By Christen Smith

PJM must provide FERC with a refreshed briefing on whether the RTO still wants to charge uplift on all virtual trades — including the currently exempted up-to-congestion transactions (UTCs) — in light of recent market changes.

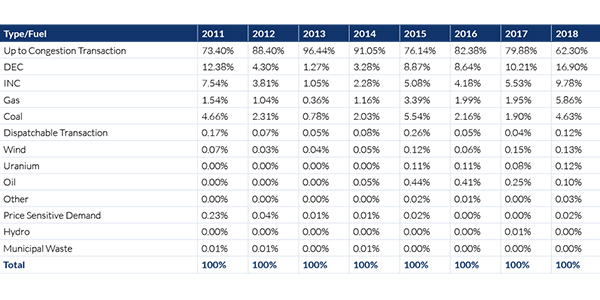

In its order issued Thursday, the commission gave PJM 30 days to respond to 10 questions that probe deeper into the “typical magnitude and direction” of UTCs’ impact on uplift and how the RTO might quantify those costs — whether it be a flat fee, a percentage-based allocation or some other methodology — given the reduced volume of virtual trading over the last two years. FERC also invited stakeholders to update the proceeding with their responses (EL14-37).

In January 2017, the commission extended PJM’s financial transmission rights forfeiture rule to cover UTCs, but it denied the RTO’s proposal to extend uplift charges to the trades as well. Under existing rules, only increment offers (INCs) and decrement bids (DECs) accrue uplift, though PJM asserts that UTCs play a crucial role in how expensive those charges can be across different bidding locations — or nodes.

In February 2018, the commission approved PJM’s proposal to reduce the number of nodes by 90%, which in turn limited INCs and DECs to those where either generation, load or interchange transactions are settled, or at trading hubs where forward positions can be taken. They also barred UTCs from zonal, extra-high-voltage and individual load nodes. The changes reduced the number of INC/DEC trading nodes from 11,727 to 1,563, and UTC nodes from 418 to 49. (See FERC OKs Slash in Virtual Bidding Nodes for PJM and FERC Upholds PJM Orders on Virtual Trading Nodes, Uplift.)

Two months later, FERC issued Order 844, which incorporated additional uplift transparency rules for all RTOs and ISOs, but it withdrew a requirement that grid operators categorize real-time uplift costs based on their causes and allocate them only to market participants “whose transactions are reasonably expected to have caused” the uplift. (See FERC Orders RTOs to Shine Light on Uplift Data.)

“The commission stated that it continued to believe that uplift ideally should be allocated to those market participants whose transactions caused the uplift and that allocations of uplift costs should avoid penalizing behavior that can improve price formation,” FERC wrote. “However, based on the record in that proceeding, the commission found commenters’ substantial concerns about the proposal sufficiently persuasive to decline to take generic action at the time.”

The proceeding represents six years of debate between PJM and its stakeholders over whether uplift can be accurately pinpointed to a specific UTC, given the day-to-day variability of the energy markets. Others argue there’s no proof that UTCs even cause uplift, let alone should be charged for it.

Given the challenges of appropriately assessing uplift on individual UTCs, PJM must tell FERC if it’s possible to instead determine an aggregate impact. The commission also wants updated analysis that shows changes to unit commitment caused by UTCs. Other questions from FERC included:

- Are there considerations other than UTCs’ impact on uplift that would still render the PJM Tariff unjust and unreasonable because it does not allocate the costs of uplift to all deviations?

- If some types of transactions typically have a smaller impact on uplift than other types of transactions, is it appropriate for PJM to allocate uplift differently to some deviations based on the impact of that transaction type? Why or why not?

- Could create an allocation factor to allocate a certain percentage of uplift associated with deviations to UTCs?

- Would PJM be able to allocate uplift costs to UTCs by assessing a fixed fee on a per-transaction basis? How would PJM determine such a fixed fee?