By William Opalka

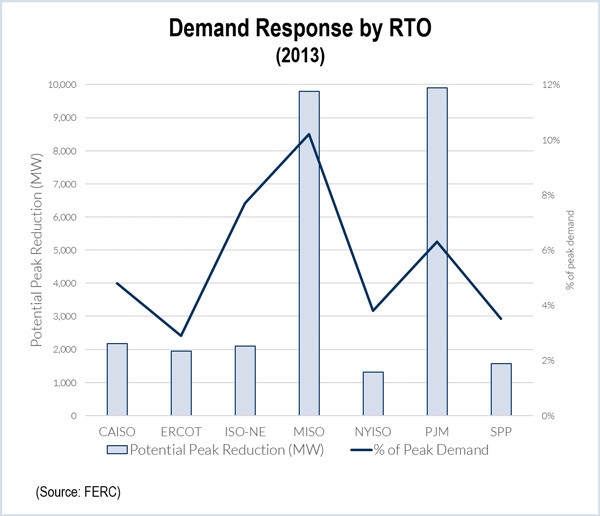

Nationally, potential peak reduction from DR in the organized markets grew 9.3%, or 2,451 MW, to 28,503 MW from 2012 to 2013. Potential peak reduction in RTOs and ISOs grew to 6.1% of peak demand in 2013, from 5.6% in 2012.

This occurred despite some setbacks in Northeastern markets, according to the ninth annual Assessment of Demand Response and Advanced Metering report released Dec. 23.

FERC also reported that advanced meters now represent almost 30% of the total, as an additional 5.9 million devices were deployed between 2011 and 2012.

Demand Response in RTOs, ISOs

Potential peak reduction increased by 2,600 MW in MISO from 2012 to 2013, largely due to increased demand response from behind-the-meter generation and load-modifying resource programs run by utilities.

In NYISO, however, fewer DR resources registered as special case resources following the RTO’s implementation of its baseline calculation and auditing methods, according to FERC. Tighter qualification criteria may have played a role. Relatively low capacity prices in NYISO were also cited.

DR in ISO-NE declined by 669 MW, or 25%. FERC cited reports that EnerNOC had reduced its participation in the forward capacity market because its customers believe that participation requirements outweighed the benefits.

DR’s future was further clouded by the D.C. Circuit Court of Appeals’ ruling, in a challenge by the Electric Power Supply Association, voiding FERC’s jurisdiction over pricing of DR in wholesale energy markets. FERC is seeking a Supreme Court review of the ruling.

Some have argued that the legal theory advanced in the EPSA ruling should bar DR participation in capacity markets. (See PJM to File Post-EPSA Demand Response Contingency Plan with FERC.)

Demand Response in Emergencies

Despite the legal uncertainties, demand response continued to prove its worth last year as a tool for grid operators during times of tight supplies, FERC observed. PJM activated about 2,000 MW of DR for several hours on Jan. 7, 2014 and more than 2,500 MW for several hours on Jan. 23 and Jan. 28.

ISO-NE’s 2013-2014 Winter Reliability Program gave it the ability to call on DR up to 10 times during the winter. DR resources provided 21 MW on each of five occasions between December 2013 and February 2014, according to the report.

Advanced Meters

Advanced meters continued to grow, but penetration rates varied widely by region.

The Texas Regional Entity leads, with penetration of 70%, followed by the Western Electric Coordinating Council at 51%. Bringing up the rear are ReliabilityFirst, which includes portions of PJM and MISO, at 17%, and the Northeast Power Coordinating Council at 12%.

Among the capabilities of advanced meters is time-based pricing. But the report found that enrollment in time-based DR programs dropped by 6.1% between 2011 and 2012.

FERC said participation dropped in SPP due to the end of programs by Southwestern Electric Power Co. and a large decline in enrollment in the programs run by Public Service Company of Oklahoma. The ReliabilityFirst region saw a decline as a result of attrition in Ohio Power’s residential program and Duke Energy Indiana’s commercial program.