By Chris O’Malley

MISO last week revealed yet another twist in its deliberations over two southern Indiana transmission projects, leading some stakeholders to question whether RTO officials are following their planning rules.

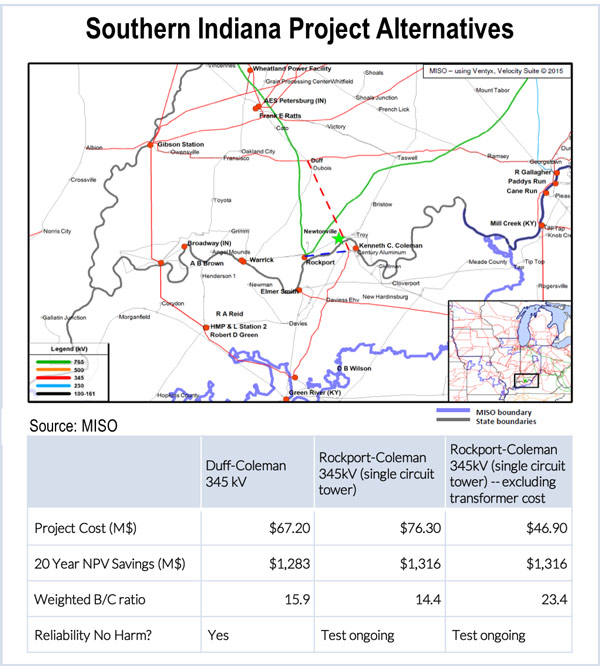

In July, MISO said it would consider swapping the proposed 345-kV Duff-Coleman transmission project, estimated to cost $67.2 million, for a previously rejected Rockport-Coleman 345-kV transmission line estimated to cost $76 million. (See MISO Plan to Revisit Runner-up Tx Project Rekindles Shareholder Angst.)

PJM offered to share the cost of the latter project, which could solve stability problems at its Rockport substation. PJM’s contribution would reduce MISO’s spending on the line by about $29 million.

At last week’s MISO Planning Advisory Committee in Eagan, Minn., MISO staff proposed a “loop-in” giving the Rockport substation paths to both Duff and Coleman.

It’s attractive to PJM in part because the RTO needs two 345-kV circuits to its 745-kV substation. PJM officials say they have had stability problems at the substation because the area has added thousands of megawatts of generation but no new transmission since 1989. (See “PJM: Despite Lack of Cost Allocation Rules, MISO Project Too Good to Ignore” in PJM TEAC Briefs.)

“They need two lines out of Rockport. So we can build the original, single-circuit Duff-Coleman, loop it in, and that loop-in would give them two lines out — one to Coleman, one to Duff,” said Jeff Webb, MISO director of expansion planning.

Costs are still being studied, but MISO estimates the new alternative would add about $200,000 to the Duff-Coleman cost, an amount that would have a negligible impact on its cost-benefit ratio.

Shareholders, however, pressed MISO officials about the additional costs, asking whether customers would bear some of them. Webb said MISO would only agree if PJM picked up the costs of its benefits, holding MISO harmless.

If not, “then all bets are off and we’re going back to the original [Duff-Coleman] project,” Webb said.

But several stakeholders questioned whether MISO should be concerned with PJM’s needs in the context of MISO’s own need to address southern Indiana congestion problems. They also questioned whether MISO was following the proper processes in evaluating the expansions.

Kevin Murray of the Coalition of Midwest Transmission Customers asked why MISO was not constructing Duff-Coleman as a market efficiency project under MISO’s Transmission Expansion Plan (MTEP) and then evaluating Rockport-Coleman as an interregional project on its own merits.

“Well, because I think we have an opportunity here to be efficient about building out the grid on both sides without any harm to MISO,” Webb replied.

“You’re going to run into the same thing PJM ran into with Artificial Island,” Murray countered. “You’re pursuing an outcome where people are going to say you didn’t follow the process. And you’re going to get tied up in litigation at FERC and the customer is going to be the loser in all this because they’re going to end up paying for transmission congestion for a period in time when it doesn’t need to happen.”

He noted that other stakeholders, such as Northern Indiana Public Service Co., weren’t happy with the idea.

“NIPSCO objects to the fact that neither of the competing recommended projects … has been studied under the process specified by the MISO/PJM Joint Operating Agreement to determine cross-border benefits and RTO cost allocations,” NIPSCO said in a letter presented at the PAC meeting.

NIPSCO said the recent actions by MISO and PJM to modify the southern Indiana proposal “suggests that there are difficulties and inconsistencies” in resolving cross-border issues through current planning processes.

“Rather than address these issues, the RTOs have circumvented the defined JOA processes for an ad hoc solution,” the company said.

NIPSCO said the proposed projects should be studied under the JOA process using a joint MISO-PJM model.

David Davis of NextEra Energy asked whether MISO had the time to study the new proposal and allow for stakeholder review before the recommended projects in MTEP 15 are submitted to the MISO board Dec. 10. “It seems like that’s a pretty long putt,” he said.

Webb said he was confident that answers could be found within six weeks.