The New England Power Pool Markets Committee continued its crammed schedule to complete the Energy Security Improvements (ESI) proposal at its expanded two-day meeting last week and entertained the possibility of adding a third day to its monthly meetings through March 2020.

ISO-NE has four months to file a long-term fuel security mechanism under FERC’s second extension since its original order last July (EL18-182). The new deadline is April 15, 2020, and the Participants Committee likely will vote on the new market construct at its April 2 meeting. Stakeholders will learn of any schedule additions by the first week of January.

ISO-NE economist Chris Geissler and Todd Schatzki of Analysis Group presented new central case results.

“To date, we have been successful at implementing all the enhancements we had planned, and the good news is that we plan no further enhancements,” Schatzki said. “There may be some small changes to considering how resources on the margins participate, but no major changes.” [Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to amplify their presentations.]

Planners are depending on new revenue streams, such as day-ahead options and forecast energy requirement (FER) payments to motivate generators to stock up on fuel oil or LNG for the winter or arrange for barge or truck delivery of fuel during pipeline constraints.

Load costs will increase under ESI versus current market rules under all three winter scenarios evaluated, according to Analysis Group. | Analysis Group

The analysis found that load costs will increase under ESI versus current market rules under all three winter scenarios evaluated because of FER payments and the net cost of day-ahead energy options.

In the “frequent” stressed conditions scenario — based on the winter of 2013/14, with its multiple, short cold snaps — total payments by load would increase 10.7% to $4.58 billion, with $480 million in FER payments and $267 million in day-ahead option payments partially offset by a $144 million reduction in payments for energy and real-time operating reserves.

Under the “extended” stressed conditions case, based on 2017/18, with its one, long cold snap, load costs would increase $183 million (6.3%) to $3.075 billion.

The “infrequent” stressed conditions case, based on 2016/17, showed $1.83 billion in load costs, a $73 million (4.1%) increase.

“There’s just more dollars in the market under ESI to maintain fuel inventory than there are under current market rules,” Schatzki said.

Schatzki said he will brief the committee in January on how the incentives will work to encourage increased fuel procurements.

“If our meteorologists and the weather services we subscribe to tell us we’re in for a really cold February, then we’re probably going to take extra steps,” said Brett Kruse, vice president of market design at Calpine, describing how his company thinks about winter fuel supplies under the current market design. “Conversely, there are some times — it happened here not too long ago — where you get enough freezing on the rivers and the icebreaker breaks down, and then you could have a problem getting oil.”

“The more you stock up, the more acorns you have left over at the end of winter,” Schatzki said.

Market Design

ISO-NE principal analyst Andrew Gillespie presented a memo on how ESI will improve the markets’ ability to reflect scarcity and provide an alternative to out-of-market contracts such as the retention of the Mystic generating plant. He followed that with a summary of the market design and a discussion of what officials call the “misaligned incentives problem.”

Gillespie also continued the discussion on setting the strike price for day-ahead energy call options and whether it can be “shaped” across the day to minimize the number of hours in which it is less than the day-ahead energy price. The alternative would be two prices, one for all peak hours and a second for off-peak hours. He also discussed applying a “bias” to adjust the strike price reduce the number of hours with a close-out charges to be applied during settlements.

The RTO is asking the Analysis Group to quantify the impact of applying a bias would have on the incentives to the marginal unit for options.

“This presentation is not an ISO proposal,” Gillespie said. “The ISO is evaluating these issues, and today we are sharing our current thinking and looking for feedback.”

FirstLight Proposal

Tom Kaslow of FirstLight Power Resources presented his company’s position that the strike price — intended to estimate the marginal price of energy to meet the next day’s forecasted load plus operating reserves — needs to vary by hour, just as marginal energy prices do.

Estimating the strike price too low could be inefficient and result in higher-than-needed day-ahead reserve costs, he said, while setting the price too high could mean little connection between the resources providing energy and those acting as reserves in real time.

Because the region lacks an hourly futures market, Kaslow said, the hourly day-ahead LMPs for two days prior (day T-2) could be used to set strike prices.

Part of the day-ahead energy price would be reflected in the FER payment (FERP); thus, the hourly day-ahead reserve strike price would be the day-ahead LMP plus the FERP rate for day T-2 in that hour.

Energy Options vs. DA Reserves

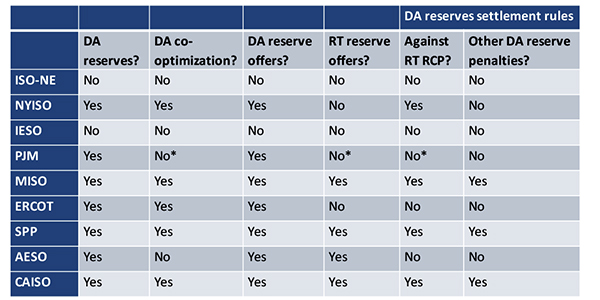

One of ISO-NE’s lead analysts, Hanhan Hammer, presented on why the RTO is proposing to settle day-ahead reserve awards as options on real-time energy, rather than as a forward sale of real-time reserves. “Unlike the day-ahead energy market designs, the reserve market designs of the nine ISOs/RTOs are not standardized,” Hammer noted.

