By Rich Heidorn Jr.

The RTO last month proposed the creation of a Capacity Performance product that would supplement the existing Annual Capacity offering. In a late afternoon meeting Wednesday, Bowring said he was “very skeptical of the multi-product proposal,” echoing other stakeholders in saying it could encourage withholding by generators.

Parameter Changes Opposed

The meeting coincided with PJM’s release of stakeholder letters urging the Board of Managers not to act on PJM staff’s proposed changes to capacity auction parameters. Stakeholders representing load interests said the board shouldn’t consider staff’s proposed changes in the shape and position of the capacity demand curve — which failed to win stakeholder consensus last month — until it evaluates how they would interact with PJM’s new product proposal.

PJM’s proposals come as the capacity market is still digesting changes implemented in May’s Base Residual Auction, when prices in most of the RTO doubled following limits on the role of imports and demand response.

The Southern Maryland Electric Cooperative called Capacity Performance “the most material changes to PJM markets since the advent of [the Reliability Pricing Mechanism] itself.” Regulators from Maryland and Illinois said the proposal means “fundamental changes to the very nature of the capacity product.”

The “Load Coalition,” a group of 17 stakeholders, including regulators and load-serving entities, said that “load must never be viewed by the PJM board as offering a blank check.”

The letters served as a preview of the arguments the stakeholders would likely make if the board seeks the Federal Energy Regulatory Commission’s approval of staff’s proposed changes.

Old Dominion Electric Cooperative noted that members participating in the Triennial Review of capacity market parameters failed to reach consensus on changes to the demand curve, the calculation of the cost of new entry (CONE) or the cost of capital.

“Dispute over any one of these components will be contentious and polarizing at FERC. All three together could be paralyzing and will distract from other priority PJM initiatives,” ODEC said.

In all, regulators or public advocates for seven of PJM’s 13 states and D.C. weighed in against the parameter changes. Also expressing opposition as members of the Load Coalition were American Municipal Power; Blue Ridge Power Agency; Duquesne Light; North Carolina Electric Membership Corp.; Rockland Electric; the Public Power Association of New Jersey; the American Public Power Association; and the PJM Industrial Customer Coalition.

Dynegy also raised objections.

The board received only two letters in favor of the changes, one from the PJM Power Providers Group and another from American Electric Power, Dayton Power and Light and FirstEnergy Service Co. They supported the proposed changes to the variable resource requirement curve but said PJM staff’s 8% after-tax weighted average cost of capital is too low.

Monitor’s Meeting

Wednesday’s meeting was scheduled to discuss the Monitor’s analysis of the 2017/18 Base Residual Auction in May. The Monitor’s report, released in July, concluded that PJM capacity prices would increase sharply but reliability would not be threatened if a recent federal court ruling eliminated demand response from wholesale markets. The report also evaluated how prices would have been affected had other changes favored by the Monitor been enacted. (See Life without Demand Response: Higher Prices but No Reliability Crisis, Says Monitor.)

Bowring told attendees he hopes to release sensitivity analyses of PJM’s Capacity Performance proposal as soon as this week. Bowring said his office is discussing the analyses with PJM to ensure the assumptions are valid and that the results don’t violate confidentiality rules.

“We want to have some meaningful results,” Bowring said. “We don’t want to make [unreasonable] assumptions.”

Bowring said that the PJM proposal had “a lot of positives,” citing staff’s call for heightened performance incentives and penalties. “Leaning heavily on the performance incentives makes sense,” Bowring said.

Jim Benchek of FirstEnergy questioned how market power would be mitigated under the PJM proposal. “That’s a part that’s been left a mystery to us,” he said.

ODEC’s Ed Tatum asked Bowring to compare the costs of PJM’s proposal to the $600 million in uplift in January, saying the PJM proposal might cost ratepayers more than it saves.

Citigroup’s Barry Trayers expressed a similar concern, saying PJM’s changes may be an overreaction to a “once-in-20-year” winter, noting that PJM typically has a 30% reserve margin during the cold months.

