By Amanda Durish Cook

CARMEL, Ind. — MISO’s system can operate on 50% renewable generation if the RTO greenlights dramatically more transmission and ups reserve requirements, and if its members embrace new technologies, new study results show.

MISO laid out the possible realities of a 50% scenario at a special Nov. 14-15 workshop to discuss the third round of results of the RTO’s ongoing Renewable Integration Impact Assessment.

To reach 50% renewables, MISO could retire 17 GW of its existing thermal fleet and add about 100 GW of renewable capacity. Results show even at a 50% renewable penetration, “the majority of the thermal fleet remains available to maintain adequacy,” Policy Studies Manager Jordan Bakke said.

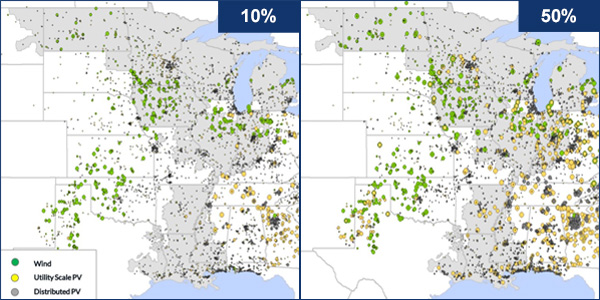

According to the study, renewables would reach 50% of the generation mix as utility-scale solar proliferates in MISO South while wind generation multiplies in the northwestern portion of the footprint. MISO also foresees distributed solar generation becoming more commonplace and concentrated near major cities.

The RTO also said the complementary characteristics of wind and solar generation — on a daily and seasonal basis, solar is generally available when wind isn’t as plentiful — “decreases the probability of not serving load during periods of high risk.”

MISO’s current generation interconnection queue contains 569 projects with 89 GW of estimated capacity, including 51 GW worth of solar and 22 GW of wind. According to a recent report, MISO expects about 3.5 GW of new wind generation to interconnect this year and more than 6 GW to come online throughout 2020.

MISO reported that it executed 43 generation interconnection agreements in 2019, breaking the previous record of 38 set in 2003. However, the RTO also reported 157 project withdrawals so far this year, just short of the record 168 withdrawals set in 2017.

President of Market Development Strategy Richard Doying said MISO now is nearing 20 GW of wind generation, which can have zero marginal cost.

“That is the right economic price, but it’s terrible for baseload generation,” Doying said at an Organization of MISO States meeting in October.

Pad Reserves?

The latest results also line up with earlier studies that conclude MISO’s daily loss-of-load risk compresses into a sharper risk during a smaller set of hours later in the day under a high-renewables scenario. (See MISO Renewable Study Predicts Later Peak, Narrower LOLE Risk.)

At 40% renewables, MISO may need to increase its reserve requirement to manage quick changes in load, the study found.

MISO research and development adviser Long Zhao said the RTO will need ramping capability to manage discrepancies between early evening reductions in solar generation and increases in wind generation and load. Going forward, sunset would probably be a particularly challenging time of day for MISO to manage, Zhao said.

When renewable generation climbs from a 40 to 50% share of the generation mix, it begins to nudge out nuclear and natural gas resources footprint-wide in economic dispatch. MISO envisions its footprint will contain a wind-dominated northern region, a southern region where solar and natural-gas fired generation begin jockeying for position, and a central region that draws on both types of renewables. It also found a significant increase in imports as renewables climb to 50% — more than 10 GW in some cases during summer days. Today, MISO does not exceed 5 GW in imports, even on summer days.

Veriquest Group’s David Harlan said he had a problem with MISO assuming that solar generation could replace the baseload generation of MISO South. He argued that solar’s production capability is simply not predictable enough for heavily industrial areas of the South.

“In MISO South, we have a heavy industrial load planned to be served by coal and nuclear and later by combined cycle,” Harlan said.

Clean Grid Alliance’s Natalie McIntire asked if the shorter and more pronounced loss-of-load risk is good or bad from MISO’s standpoint.

MISO adviser Brandon Heath said the sharper risk is simply a future reality. “It’s neutral. It’s not a good thing or a bad thing just yet,” he said.

Miles and Miles of Lines

It’s not until renewables take a 40% share of the generation mix that MISO foresees a need for transmission projects to “significantly reduce curtailment.” Without transmission solutions, renewable additions beyond a 40% penetration cannot continue displacing thermal generation because there isn’t enough transmission capacity, the RTO found.

“We see needs at the very beginning, but the needs are very small. We see energy adequacy needs when we get to 40%,” Bakke said.

MISO Policy Studies Engineer Yifan Li said while some areas might exhibit needs for local transmission solutions, there’s no need for anything major beyond the normal annual planning cycles until 40% renewable penetration.