Seven of the nine ISOs and RTOs in North America have reserve awards in their day-ahead markets, the exceptions being ISO-NE and Ontario’s IESO. | ISO-NE

The RTO’s proposal will mean stronger incentives to arrange fuel than the alternative, Hammer said, because the day-ahead energy options tie financial consequences to the price of energy in real time, addressing the “misaligned incentives.”

“Seven out of the nine ISOs and RTOs [in North America] have reserve awards in their day-ahead markets,” Hammer said, the exceptions being ISO-NE and Ontario’s Independent Electricity System Operator. Some ISOs and RTOs co-optimize energy and reserves in the day-ahead market, and some procure reserves separately from energy.

Geissler looked at how total consumer costs and producer revenues would change with a day-ahead forward reserves design.

The analysis studied day-ahead and real-time reserve prices from NYISO and MISO to assess potential market impacts. The data showed NYISO has higher reserve prices in the day-ahead than in real time, as its design allows participants to submit priced offers for reserves in the day-ahead market but does not allow priced real-time offers. Average prices for 30-minute reserves in West New York were $4.16/MWh in the day-ahead and 41 cents/MWh in real time in 2018.

NYISO’s design allows participants to submit priced offers for reserves in the day-ahead market but does not allow priced real-time offers. | NYISO

Applying NYISO’s day-ahead premiums to New England reserve needs pencils out to an annual increase in reserve costs of $61.6 million.

“This is meant to be illustrative rather than in any way definitive,” Geissler said. “I would urge caution about taking any specific number like $62 million and saying this is what it’s going to cost, because that’s a ballpark figure.”

Geissler also presented on how ESI motivates resource owners to make cost-effective fuel arrangements before the day-ahead market is cleared, and does so without a forward market component.

FCA 15 Bid Submittal Processes

The RTO’s assistant general counsel for markets, Chris Hamlen, presented a memo outlining potential changes to the Forward Capacity Auction 15 delist bid submittal process to accommodate the timing of NEPOOL votes on ESI and the possible early sunset of the inventoried energy program.

Internal Market Monitor Jeff McDonald and Mark Karl, vice president of market development and settlements, wrote the memo, which notes that FCA 15 retirement and permanent delist bids are due March 13, 2020, a month before the ESI filing deadline. ISO-NE will request FERC approval to waive the FCA 15 deadline if the ESI market design is revised afterward.

If the waiver is granted, and a “non-clerical” revision is made to the ESI market rules after the delist bid deadline, participants that have submitted retirement or permanent delist bids will be given the option to update their bids or withdraw them.

Either option will need to be exercised within a week following the Participants Committee’s April 2020 vote on the market rules, in order to afford the Monitor time to complete its review within the Tariff-prescribed deadlines. The RTO intends to file this waiver request in early January 2020 and will request an order prior to the March 13 deadline.

NESCOE Intent on EER Revisions

The New England States Committee on Electricity’s director of analysis, Jeff Bentz, refined his presentation and answered stakeholder questions from last month’s MC meeting on NESCOE’s proposal for Tariff revisions regarding energy efficiency resources and related capacity obligations during scarcity conditions.

FERC ruled in May 2014 that energy efficiency capacity performance payments should be calculated only for capacity scarcity conditions occurring during peak hours (ER14-1050).

Bentz said that NESCOE still intends to propose a Tariff change that would implement Shaping Option A from the Demand Resources Working Group’s final report issued in July.

“We really do think that Shaping Option A better aligns with the implementation of ISO New England’s original [Pay-for-Performance] design, which is a no-excuses concept,” Bentz said.

Order 841 Compliance

Day Pitney attorneys Sebastian Lombardi and Rosendo Garza briefed the MC on FERC’s ruling conditionally accepting ISO-NE’s Order 841 compliance filing (ER19-470). The commission required additional changes, saying the RTO’s Tariff revisions hadn’t adequately dealt with the application of transmission charges to electric storage resources. (See Storage Plans Clear FERC with Conditions.)

The RTO’s next compliance filing is due Jan. 21, with requests for rehearing on the FERC order due Dec. 23. NEPOOL plans to request an extension on the filing; absent an extension, the proposed market rule changes would be voted on by the MC at its Jan. 14-15 meeting.

Forward Certificate Transfers in GIS

The MC agreed to a request from NEPOOL Counsel Lynn M. Fountain to instruct the Generation Information System Operating Rules Working Group to consider changes to the GIS operating rules. Fountain said the changes are a “way of making a manual system right now a little less so.”

Among other things, the changes would allow batch uploading for forward certificate transfers and improve data sorting.

Officer Changes

The committee re-elected Vice Chair Bill Fowler, president of Sigma Consultants, to continue in his role in 2020. No other members of the committee expressed an interest to be considered as a candidate.

— Michael Kuser