NYISO’s Business Issues Committee on Wednesday voted unanimously to recommend that the Management Committee approve Tariff changes intended to help speed up the interconnection process.

Thinh Nguyen, senior manager for interconnection projects, presented the proposed changes, which seek to expedite the class year portion of the interconnection study and limit the potential for one or two projects to cause delay for other projects.

NYISO is proposing to:

- require deliverability evaluation in system reliability impact studies;

- remove additional system deliverability upgrade studies from the class year study;

- conduct expedited deliverability studies for capacity resource interconnection service (CRIS)-only projects; and

- tighten CRIS expiration rules to prevent the retention of CRIS by facilities not participating in the capacity market.

Nguyen noted that stakeholders were keen to ensure the proposal would not change the qualities of the current process most important to them, including:

- the identification of system upgrade facilities for projects to reliably interconnect, including detailed design, engineering and construction estimates;

- provision of binding, good-faith cost estimates that provide reasonable closure on upgrade costs; and

- equitable allocation of upgrade costs.

NYISO intends to make many of the proposals effective for Class Year 2019.

Competitive Entry Exemptions

The committee also voted unanimously to recommend that the MC approve Tariff changes to make competitive entry exemption (CEE) available to requests for additional CRIS megawatts in a manner consistent with the underlying rationale for the exemption.

Senior ICAP Mitigation Analyst Jonathan Newton presented the proposal, which includes a change in the consequences of withdrawing a CEE request or providing false and misleading information.

The changes also modify the CEE rules in a way that could facilitate the repowering and replacement of existing generators by allowing existing portfolio owners that have entered into competitive short-term hedging contracts to qualify for the CEE.

“The changes are a reasonable way to let people move forward without penalizing normal commodity hedging,” one stakeholder said.

NYISO intends to make the proposed rules effective for Class Year 2019 projects, Newton said.

If the MC approves the queue changes this month, and the Board of Directors approves them in December, the ISO anticipates making the filings with FERC by Dec. 20 and seeking orders from the commission during the third week of February 2020.

More Granular Operating Reserves

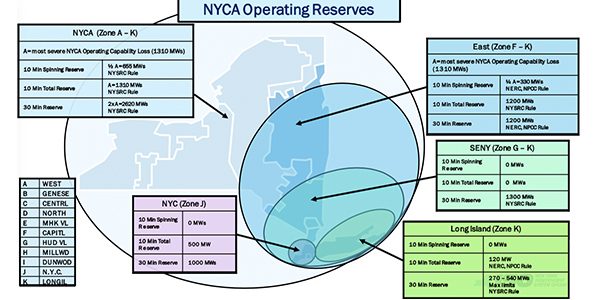

The BIC discussed a proposal to implement local reserve requirements in certain New York City (Zone J) load pockets.

Market Design Specialist Ashley Ferrer presented the proposal, as recommended by the Market Monitoring Unit, including the modeling of the requirements based on N-1-1 reliability criteria.

Load pockets in Zone J are areas constrained by load levels and generation capability, as well as by transmission-supported import levels into the pocket. The structure and boundaries of each load pocket varies based on load, generation and transmission imports, Ferrer said.

The ISO last June established a reserve region in Zone J based on a market design approved by stakeholders in March.

NYISO is proposing to establish operating reserve demand curves for each load pocket that assign a $25/MWh value to the proposed reserve requirements. The ISO proposes 30-minute reserve requirements of 325 MW in Astoria East/Corona/Jamaica; 225 MW in Astoria West/Queensbridge/Vernon; and 250 MW in Greenwood/Staten Island.

“This issue is not prioritized in 2020, but we still consider it important, and it could go forward conceivably in 2021,” said Rana Mukerji, senior vice president for market structures. “We will actually bring forth the methodology [for an impact analysis] before conducting any consumer impact analysis [with respect to the proposal].”

Broader Regional Markets Report

In presenting the month’s Broader Regional Markets Report, Mukerji highlighted updates to two ongoing proceedings.

The first item concerned five-minute real-time dispatch transaction scheduling with Hydro-Québec (HQ) across controllable interties at the Chateauguay proxy.

The proposed plan includes a project to consider scheduling transactions on a five-minute basis with HQ, instead of either the 15-minute or hourly basis currently in effect using NYISO’s real-time commitment software. The ISO is targeting to complete a study of the potential enhancement in 2020.

The second item concerned an effort to clarify the minimum deliverability requirements for external capacity.

At the MC’s May 20 meeting, stakeholders approved enhancements to the performance requirements for external capacity suppliers in response to a supplemental resource evaluation, a proposal that became effective in August after FERC approval.

IPPNY’s Matt Schwall Elected as Vice Chair

The BIC elected Matthew Schwall as its incoming vice chair for 2019/20. Schwall is director of market policy and regulatory affairs for the Independent Power Producers of New York, where he has worked since 2014, and previously worked in various capacities at the New York State Assembly. He is earning a master of science in global energy management at the University of Colorado Denver.

— Michael Kuser