By Tom Kleckner

SAN ANTONIO — Two environmental groups that say regulated utilities’ practice of self-committing coal plants is costing ratepayers have a point, RTO officials said Monday, even as they challenged the groups’ estimates.

The issue is also attracting scrutiny from state regulators.

The Sierra Club released a study last month that estimates that “captive ratepayers” in MISO, SPP, ERCOT and PJM paid $3.5 billion more for energy from 2015 to 2017 because of the “noneconomic dispatch relative to the potential procurement of energy and capacity on the market.”

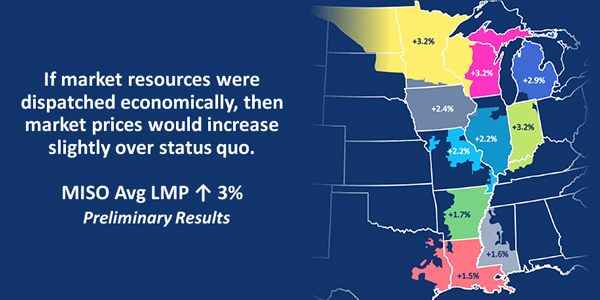

Meanwhile, the Union of Concerned Scientists (UCS) will release a study early next year that indicates that if MISO economically dispatched all its generation, average wholesale power prices would rise 3% but production costs would drop 11%. That would lower consumer costs, UCS Senior Energy Analyst Joe Daniel said during a Nov. 19 breakfast panel at the National Association of Regulatory Utility Commissioners’ annual meeting. “The market surplus, the relative profitability of the MISO system, would improve by 64%,” Daniel said.

The group, along with the Sierra Club and consumer advocates, has raised concerns about coal plants owned by vertically integrated utilities that self-commit, or run out of merit at times when their production costs exceed the wholesale market price.

The Sierra Club said out-of-merit operations suppress market prices, estimating that MISO’s median hourly market price would have been about $7.70/MWh (30%) higher if coal units had economically dispatched in 2017. “Improved dispatch practice would reduce customer costs, improve market revenues for efficient generators and renewable energy operators, and substantially reduce emissions,” it said.

‘Markedly Different Behavior’

The organization said the decision to operate consistently out of merit is not based on coal generators’ constraints alone, such as slow ramp rates, large fixed-price fuel contracts and avoiding the thermal stresses of repeated start-ups. “For example, within PJM, where most power units are merchants (i.e. unregulated), coal units generally operate in accordance with market prices. The few regulated coal units, owned by Dominion [Energy] or American Electric Power, demonstrated a markedly different behavior, operating in far more hours than warranted by market prices.”

Dominion did not respond to Sierra Club’s observations in detail Monday, saying in an email only: “Our customers expect clean energy that’s also affordable and reliable. We deliver just that, with enough solar and wind energy in operation or under development in Virginia by 2022 to power 750,000 homes. We’re proud of what we’ve accomplished and plan to do more.”

AEP’s Melissa McHenry said the report “does not provide an accurate portrayal of AEP’s generation unit operations within the RTOs” and said RTOs could improve efficiency through multiday dispatch and by sharing forecasted unit operation data.

AEP bids its generation into the markets to allow it to be economically dispatched, but the coal plants’ long start-up time makes it necessary to commit the units “to ensure they are available to produce benefits for our customers,” she said.

“During periods in which AEP anticipates sustained low prices, AEP does offer coal units for commitment and decommitment,” McHenry said.

RTOs Respond

ERCOT said it doesn’t comment on reports that are not staff’s own. Beth Garza, director of ERCOT’s Independent Market Monitor, said on Monday she had not reviewed the report and cautioned against assessing the results of decisions after the fact. “There are legitimate reasons why commitment decisions may appear uneconomic after the fact,” Garza said. “Specific examples are the load forecast didn’t materialize, or actual wind generation was higher than forecast.”

SPP said self-commitment “is not inherently and totally undesirable,” noting a self-committed unit may displace a more expensive one from running. But SPP spokesman Derek Wingfield acknowledged that self-commitments “may limit a market operator’s ability to dispatch generation as economically as possible” and said that SPP studies have shown there is room for “further optimization” in the markets through “further reduction of self-commitments.”

MISO conducted a study on multi-day commitments in 2017 that showed “significantly lower production cost savings” than Sierra Club’s report, spokesperson Julie Munsell said. “MISO’s generation owners and operators are in the best position to know all of the factors and requirements to optimize the reliable and efficient operation of their assets,” Munsell said.

PJM spokesman Jeff Shields did not comment on the Sierra Club report but acknowledged that although units that self-commit on their own can’t set LMPs, they do change the offer stack “and can ultimately impact what the marginal unit may be.”

Self-committing units that provide an operating range and offer curve and allow PJM to dispatch them are eligible to set prices. PJM doesn’t assess “outright” penalties, but self-scheduled units are subject to operating reserve deviation charges, Shields said.

PJM Independent Market Monitor Joe Bowring said the Monitor’s analysis of coal plants at risk of retirement — which it defines as units for which the forward-looking net revenue from PJM markets does not cover going-forward costs — “does not support the conclusion that regulated units are uneconomic in PJM.”

