By Ted Caddell

Dynegy has reached a settlement with PJM’s Independent Market Monitor to alleviate market power concerns over its purchase of 12,400 MW of generation from Duke Energy and Energy Capital Partners.

In an agreement filed Feb. 6 (EC14-140), Dynegy said it would not to buy any of the plants that will come on the market as a result of the PPL-Riverstone Holdings spinoff to form Talen Energy.

Additionally, Dynegy committed to offer all of its units into PJM capacity market auctions and promised it wouldn’t retire any units unless they failed to clear. It also promised to enter such plants into reliability-must-run agreements if PJM decided they were necessary. The settlement also contained commitments concerning energy and ancillary services offers, which Dynegy said would be good for seven years.

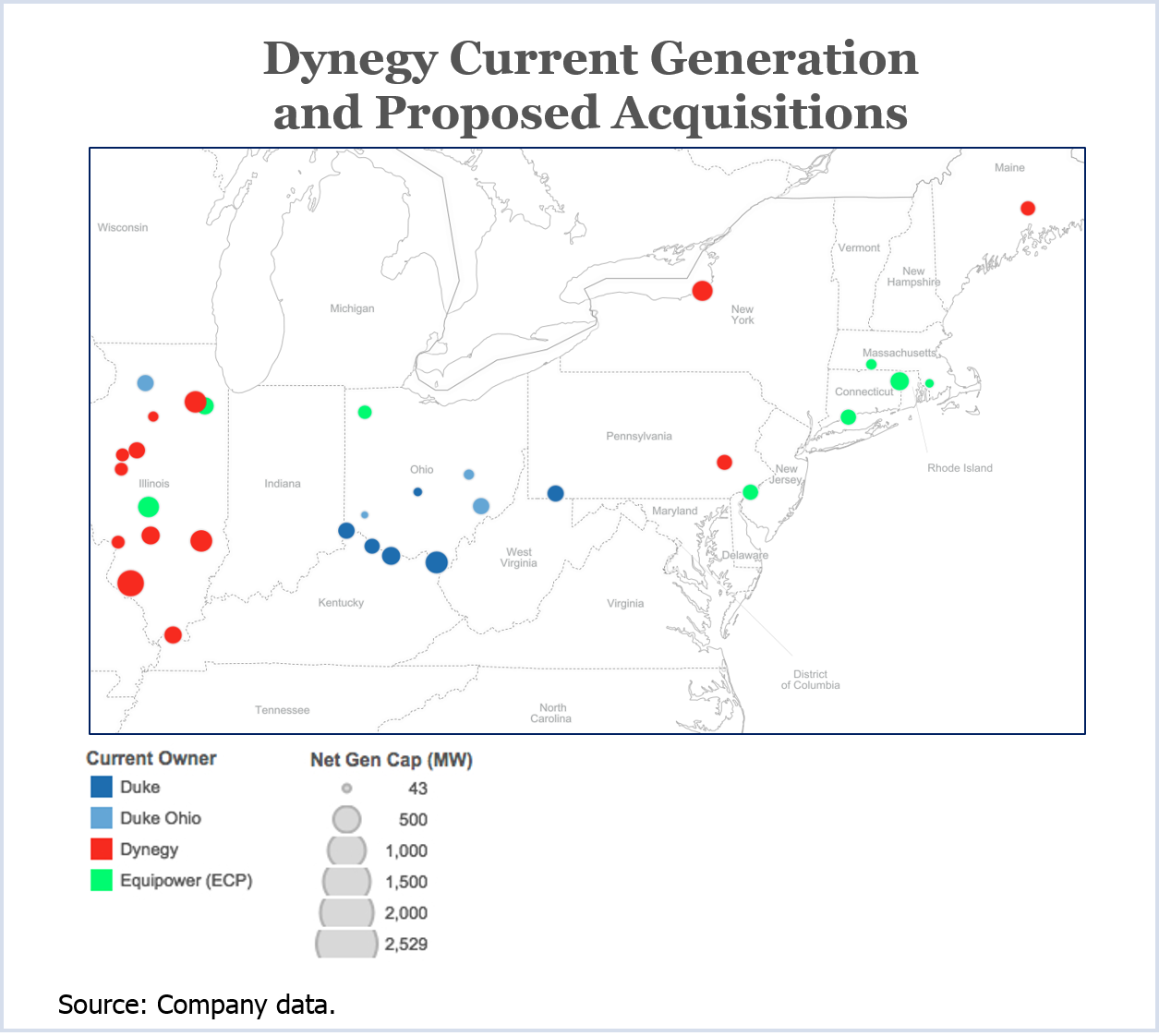

Dynegy is hoping to acquire 11 Duke generating units in the Midwest and 10 Energy Capital Partners generators in the Midwest and New England. Dynegy would gain about 9,000 MW in PJM, boosting it to more than 10,700 MW and eighth in generation share in the RTO. (See Dynegy Back in the Game with Duke, ECP Acquisitions.)

In their application for approval of the purchase, the companies told the Federal Energy Regulatory Commission that Dynegy’s 6.5% share of the PJM market post-acquisition would have a minimal impact on competition.

The settlement was filed along with a response to a Jan. 16 deficiency notice in which FERC said that the applicants had not addressed all of the commission’s competitive concerns.

The response included market power analyses it said proved that the transactions “will not have an adverse effect on competition” in PJM or any PJM submarket.

Noting that the Monitor was the only intervenor to raise competitive concerns in PJM, the companies asked FERC to approve the deals by April 1. Dynegy said additional delays would cost it $1 million a day in financing costs, impact outage coordination activities needed to prepare for summer operations and threaten the consummation of the deal.