The New England Power Pool Participants Committee on Friday approved ISO-NE’s proposed installed capacity requirement (ICR) calculations for Forward Capacity Auction 14 (2023/24) and three annual reconfiguration auctions (ARAs), to be conducted in 2020.

The PC followed the Reliability Committee in reversing its earlier rejection of net ICRs of 32,205 MW for 2020/21 ARA 3, 32,230 MW for 2021/22 ARA 2 and 32,465 MW for 2022/23 ARA 1, with 61.71% in favor. (See NEPOOL Reliability Committee Briefs: Oct. 23, 2019.)

The Generation sector unanimously opposed the ICRs, but they had the support of the other sectors, including Transmission (16.79%), Supplier (3.36%), Alternative Resources (10.38%), Publicly Owned Entity (16.79%) and End User (14.39%).

The committee also narrowly approved, with 60.04% in favor to meet the minimum 60%, a 940-MW value for the Hydro-Québec interconnection capability credit (HQICC) for FCA 14’s ARA 3, with the value rising to 958 MW for ARA 2 and 969 MW for ARA 1.

The Generation sector also unanimously opposed the HQICC motion, but the other sectors supported, including Transmission (16.79%), Supplier (1.68%), Alternative Resources (10.38%), Publicly Owned Entity (16.79%) and End User (14.4%).

ISO-NE plans to file the ICR values with FERC on Tuesday.

2019 system operations – load forecast accuracy | ISO-NE

No Recovering IROL Costs

The PC failed to support the Schedule 17 cost recovery provisions as proposed by ISO-NE to compensate certain generators and transmission facilities for incremental costs related to interconnection reliability operating limits (IROL) and critical infrastructure protection.

The motion failed to pass, with 63.84% in favor, just short of the necessary two-thirds. The Transmission and End User sectors were unanimous in opposition, while the other sectors supported, including Generation (16.79%), Supplier (15.86%), Alternative Resources (14.4%) and Publicly Owned Entity (16.79%).

These incremental costs cannot now be competitively offered and recovered through the energy and capacity markets.

An IROL is an operating limit that, if exceeded, could lead to a significant adverse reliability impact on the New England system, as well as neighboring systems to the west and north, according to a background memo from ISO-NE analyst Jon Lowell.

The reliability impact could be loss of significant portions of the New England system — and neighboring systems — because of system instability, cascading outages or uncontrolled system separation.

Generators and transmission facilities designated by the RTO as critical to the determination of IROLs must meet higher NERC CIP standards because their loss or misuse could have an adverse impact on the reliable operation of the grid, including instability in the bulk electric system, the memo said.

Energy Market in October down 61% Y-o-Y

ISO-NE CEO Gordon van Welie did not appear before the committee, though he did attend various meetings earlier in the day between market participants, the RTO’s Board of Directors and officials from the six New England states.

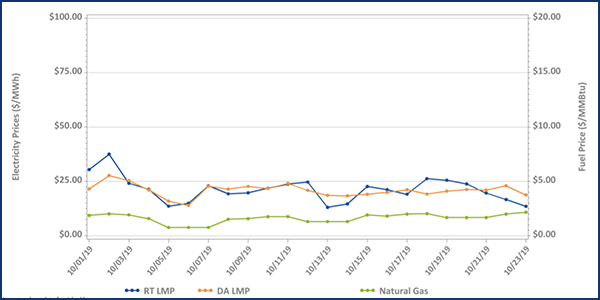

COO Vamsi Chadalavada reported that prices in the region’s energy markets have been hitting historic lows, with the market value for October at $151 million, down $60 million from September 2019 and $238 million from the same month a year ago.

Average natural gas prices and real-time hub LMPs over the period were down 51% and 46%, respectively, from October 2018.

Average day-ahead cleared physical energy during peak hours as a percentage of forecasted load was 98.9% through Oct. 23, down from 99.5% during September.

Daily average day-ahead and real-time ISO-NE hub prices and input fuel prices: Oct. 1-23 | ISO-NE

Financial Assurance Policy Changes

The PC approved changes to the RTO’s Financial Assurance Policy (FAP) related to financial assurance requirements for non-commercial resources in the Forward Capacity Market, but it rejected changes to the rate used to calculate the FAP for non-commercial capacity.

According to a memo from NEPOOL counsel Paul Belval, the RTO said the proposed change would remove the profit motivation for resources not expected to deliver because such profits would be offset by a proportionate increase in collateral requirements until the project achieves commercial operation.

The change does not collateralize any capacity supply obligation that originates outside of the FCA, consistent with the existing design.

The committee rejected basing the rate used to calculate non-commercial financial assurance on the net cost of new entry value in place for the given FCA, rather than the current practice of using the FCA clearing price.

The motion failed to pass the two-thirds needed with a 61.47% vote in favor.

ISO-NE this week will inform market participants what it plans to do with the split decision.

NEPOOL rules prohibit RTO Insider from quoting stakeholders’ comments during the meeting. However, Brett Kruse, vice president of market design at Calpine, confirmed after the meeting that, for example, in FCA 10, New England saw 900 MW of so-called phantom capacity that bid into the market, cleared and then never showed up in the operating year.

“This region performs exponentially worse than other forward capacity markets for what is supposed to be a physical resource,” Kruse said.

Consent Agenda

The committee unanimously approved, with abstentions noted, four items on the consent agenda. The first three were approved by the RC and the last by the Transmission Committee:

- Revisions to Operating Procedure 16J, to modify the timing for initiating the annual certification of transmission equipment dynamics data;

- Revisions to Operating Procedure 2A, to modify the table of itemized equipment maintenance of communications, computers, metering and building services;

- Revisions to Planning Procedure No. 10, to delete provisions related to interconnection service adjustments that are being incorporated into the Tariff; and

- Tariff revisions (including Section II.48 and Schedules 22, 23 and 25) to clarify interconnection service adjustments.

The committee also approved in a single vote, with one abstention, two other items that did not make it on the consent agenda because of lack of time:

- Revisions to OP-16 Appendix J, to clarify the requirements for the annual certification of transmission equipment dynamics data and incorporate additional clarity; and

- Revisions to OP-2 Appendix A, to add certain equipment and technology, and delete obsolete language.

Litigation Report

NEPOOL Secretary David Doot, a Day Pitney attorney, highlighted two items from the monthly litigation reports, including a FERC investigation into Order 1000 exemptions for “immediate-need” reliability transmission projects, which will be discussed in detail at the next TC meeting, Dec. 17 (EL19-90).

The second item concerned an appeal pending of the commission’s notice of inability to act for lack of a quorum on the RTO’s inventoried energy program proposal, which became effective “by operation of law” in September, as did the latest FCA results. (See FCA 13 Results Stand Without FERC Quorum.)

Several New England municipal utilities and Energy New England last week petitioned the D.C. Circuit Court of Appeals to rule on the matter (ER19-1428).

— Michael Kuser