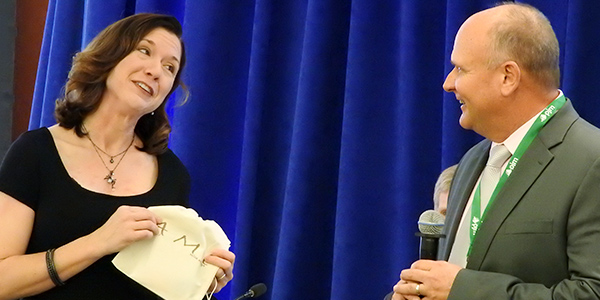

VALLEY FORGE, Pa. — PJM staff and stakeholders kicked off Thursday’s Markets and Reliability Committee meeting with an homage to Denise Foster, the RTO’s vice president of state and member services, on her last day with the organization.

“Denise has always been committed to the success of PJM,” said Stu Bresler, senior vice president of market services. “She was very adept and very skilled at building, maintaining and, if I may, fostering relationships.”

Foster resigned in September, much to the disappointment of stakeholders — particularly state consumer advocates — who described her as engaging, personable and sharp. Bresler echoed those warm sentiments in his send-off, saying that Foster served as a mentor to other staff and provided great “insights on the substance of what we do at PJM.”

“She made tough decisions when she needed to and followed through on those decisions when she needed to and really earned the respect of staff here at PJM,” he said.

New Load Management Test Rules Endorsed

The MRC endorsed new load management and price-responsive demand testing rules for Capacity Performance resources after PJM said old measures failed to mimic real-life emergency procedures. (See PJM Stakeholders Support More Realistic DR Testing and “Stakeholders Urge Consensus on Load Management Testing Requirements,” PJM MRC/MC Briefs: Sept. 30, 2019.)

The new rules, effective with the 2023/24 delivery year, would give PJM authority over scheduling tests — instead of the resource itself — and provide advanced notification so participants can prepare. The changes would implement a three-step system that gives resources first notice of an upcoming test one week prior to the two-week testing window, with additional alerts by 10 a.m. the day before and the day of the scheduled test. There will be one test per year when there is no event, with half of resources tested in winter and the other half in summer.

The current rules, developed when demand response availability was limited to just six hours a day over the summer, require one test during the summer. They give resources a two-day warning — down to the exact hour — and provide unlimited retesting.

Enel X North America, sponsor of an alternative package that provided a week-ahead notification of a one-week testing window, withdrew its proposal Thursday and encouraged members to support PJM’s plan instead.

“Both sides gave some blood here,” Enel’s Brian Kauffman said. “There’s some philosophical questions that won’t be answered here and will ultimately end up before FERC.”

Stakeholders Mull Tx Asset Management Discussion

Stakeholders will once again consider assembling to discuss how incumbent transmission owners make asset management decisions and whether those projects should stay outside of the regional planning process.

Ed Tatum, vice president of transmission for American Municipal Power, proposed a problem statement and issue charge that would create a special session of the MRC to discuss what criteria TOs should observe before determining their infrastructure has reached the end of its life and whether those determinants could be — or even should be —standardized across all zones.

“It’s important for the stakeholders to weigh in as to how they think this process should work,” Tatum said. “There’s going to be some disagreement, and we need to get some clarity from Washington, D.C., as we go to Federal Energy Regulatory Commission.”

Currently, PJM considers projects related to local asset management as supplemental to the Regional Transmission Expansion Plan and only studies their impacts on the grid’s reliability — not whether the proposals are necessary or the most cost-effective solution. AMP and others have argued that local replacement decisions have regional implications and, therefore, PJM should take over planning in order to assure new projects will not just solve reliability concerns, but also support the “grid of the future.”

“We have talked around this issue so much in recent years, perhaps there’s a degree in fatigue in thinking about it,” said Susan Bruce of the PJM Industrial Customer Coalition. “The first time we went through this, we didn’t have as much clarity as to how PJM was viewing these issues. I think we have a better appreciation for PJM’s asset management concerns in this space.”

Both staff and PJM’s Board of Managers maintain that FERC precedent leaves asset management up to the discretion of TOs, where the local planning expertise lies. Incumbent TOs agree.

“By having PJM responsible for end of life, you are putting more liability on PJM and its membership,” said Pulin Shah, director of transmission strategy and contracts for Exelon. “Even if an artificial end-of-life criteria is established, the transmission owners will still need to move forward with their own end-of-life decisions. Having PJM develop or create some may result in significant increase in supplemental spend if PJM now has to take on this responsibility.”

Tonja Wicks, manager of federal regulatory and regional affairs for Duquesne Light Co., said the term “end of useful life” is what both the industry and FERC have defined and accepted. She then reiterated that the commission concluded that planning for these particular assets is “beyond the scope of PJM’s authority” and questioned whether the newly created term “end of life” was an oversight or if AMP concedes that the FERC term and definition “are what we are working from.”

“There is no industry accepted definition of ‘end of life,’ so we are trying to understand how to work out this issue based on a term that has not been defined,” she said. “We are trying to get an understanding of what we are talking about because there is no such term.”

Tatum said he hopes “TOs will indeed come to the table and come up with some creative solutions that hopefully we can find a consensus around.” While PJM didn’t move off of its long-held position on its authority over supplementals, staff said the conversation was still worth having.

“We will not be put into a position to do condition decisions or asset management-type decisions,” said Ken Seiler, PJM’s vice president of planning. “It’s not our authority to do that, but there is solution space here.”

The MRC will vote on the initiative at its Dec. 5 meeting. Notably, the Planning Committee turned down the problem statement at its September meeting. (See “PC Says ‘No’ to End-of-life Transparency Discussion,” PJM PC/TEAC Briefs: Sept. 12, 2019.)

FTR Market Rule Changes

PJM presented the first round of recommended rule changes for its financial transmission rights market in the wake of the GreenHat Energy default.

Brian Chmielewski, manager of market simulation, said the recommendations will improve PJM’s credit risk policies after the Financial Risk Mitigation Senior Task Force delegated a more holistic FTR market review and possible design changes to a separate MIC task force.

First, PJM suggests hosting five long-term FTR auctions a year, instead of just three, in order to increase oversight and visibility into portfolio conditions so that more collateral can be collected if necessary.

“One of the things we saw with GreenHat, between December and June there was a massive devaluation in that portfolio, so this would have an auction right in March to catch that sooner,” Chmielewski said.

A second recommendation would alter the structure of Balancing of Planning Period FTR auctions so that participants can buy and sell in any month of the year, rather than being limited to a specific quarter.

The FRMSTF voted 75% in favor of the changes. MRC endorsement is scheduled for Dec. 5, with implementation effective in 2020/21.

Endorsements

- Manual 14D: Generator Operational Requirements, a periodic cover-to-cover review and language changes that comply with FERC Order 841 for energy storage participation.

- Manual 36: System Restoration and Manual 40: Training and Certification Requirements regarding Order 841.

- 2019 Reserve Requirement Study results, including updated values for the installed reserve margin and forecast pool requirement, which reset key parameters for the RTO’s upcoming capacity auctions. (See “2019 Installed Reserve Margin Study Results,” PJM PC/TEAC Briefs: Oct. 17, 2019.) Also approved by the Members Committee.

– Christen Smith