The New England Power Pool Markets Committee on Wednesday continued discussing ISO-NE’s Energy Security Improvements (ESI) proposal, with a focus on the plan’s treatment of day-ahead ancillary services.

One document up for discussion was a memo from ISO-NE COO Vamsi Chadalavada on the RTO’s draft 2020 Work Plan to file a long-term fuel security mechanism, as presented to the Participants Committee earlier this month. The other was a schedule of ESI milestones. (See “ISO-NE Draft 2020 Work Plan,” NEPOOL Participants Committee Briefs: Oct. 4, 2019.)

ISO-NE Chief Economist Matt White reviewed the monthly components of the ESI project through FERC’s April 15, 2020, filing deadline, starting with the design and impact assessment of core day-ahead ancillary services.

The RTO’s work on ancillary services falls into two distinct areas. The first is the time-intensive process of completing the full mathematical formulation for the day-ahead co-optimized design. The second is addressing stakeholder questions about how the core design will actually work.

A footnote on the schedule said the RTO “plans to prepare a summary for the November MC on the current state of the ESI design, e.g., the status of the various components.”

Speaking about the conceptual design for mitigation of day-ahead ancillary services at the Sept. 3 MC meeting, External Market Monitor David Patton expressed willingness to elaborate on the views he presented, which likely will be provided before the discussion scheduled for January. (See ISO-NE IMM Details Market Power Concerns on ESI.)

Patton has direct experience monitoring markets that have co-optimized day-ahead ancillary services in both NYISO and MISO, and also has views on how the current mitigation can be made to work under ISO-NE’s design.

NESCOE Seeks ESI Analysis

New England States Committee of Electricity (NESCOE) representative Ben D’Antonio submitted a memo ahead of the meeting outlining the group’s priorities for the extra months of planning provided by FERC’s deadline extension.

NESCOE said it seeks a comparison of the differences between the ISO-NE ancillary services proposal and those currently used in other markets, and how they would be modeled differently by the RTO’s consultant, who also should provide an annual simulation of the ESI proposal’s impacts.

The memo requested analysis of the External Market Monitor’s recommendation to incorporate operating reserves into the day-ahead market, asking that the RTO demonstrate that the ESI ancillary services proposal is better than other more straightforward approaches for integrating operating reserves into the day-ahead market.

NESCOE also requested further evaluation of the sensitivity of the results to the underlying input assumptions.

ESI Impacts

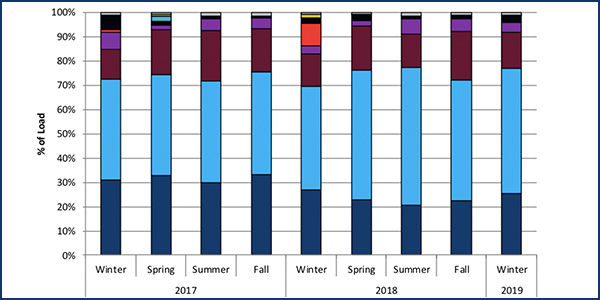

ISO-NE economist Chris Geissler presented on improvements to the production cost model used in the impact assessment of ESI, including enhancements that extend the model to non-winter months, further assess its fuel input assumptions and improve its calculation of energy imbalance reserves (EIR).

ISO-NE agrees with NESCOE that inclusion of non-winter months in the model will allow the RTO and stakeholders to better assess the expected market and reliability impacts from ESI, Geissler said.

Geissler pointed out that there may be some instances where the model assumes that resources will procure more or less incremental oil than would be expected. Further analysis could help the RTO determine whether to modify those assumptions to better reflect their impact on incremental incentives, fuel inventory and reliability, he said.

He also said that while the current practice of setting the EIR at a fixed value for each hour captures the historical gap between the forecast load and cleared day-ahead generation, it does not account for proposed rule changes under ESI that could decrease the size of the gap. Enhancement would modify the model’s assumptions about day-ahead load to include price-responsive demand bids, as occurs in the day-ahead market in practice.

Benefits to improving the EIR calculation, he said, are market and reliability outcomes that better reflect those expected under the ESI proposal; increased day-ahead energy awards and reduced EIR awards; reduced impacts on energy and ancillary service clearing prices; and a weaker impact of ESI on consumer costs.

Geissler said the RTO hopes to publish an impacts analysis report in February in preparation for an MC vote in March ahead of an April filing with FERC.

Other ESI Business

Brett Kruse, vice president of market design at Calpine, briefly outlined the company’s proposal for a forward enhanced reserves market (FERM), which would value existing fuel-secure resources in the region and provide a forward price signal to incentivize fuel supply arrangements or investments.

The Connecticut Public Utilities Regulatory Authority presented an amendment to insert Tariff language requiring the Internal Market Monitor to prepare a quarterly report assessing the competitiveness of energy call option offers in the day-ahead energy market.

David Errichetti of Eversource Energy presented the utility’s proposed amendment dealing with the overlap of the inventoried energy program and ESI operating at the same time in winter 2024/25.

Enhancing Search in GIS

The MC unanimously approved changes to the Generation Information System (GIS) and its operating rules to provide additional searching and sorting capabilities for users, effective Jan. 1, 2020.

NEPOOL Counsel Lynn Fountain presented the changes, which will allow users to access GIS data related to imports for New England state renewable portfolio standards, aggregated separately by type of generator and resource for each control area where an importing generator is located. Parties would remain unable to identify individual generators or load-serving entities associated with any data, Fountain said.

The GIS Agreement provides that the system administrator perform up to 200 hours of development work for enhancements to the GIS each year without additional cost. The administrator estimates that the proposed changes would require 34 hours to complete. Because changes approved earlier this year required 166 hours to complete, the 200-hour credit would be fully used for 2019. The MC has authority to approve the changes without Participants Committee action.

Sunsetting Fuel Security Reliability Review Provisions

The MC discussed revisions to Market Rule 1 to sunset the fuel security reliability review provisions following Forward Capacity Auction 14, one year earlier than the currently effective period. Allison DiGrande, ISO-NE director of NEPOOL relations, presented the changes.

Committee Chair Alex Kuznecow scheduled the item for a vote by the MC at its Nov. 12-13 meeting.

The MC last month approved amending Market Rule 1 to limit the retention of resources needed for fuel security to two years. (See NEPOOL Markets Committee Briefs: Sept. 18, 2019.) Continuing retentions into the 2024/25 capacity commitment period (FCA 15) is not necessary with the expected implementation of ESI in the same period, DiGrande said.

The proposal would delete any language referring to 2024/25 from Section III.13.2.5.2.5A and Appendix L in Market Rule 1.

The RTO wants the change to become effective prior to March 13, 2020, the retirement delist and permanent delist bids deadline for FCA 15.

— Michael Kuser