By William Opalka

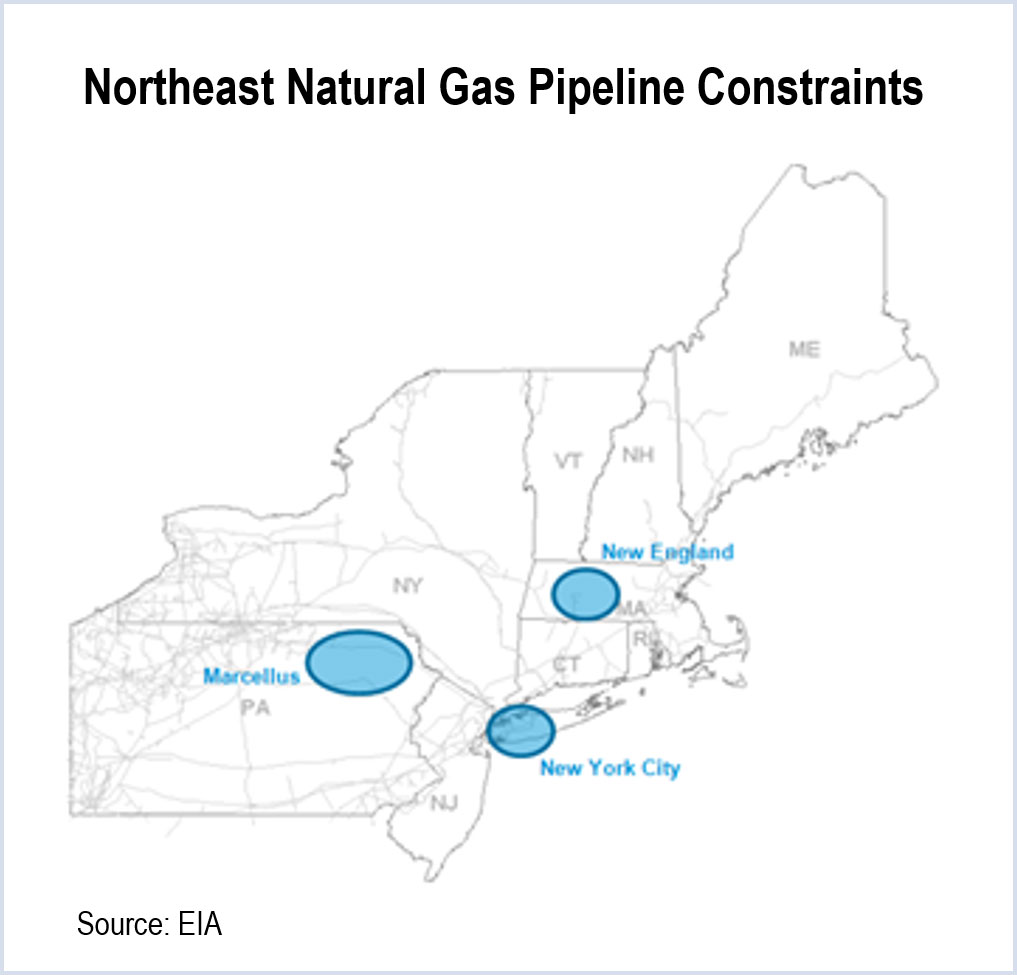

“The lack of pipeline infrastructure has raised fuel adequacy for natural gas generators to the top of the list of pressing concerns for New England’s power system,” said ISO-NE CEO Gordon van Welie in a statement announcing the plan.

New England is projected to lose 4,600 MW of generation by June 2017, further stressing a regional power system that barely maintained reliability during last winter’s polar vortex. Of the 8,300 MW of new generation proposed through November, 4,500 MW is natural gas while most of the remainder (3,700 MW) is wind.

Natural gas is projected to rise from 43% of capacity in 2013 to 48% by 2017. Gas produced 45% of the ISO’s energy last year, typically setting the marginal price.

ICF International projects the region will face natural gas shortfalls during winters through 2020. The ISO says it may face gas shortages on 24 to 34 days per winter by 2019/2020 — even more during a severe winter such as 2013/2014.

In addition to highlighting challenges faced by the region, the plan’s 10-year look forward takes note of the region’s increased reliance on energy efficiency and demand response in a climate of relatively flat load growth.

Load Flat but Capacity Short

Including energy efficiency — currently 2,100 MW — the ISO forecasts no growth in total electricity usage, while predicting a 0.7% annual increase in summer peak demand over the 10-year planning horizon.

A year ago, the ISO was predicting a surplus of capacity. But that forecast was undermined by plant retirement announcements that preceded the eighth Forward Capacity Auction in February. The auction fell short of the targeted resource acquisition for the 2018/2019 commitment period, resulting in higher capacity prices than the seven previous auctions.

Chief among the retirements are the 619-MW Vermont Yankee nuclear plant that went offline this year and the 1,517-MW Brayton Point coal-fired generator in Massachusetts, slated to be mothballed in 2017.

Beginning with FCA #9, the ISO will implement a sloped demand curve similar to that used in PJM. The sloped curve is intended to reduce price volatility when the market moves between excesses and shortages. New resources also will be able to lock in clearing prices for seven years, an effort to reduce developers’ risks.

Winter Preparation

For the second year, the ISO will employ a Winter Reliability Program, which includes incentives for oil and dual-fuel generators to increase their oil inventories and for plants to become dual-fuel generators.

The Federal Energy Regulatory Commission approved most of the ISO’s long-term “Pay for Performance” plan, which will reward capacity resources that exceed their commitments and penalize those that fall short beginning in 2018.

One achievement noted in the report is the ISO’s investment in transmission infrastructure. Since 2002, when transmission bottlenecks were seen as the greatest threats to system reliability, 559 transmission projects totaling $6.6 billion have been completed, all but eliminating congestion.

For 2013, real-time system-wide congestion costs totaled only $175,000, and payments for “must-run” generators totaled $54.6 million — representing only 0.6% of the $8.82 billion wholesale electric energy market.