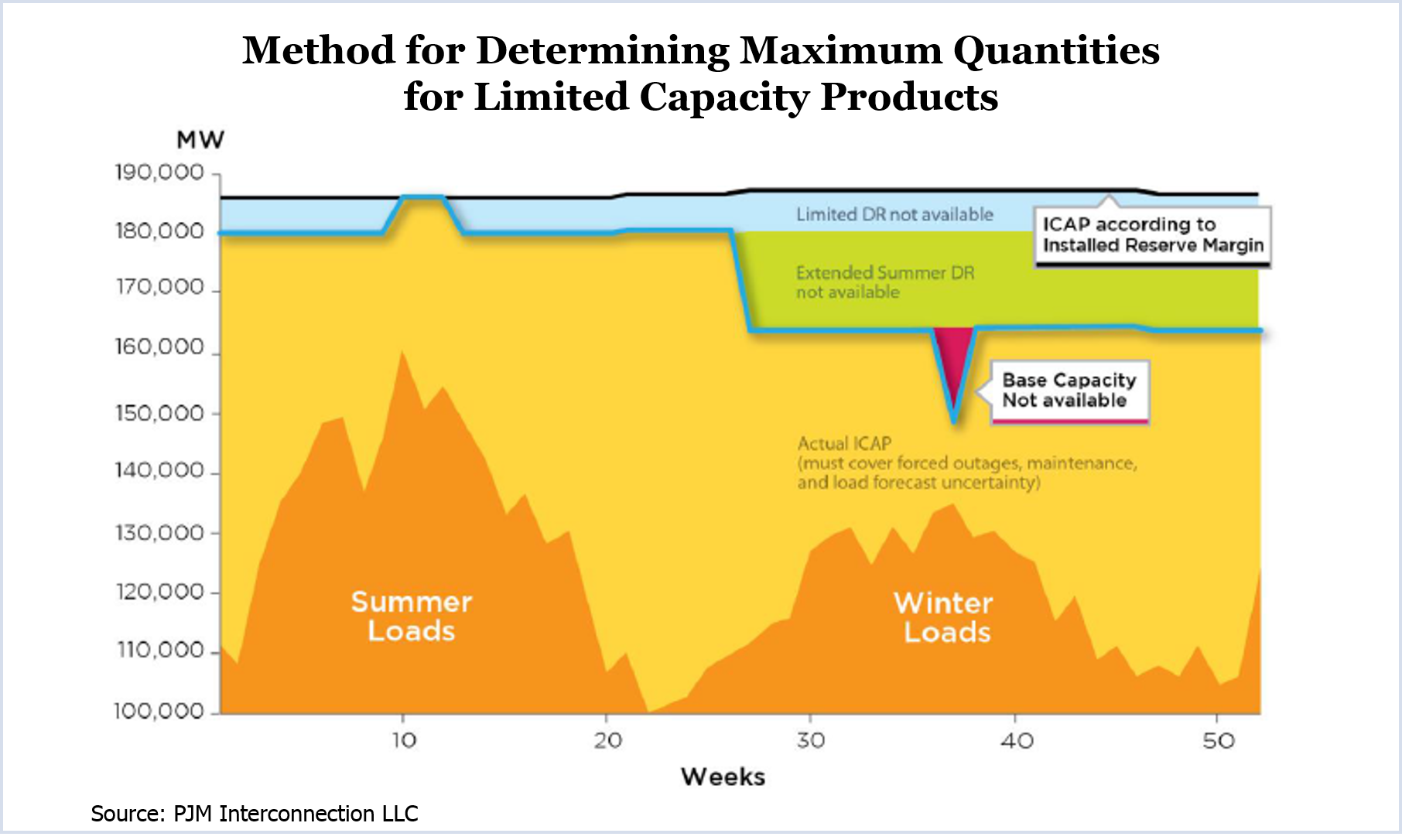

Bowring said he shared concerns about overreacting to last January, when as much as 22% of PJM’s generation suffered forced outages. At the same time, he reiterated his contention that capacity prices have been improperly suppressed by the role of Limited and Extended Summer demand response.

At the Operating Committee meeting last week, several members expressed concern about including new rules regarding gas unit commitment as part of the Capacity Performance filing with FERC.

