By Michael Kuser

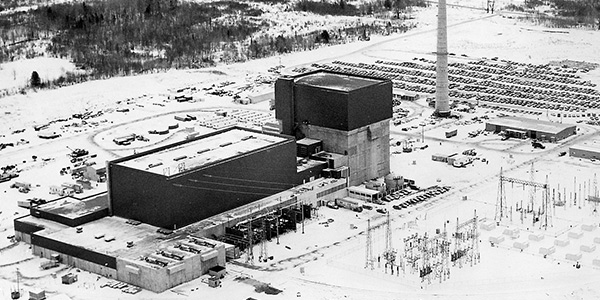

FERC on Thursday denied Public Citizen’s request for a rehearing of the commission’s September 2017 order granting market-based rate authority to Exelon’s James A. FitzPatrick nuclear power plant (ER17-2201-001).

Public Citizen protested that Exelon’s application for MBRA was “incomplete, as it fails to incorporate the New York zero-emission credit (ZEC) in its horizontal market power screen,” which would “result in windfall profits … resulting in rates that would likely not be just and reasonable.”

“That Exelon Fitzpatrick may receive another revenue stream from the state in the form of ZECs has no bearing on the commission’s market-based rate analysis and therefore does not change the commission’s determination that Exelon Fitzpatrick lacks market power and therefore may charge market-based rates,” the commission said. “Public Citizen conflates its concerns regarding the state-approved ZECs with the commission’s market power analysis in this proceeding.”

Earlier this month, the New York Supreme Court rejected a challenge to the state’s ZEC program, dismissing a suit by Hudson River Sloop Clearwater and others against the Public Service Commission’s 2016 decision to establish the program to subsidize economically unviable nuclear plants. (See NY Court Rejects Challenge to ZEC Program.)

The commission in December 2016 authorized Entergy’s sale of the 838-MW nuclear plant to Exelon over Public Citizen’s protests, saying the issues raised concerned the effects of the ZEC program rather than the impact of the plant sale on competition, rates, regulation or cross-subsidization. (See FERC Denies Rehearing on FitzPatrick Nuclear Plant Sale.)

On Thursday, the commission reiterated its original conclusion on MBRA: “Because the ZEC does not affect the amount of generation capacity owned or controlled by applicant or its affiliates, it was appropriate for applicant not to include the ZEC in its horizontal market power analysis.

“Thus, we find no merit in Public Citizen’s argument that Exelon Fitzpatrick’s application should have been analyzed differently,” the commission said.

FERC OKs Sale of Empire Gen Owner

FERC also approved the sale of the upstream owner of Empire Generating, which operates a 653.7-MW natural gas-fired power plant in Rensselaer, N.Y. (EC19-99).

Empire Gen Holdings is indirectly and wholly owned by TTK Power, which in turn is indirectly owned by three entities: Tyr Energy (50%); Kansai Electric Power (25%); and Tokyo Gas (25%). The buyers are: Black Diamond Capital Holdings; AEIF Trade and ASSF IV AIV B Holdings III (together, Ares Holders); and SPTIF Parent.

The commission ruled the sale will not adversely affect horizontal competition, as the increase in Herfindahl-Hirschman Index (HHI) levels in the market is below the threshold for competitive concerns and does not warrant further review. HHI is a measure of market concentration calculated by squaring the market share of each firm competing in the market and summing the results.

The commission also found the sale would have “no adverse effect on vertical market power because it does not involve the acquisition or consolidation of any electric transmission capacity or inputs to electricity production,” nor would the new owners “provide inputs to electricity products or electric power production in the same geographic market.”

The sale will not harm rates because the plant will continue to sell power under its market-based rate tariff and under individual market-based rate power sales agreements, said FERC.

The commission denied a request by Ares Management that Empire provide information concerning how, or by whom, the new entity will be managed and controlled, saying, “We are not persuaded that it is necessary to require additional details regarding the governance structure.”