By Suzanne Herel

VALLEY FORGE, PA. — The electric industry’s historic shift to natural gas will aid its compliance with federal regulators’ pending carbon emission rules and provide a boon for gas producers. But the shift won’t be accomplished, speakers said at the PJM Grid 20/20 symposium last week, without an answer to a difficult question: Who will bear the cost of building new pipelines to relieve constraints, and how will they be incented to take on the expense?

Outgoing PJM CEO Terry Boston expressed confidence in the future, saying, “This is the first time in my career I can say that energy independence for the United States of America is attainable.”

The gas and electric industries, he said “are connected at the hip.” There’s not a lot of room for error, he said, “between just-in-time and too-dang-late.” ISO-NE CEO Gordon van Welie who keynoted the conference, shared the challenges faced by New England, where natural gas’ share of electric production has ballooned from 15% in 2000 to 44% in 2014. The region adopted a Winter Reliability Program and Pay-for-Performance incentives to encourage upgrades and improvements to fuel reliability.

“Natural gas infrastructure has not kept pace with the tremendous growth in gas-fired generation,” van Welie said. “We don’t think response to Pay-for-Performance alone is going to result in investments in natural gas pipelines.”

Meanwhile, he said, “It’s not that our situation is getting better — it is getting worse.”

Speakers said the Federal Energy Regulatory Commission’s April order moving the timely nomination cycle deadline for scheduling gas transportation to 1 p.m. CT from 11:30 a.m. CT and adding a third intraday nomination cycle should improve coordination between the two industries. (See FERC Approves Final Rule on Gas-Electric Coordination.)

“The idea of adding more cycles, it can’t hurt,” said Joseph Kienle, director of Dominion Transmission. But, he said, “At the end of the day, if I’m in a winter situation and I’m fully subscribed, it doesn’t matter how many cycles you add.”

Andy Ott, who will become PJM’s CEO upon Boston’s retirement, said operational awareness of the natural gas industry has expanded from being a winter concern. PJM in May reconvened its gas “war room” to stay abreast of issues. “This is going to become a normal course of business,” he said. “It’s becoming an annual, year-round phenomenon for us.”

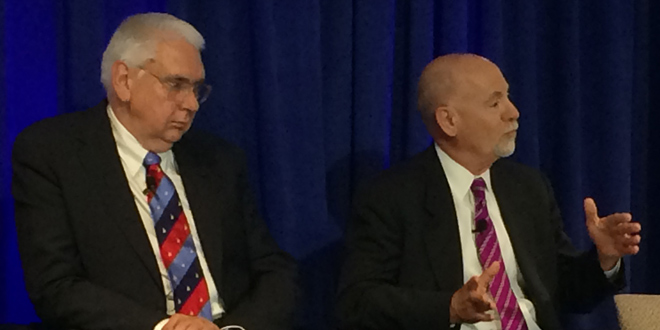

Outgoing FERC Commissioner Philip Moeller encouraged attendees to be proactive in recommending solutions to the commission and its new chairman Norman Bay. “He’s got a bigger, steeper learning curve to tackle,” he said. “Keep that in mind because he’s the person who will lead the commission at least for the next one and a half years.”

Moeller said he has been impressed so far with Bay, who he said is trying to bring the commissioners into decision-making conversations earlier. He declined to comment on Bay’s lone dissent on PJM’s Capacity Performance proposal, citing a “99.99% chance of rehearing that order.”

“My main message to you is: Creative ideas are welcome. We need desperately to keep the momentum going on this issue,” he said.

FERC is good at dealing with singular issues, he said, but, “Sometimes being able to see out a little farther is a challenge the commission has.”