“From the bulk amount of energy flow paths to deliver energy and reduce curtailment, an overall systemwide [extra-high-voltage] rebuild is not needed until the 40% milestone,” he said.

But McIntire pushed back on the idea that a 40% renewables mix is the inflection point for new transmission needs. She argued that MISO will require steady transmission buildout as renewable generation rises.

“I just don’t want us to minimize that message. We’re going to need significant transmission before 40%,” McIntire said.

Li agreed that annual transmission buildouts would continue to be needed, but at the 40% penetration level, MISO’s usual annual plans would fail to keep pace with transmission capacity needs.

“I like to compare it to a fever. … Our system is having a high fever around 40% renewables without significant amount of additional transmission,” he said.

At a 40% penetration, Li said, about 80 new transmission projects located all over the footprint might provide the necessary energy delivery. The bundle of projects includes 2,400 miles of 345-kV and lower-voltage lines, 320 miles of 500-kV lines, 270 miles of 765-kV lines and 410 miles of HVDC lines.

At 50% penetration, an additional 70 projects across the footprint could help, including 590 miles of 345-kV and lower-voltage lines, 820 miles of 500-kV, 2,040 miles of 765-kV and 640 miles of HVDC. Li said the transmission additions would be particularly helpful in reducing wind curtailment in the northern part of the footprint, where wind capacity will be ubiquitous.

“We evaluated more than 11,000 [transmission project] candidates,” Li said. MISO staff have repeatedly said the results will not be used directly in transmission planning. They also clarified the study was not conducted with the goal of carbon reduction, saying it only demonstrates the challenges the system might encounter as solar and wind generation flourish.

“That’s a lot of transmission,” McIntire quipped to laughter. She urged MISO to examine the benefits of co-located storage and other ways to maximize existing transmission capability before it starts studying new transmission plans.

Other stakeholders agreed that MISO was suggesting a need for a staggering amount of transmission. Some said the jump in transmission needs from a 30% to 40% share of renewables seemed too high to be believable.

No Agenda

“We do see these drastic needs at certain intervals. It’s a non-linear trend as we deploy renewables,” Bakke said. “That discontinuity at very high renewable levels requires more transfer capacity.”

Bakke said MISO will begin relying more on regional energy transfers, which in turn will become more unpredictable, leading to a need for increased EHV thermal line capabilities.

“Existing infrastructure becomes inadequate for fully accessing the diverse resources across the MISO footprint,” Bakke said.

Not only will the footprint eventually need new physical lines, but it will require more technology on transmission lines, including synchronous condensers, more transformers and HVDC capabilities, staff said.

“As we see more renewable integration, we see additional types of technology needed to help support the system,” Bakke said. “It’s a portfolio of solutions that best enable renewable deployment in the system.”

Bakke said MISO is making no proposals for new technology or lines as a result of the study. “We’re trying to point out where we see these issues … to see if our processes should change and what we need on the system long-term,” he said.

MISO found that a diversity of technologies and geography improves the ability of renewables to serve load. Bakke said storage facilities, the load-taming abilities of electrification and other demand-side management can enable more renewable penetration. He also noted that thermal generation can begin scheduling outages during times where renewable output is predicted to be abundant.

The RTO also said the number and severity of thermal overloads starts to increase at a 20% renewable penetration and becomes widespread especially in the western portion of the footprint at a 50% penetration. It said it will need more thermal mitigations on higher-voltage lines. Likewise, it will encounter dynamic stability issues beyond a 20% penetration.

To counter small-signal instability, MISO said it may need must-run units equipped with power system stabilizers or specially tuned batteries to support grid reliability beyond a 30% penetration.

But MISO now says frequency response performance remains stable up to 60% renewable penetration. The newest result is even more optimistic than its July announcement that its grid can withstand major reliability risks even when renewables reach 40% of the generation mix. (See MISO: Grid Can be Stable at 40% Renewables.)

“We see needs on the thermal side greater than needs on the voltage side,” Bakke said.

WPPI Energy’s Steve Leovy said MISO may need to more thoroughly examine steady-state issues starting with the generation interconnection queue. He recommended the RTO screen for such issues there.

Where’s the Storage?

McIntire pointed out that much of future solar development is predicted to be solar paired with storage, which could change what system needs MISO identifies.

Examining how storage can help a future fleet mix will be included in the upcoming phase of MISO’s renewable impact study. Stakeholders have repeatedly asked the RTO to study heavy wind and solar generation balanced by storage facilities. Some stakeholders predicted that if storage is optimizing wind and solar generation, MISO won’t forecast nearly as many energy delivery issues.

McIntire urged that the next phase of the study examine other less traditional solutions.

“Largely you’ve been looking to transmission and the existing thermal generation,” she said.

Bakke asked stakeholders to send his team examples of nontraditional solutions for evaluation.