“We think the UCS analysis is insightful, and we are continuing to develop more detailed analysis of self-scheduling practices in PJM using unit-specific, confidential data not available to UCS,” Bowring said.

Regulatory Recovery

UCS and Sierra Club say that by running the plants out of merit when their production costs are greater than wholesale market prices, utilities can recover fuel and operations and maintenance costs through regulatory proceedings. Sierra Club said its study estimated coal plants with negative revenue lost more than $3.8 billion in 2015-2017 when accounting for fixed O&M costs and revenues from MISO’s and PJM’s capacity markets. State ratemaking likely makes the utilities whole for their losses, Sierra Club said.

Annie Levenson-Falk, executive director for the Minnesota Citizens Utility Board, noted that the UCS study indicates that the state’s two largest entities — Xcel Energy’s Northern States Power and ALLETE’s Minnesota Power — could have realized $85 million to $90 million in gross savings had their coal units been dispatched economically.

“Those are substantial numbers, and it raises concerns for us,” Levenson-Falk said during the NARUC session. “Clearly, this is a problem in the way the plants are operating. In Minnesota, we’re moving quickly to a much higher level of renewable power. You talk about not just generating to meet load, but scheduling variability.”

FERC Commissioner Richard Glick, seated next to Levenson-Falk, was asked whether it was time for the federal commission to get involved.

“This is primarily, at this point, a matter for the state[s],” he said. “Certainly, we’re looking at it. It potentially could have a significant impact on the transparency in the markets we regulate and the price signals to market entry.”

“We can agree and disagree on whether it’s a state issue. I think it’s a game of hot potato,” said Indiana Utility Regulatory Commissioner Sarah Freeman, drawing a wry smile from Glick.

State Investigations

Minnesota and Missouri regulators have picked up the potato by opening investigations into self-commitment. Minnesota Public Utilities Commissioner Matt Schuerger said his commission opened the proceeding as an information-gathering process.

“I do think there are legitimate reasons for self-committing and scheduling, but things can be done better to save customers money,” he said.

Schuerger said the PUC also has potential questions around the reliability unit commitment (RUC) process. “ISOs like MISO have built their reliability commitment process on a large chunk [of generation] coming in at self-commitment,” he said.

“When I got to FERC, I thought I knew about markets,” Glick said last month. “The general notion is you bid in at marginal costs. The ones that bid in the lowest get what they’re needing. Where people aren’t bidding in at the marginal cost, sometimes they’re being told they’re not bidding high enough.

“A significant part of some of these markets, especially MISO and SPP, are not having a truly functional market. That raises a broader question of whether markets are functioning well and sending the right price signals.”

Ted Thomas, chair of the Arkansas Public Service Commission, suggested market monitors might be the right people to look at self-commitment practices.

“This is like the tip of an iceberg of a very big issue all markets will have to deal with,” he said.

SPP MMU IDs Problem

Indeed, SPP’s Market Monitoring Unit called self-commitment a problem two years ago and has been focused on the issue ever since. Its 2016 State of the Market report jived with a 2017 Sierra Club study that found SPP utilities with coal plants generated $300 million in excess costs in 2015 and 2016, costs that consumers picked up. (See Report: Costly Coal Undermining SPP Market, Bilking Consumers.)

The MMU is planning to release its own report on self-commitment within SPP in the next two weeks. Executive Director Keith Collins on Monday said the study results are “directionally” similar to Sierra Club’s latest report, but at a lesser magnitude. The MMU study found only about a 7% increase in costs when units were economically dispatched, as compared to the Sierra Club’s 30% figure.

Collins said the MMU used a day-ahead model in running its study, using historic bids and offers for additional granularity.

“The Sierra Club talks about more advanced forward markets that send a clear commitment signal. We, in our analysis, found that that is potentially a key factor in the analysis,” he said. “Our study found that if you made no change to the market and you just told resources to participate in the market, not only do you increase prices, you increase production costs. When you add a second day to the optimization, you effectively get the benefits of reduced production costs and you do get the increase in price. With a second day … you can capture most of the benefits of addressing the lead-time resources you see self-committing in the market.”

Recommendations

The Sierra Club report suggests commissioners examine the utilities’ market self-commitment and self-scheduling practices through investigations, expanded fuel or rate-case dockets, or during resource-planning reviews. The group also urges regulators to consider disallowing operational costs in excess of market necessity.

Thomas and Freeman last month responded with their own suggestions.

“Meet analysis with analysis … but determine what is going on operationally,” Thomas said. “There are formal and informal things we can do. There are suggestions, and there are carrots and sticks. My normal approach is to start with informal suggestions, because that’s easy, and proceed until the normal collision.”

Freeman argued against what she called adversarial proceedings. She invoked the name of noted regulatory attorney Scott Hempling, who she said preaches aligning interests, as opposed to balancing them.

“If ever there was an issue ripe for aligning interest, this is one of them,” she said. “Everyone wants to achieve those really favorable economic numbers that Joe has shown.”