By Tom Kleckner

ERCOT will likely welcome back double-digit reserve margins next year and well into the decade, according to the grid operator’s latest capacity, demand and reserves (CDR) report.

While they won’t provide relief from Texas’ blistering summers, the additional reserves will give ERCOT a little more room to work with than it did in surviving 2019’s record demand with a 8.6% margin — up from an initial historic low of 7.4%.

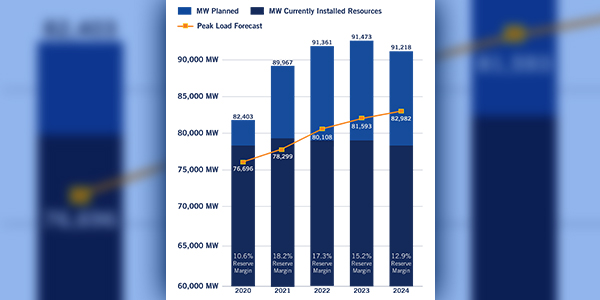

Released Thursday, ERCOT’s newest CDR indicates its planning reserve margin will hit 10.6% in 2020 and 18.2% in 2021. The margin will shrink again after that, reaching a projected 12.9% in 2024. The grid operator has a target planning reserve margin of 13.75%.

“Yes, the reserve margin’s improving, and the [later] years seem to be significantly better,” said Dan Woodfin, ERCOT’s senior director of system operations. “While the reserve margin seems higher in 2020, we could still see some operating days with tight conditions. We’re prepared for that, just like we were last year.”

ERCOT shattered its all-time system peak in August, hitting 74.8 GW and breaking the mark set in 2018 by more than 1 GW. While its resources met peak demand, the grid operator ran into tight conditions during the early afternoon when West Texas wind energy dropped off. It was twice forced to call energy emergency alerts to ease the scarcity. (See “ERCOT CEO Briefs Commission on Summer Performance,” Texas PUC Briefs: Aug. 29, 2019.)

Staff are projecting a peak of more than 76.7 GW in 2020, but they also expect an additional 7.6 GW in new capacity for summer 2020, based on preliminary data from generation owners. Most of those resources are renewable or smaller gas-fired peakers.

ERCOT has approved 1,058 MW of installed capacity for commercial operations since the last CDR was released in May. More than 4,650 MW of installed capacity has become eligible for inclusion in the CDR after completing necessary agreements and permits.

Two canceled gas plants with 1,227 MW of capacity were removed from the CDR, and eight solar projects with a 1,056-MW capacity contribution were delayed until 2021, accounting for the reserve margin’s leap to 18.2% that year.

Wind and solar energy will continue to increase their shares of ERCOT’s fuel mix. Solar’s summer capacity is forecast to account for 9.7% of the fuel mix by 2022, while coal will drop to 15.6%. Wind energy is projected to reach 10.2% of the summer mix in 2024.

ERCOT has changed the way it calculates wind and solar capacity for the CDR, switching to a capacity-weighted average instead of a simple average of historical contributions. Staff also split its non-coastal wind region into “Panhandle” and “other” wind regions.