By Suzanne Herel

The company reported earnings of $693 million ($0.80/share) compared with $90 million ($0.10/share) a year earlier. Excluding certain items, the company delivered a per-share profit of 71 cents, compared with 62 cents the same time last year.

Exelon said its earnings benefited from fewer storms and more hot days for PECO, its generation-to-load-matching strategy, the $60 million acquisition of Integrys, increased rates at BGE and the Department of Energy’s cancellation of spent nuclear fuel disposal fees.

These factors were partially offset by some nuclear outages; lower profit at Commonwealth Edison, where heating degree days and electric deliveries fell; higher operating and maintenance costs for contracting; interest expenses; and the termination of interest rate swaps.

Exelon’s generation segment — which includes its retail suppliers and Constellation, which sells to both wholesale and retail customers — saw a profit of $443 million, compared with a year-earlier loss of $185 million.

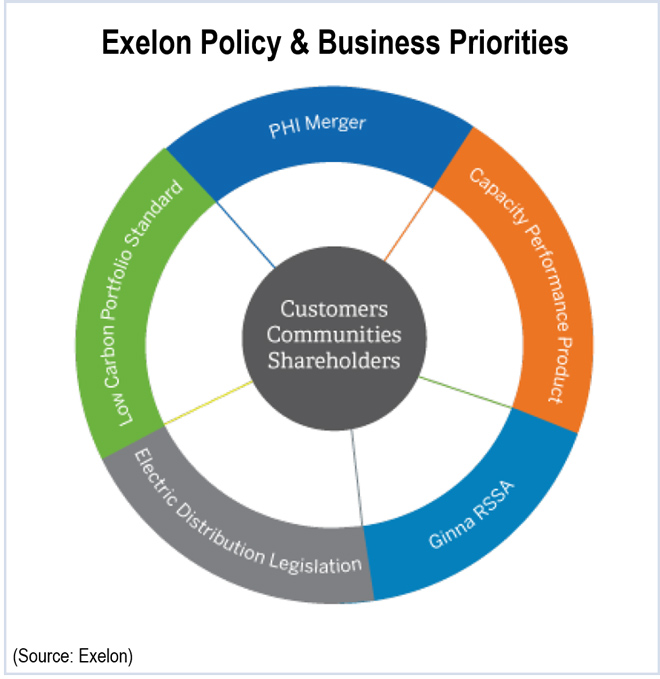

In a conference call with analysts, CEO Christopher Crane said he was hopeful that an Exelon-backed bill designed to support some of the company’s underperforming nuclear reactors would clear the Illinois legislature this session. (See Exelon-Backed Bill Proposes Surcharge to Fund Illinois Nukes.)

He dismissed rumors that Maryland Gov. Larry Hogan opposed the merger, saying, “The governor has stayed neutral since he says he’s come in late to the process.” Crane said Hogan had penned a letter to the state Public Service Commission saying he was neither for nor against the transaction.

Crane said he expects the company to receive a decision from the Maryland PSC by May 15.

Chief Financial Officer Jack Thayer said that should regulators reject the deal or place such onerous conditions on it that it no longer was viable, Exelon would use the money to “fund growth at the business or return value to shareholders through other means.”