarpignato of Calpine disagreed with PJM’s decision to call upon DR with two-hour lead times rather than the 30-minute resources that make up the bulk of the RTO’s DR fleet. Carroll said the challenges facing the grid that morning, combined with the cheaper pricing offered from long-lead DR, factored into its decision.

“You’re not allowing the prices to go where they need to go,” he said. “You’re taking emergency actions, and if you’re making them wrong, you’re going to crush prices.”

Carroll later told the Market Implementation Committee on Wednesday that staff originally anticipated needing DR for several hours to sustain the forecasted load that afternoon.

“It didn’t set price when we called it, but the anticipation was that it would have been marginal throughout some portion of that day as the load materialized,” she said.

Paul Sotkiewicz, president of E-Cubed Policy Associates and PJM’s former chief economist, pushed staff to explain why prices at generator buses in the AEP zone turned negative during the PAI.

“I’m basically eating the negative prices or I’m getting penalized, and that’s something that should never happen in a PAI,” he said.

Carroll said PJM’s operations staff are preparing a paper for next month’s OC meeting that will walk through the timeline for the two days, the decisions made and the factors that impacted pricing. Staff will also release an FAQ that answers stakeholders questions posed in both meetings and through email.

“PJM does really have some concerns about the way the load materialized on Oct. 2,” she said. “There’s a chunk of 3,000 MW [missing] that PJM can’t explain at this point, and we don’t know where it went.”

She also said staff suspects there was a “behavioral component” among larger customers that made the decision to go offline during the PAI to avoid the higher prices that were anticipated.

“We are hoping that through these back-casting activities, we can put a finer point on where PJM made an error in load forecasting and where we need more visibility on how generation and load are going to behave,” she said.