By Rich Heidorn Jr.

PJM’s biggest news story of the year may well come Friday with the release of the results from last week’s capacity market auction.

The 2018/19 Base Residual Auction – the results of which are due Friday afternoon — will be the first under the new Capacity Performance rules approved by FERC in June. The rules increase incentives for high-performing resources and penalties for poor performers, largely eliminating force majeure provisions under a “no excuses” policy.

The auction, which ran from Aug. 10-14, was postponed from May due to delays in winning FERC approval.

The changes will be phased in beginning with the 2018/19 and 2019/20 delivery years, when PJM hopes to make at least 80% of its procurement CP resources, with the remainder “Base Capacity” subject to lower performance expectations. The transition will be complete for 2020/21, when PJM expects 100% of capacity to be CP.

FERC Approval

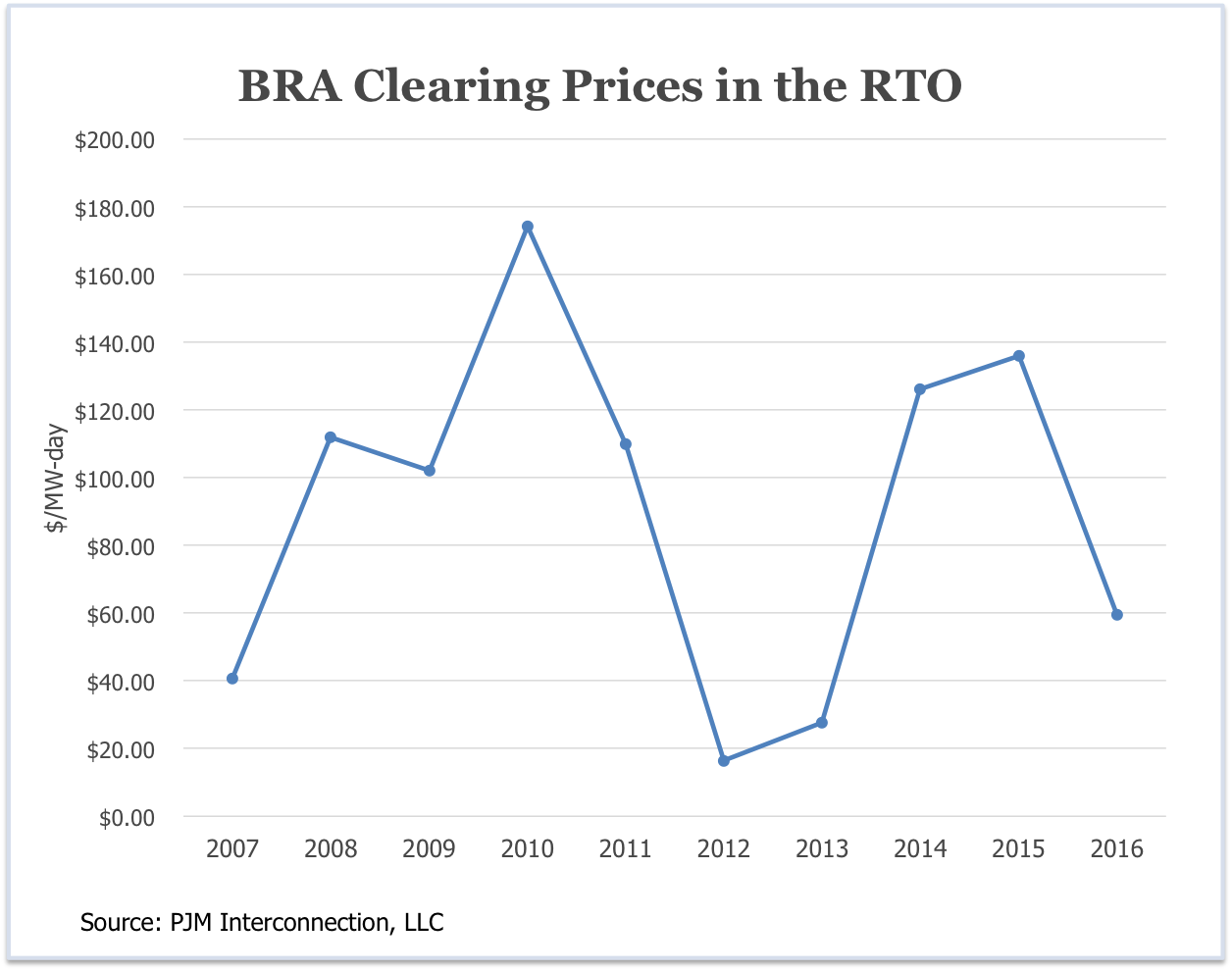

The commission approved PJM’s proposal by a 4-1 vote June 9, citing evidence of increased generator forced outage rates since 2007. (See FERC OKs PJM Capacity Performance: What You Need to Know.)

It accepted PJM’s prediction that resource performance will continue to worsen without changes, as the RTO sees much of its coal fleet retire, replaced largely by natural gas-fired generation. The majority rejected the arguments of opponents who said the changes were not necessary because generator performance improved last winter following more modest changes, including testing of seldom-used units.

Chairman Norman Bay dissented, saying the proposal will continue to allow generators to profit from poor performance while potentially saddling ratepayers with billions in excessive capacity costs annually.

Friction with Stakeholders

The ruling was followed by a testy, six-hour stakeholder meeting over CP manual changes June 18 that left some stakeholders complaining that the RTO had not thought through all the details. Criticism continued in July, as some members warned PJM officials that the way the RTO plans to calculate CP could lead generators to ignore dispatch instructions to avoid penalties. (See PJM Members: Capacity Performance Penalties May Hurt Dispatch Discipline.)

FERC issued a procedural order July 28 saying it needed more time to consider rehearing requests of its June 9 order from state regulators, consumer advocates, generators and the Independent Market Monitor.

Higher Costs

According to a cost-benefit analysis released in October by PJM and the Monitor, CP could cost ratepayers as much as $6 billion over the next four years, with long-term costs of as much as $700 million annually.

PJM says the increased performance will result in increased monthly capacity costs of about $2 to $3 per household beginning in 2018, assuming average winter and summer weather. In a year of extreme weather, officials say, it would result in net savings because the increased capacity costs will be more than offset by reduced energy costs.

For More Information

PJM’s Board of Managers filed the Capacity Performance proposal in December to increase the reliability expectations of capacity resources with a “no excuses” policy that would result in larger capacity payments and higher penalties for non-performance. (See What You Need to Know about PJM’s Capacity Performance Proposal.)

FERC’s June 9 order required several significant changes from PJM’s Capacity Performance proposal. (See What is Changing in PJM’s Proposal?)