Dave Pratzon of GT Power Group said there wasn’t enough time to reach consensus on the gas rules and that their inclusion could lead to more adversarial proceedings before FERC.

John Farber of the Delaware Public Service Commission agreed. “To try to force this into the same filing, I think a lot would be lost,” he said.

Auction Parameters and Capacity Performance

Members deadlocked last month on changes to capacity market parameters, with none of five proposals resulting from the FERC-ordered Triennial Review winning a supermajority at the Markets and Reliability Committee. (See Members Deadlock on Capacity Parameter Changes.)

As a result, the Board of Managers will decide for itself whether to seek FERC approval for PJM staff’s proposed changes. The board also is expected to decide unilaterally whether to seek FERC approval for staff’s Capacity Performance proposal under the never-before-invoked Enhanced Liaison Committee process. PJM officials said they initiated the Liaison process because they did not expect stakeholders to reach consensus.

In their letters, load representatives said changing the auction parameters and introducing the new capacity product could cause unreasonable increases in capacity costs. Maryland and Illinois regulators said the proposed parameter changes could increase capacity costs by $1.5 billion annually.

“In the Capacity Performance discussions with PJM staff last month, PJM indicated that 140,000 MW of resources are potentially compliant with the requirements of being a Capacity Performance resource, meaning that the clearing price required of those resources which are not compliant will create a windfall for the remaining compliant resources,” SMECO said. “By creating two classes of annual capacity products, the potential for the exercise of market power in the supply curve of Capacity Performance resources is only exacerbated by the changed VRR curve shape proposed by PJM.”

The Load Coalition said the board should defer action on the capacity parameters for which there is no consensus “so the board may ensure the interrelated parts of RPM work together appropriately to satisfy the applicable reliability standards while still honoring the Federal Power Act’s ‘just and reasonable rates’ standard.”

The coalition challenged PJM staff’s contention that the parameter changes and Capacity Performance initiative are “separate and distinct.”

The coalition noted that PJM asked FERC to defer action on its Section 206 proceeding on replacement capacity — PJM’s effort to reduce arbitrage opportunities in incremental capacity auctions — pending the Capacity Performance filing.

“The Load Coalition views the Triennial Review to be at least as closely linked, if not more so, with the Capacity Performance initiative than the Replacement Capacity effort may be, particularly because PJM’s proposed VRR curve shape has been shown individually by PJM’s own simulations to procure capacity materially beyond what would be required to meet our resource adequacy objectives,” the coalition said.

Based on the modeling assumptions of PJM’s consultant, the coalition said the parameter changes would result in a Loss-of-Load Expectation of one load shed event in 16.7 years — far above PJM’s 1-in-10 LOLE standard. The coalition said the consultant’s assumptions “greatly overstate volatility and reliability risk.”

“As virtually captive customers to the PJM markets, load must never be viewed by the PJM board as offering a blank check. With the close nexus between energy markets and economic growth, the PJM board has a serious responsibility to ensure not only reliable operations but also rates that are just and reasonable and not unduly discriminatory, as the Federal Power Act requires.”

The Maryland and Illinois commissions said the Capacity Performance initiative and the possible elimination of the $1,000 Offer Bid Cap in the energy market could add to the increased costs resulting from the parameter changes.

“The commissions believe it is important to evaluate these measures together rather than a piecemeal fashion so that a full understanding of all of the implications of these changes upon PJM’s capacity market can be achieved. Changes to RPM have often had unintended outcomes; a process that does not fully evaluate proposed changes jointly will do nothing to minimize the occurrence of such unintended outcomes.”

The P3 Group said the board should seek FERC approval of the demand curve changes without delay, saying they are necessary to “enhance the long-run performance of the curve, ultimately improving auction outcomes and supporting long-run reliability.”

“The purpose of the Triennial Review is distinct from the Capacity Performance proposal. The components of the Triennial Review work to establish the volume of procured capacity to meet resource adequacy standards. In contrast, the capacity performance proposal describes the attributes of the capacity commitment. Further, the outcome of the capacity performance proposal is uncertain. Its uncertainty should not cloud the completion of the Triennial Review.”