By Rory D. Sweeney

The Clean Power Plan poses no threat to PJM’s reliability, but compliance costs are highly sensitive to gas prices and whether states go it alone or combine efforts with a regional approach, according to a study released by the RTO last week.

If gas prices remain low, states within PJM’s footprint are likely to meet EPA-mandated emissions reductions simply through the replacement of coal plants with new combined cycle generators. However, compliance costs could more than triple if states decide to meet their CPP targets individually while also regulating emissions from new sources, the RTO’s analysis concludes.

Issued by EPA in August 2015, the CPP requires PJM’s states to reduce carbon dioxide emissions by 36% from 2005 levels by the year 2030. The analysis, requested by the Organization of PJM States Inc., compared seven compliance “pathways” employing mass- and rate-based trading at regional or state levels. Rate-based plans would mandate that generators meet a pounds-per-megawatt-hour target, while mass-based plans cap state emissions in tons per year.

PJM also looked at several sensitivities, including the impact of retirements on resource owners’ exit decisions based on five- and 20-year horizons. Also modeled were the impact of lower natural gas prices, a multistate split of rate- and mass-based compliance within the PJM region and state renewable portfolio standards.

Regardless of the pathway used, the CPP would not have a substantial impact on resource adequacy as “the capacity and energy markets [will be] able to attract sufficient new investment to satisfy PJM’s reliability requirements,” the RTO said.

Regional Compliance Reduces Costs

The analysis found that levelized compliance costs would range from $0.61/MWh (1.1% of the average total wholesale cost) for regional plans and $1.93/MWh (3.3%) for individual state plans that include regulation of both new and existing sources.

“The cost of compliance for the entire PJM region differs according to the compliance pathway chosen, but regional compliance leads to lower costs than does individual state compliance under both mass-based and rate-based compliance pathways,” the report said.

Regional compliance would result in fewer coal generator retirements and less new combined cycle gas plants than individual state compliance “due to the greater flexibility and options for emissions reductions offered across the entire PJM region,” the study said.

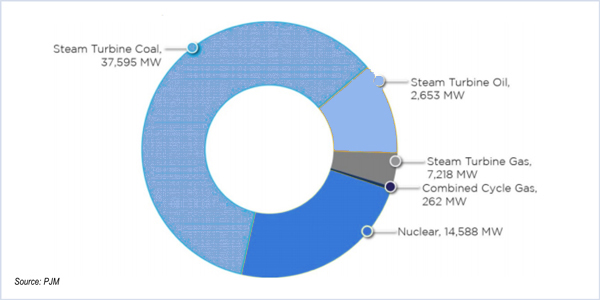

As a reference case, PJM also ran a simulation in which the CPP, which has been stayed by the U.S. Supreme Court pending legal challenges by numerous states, is not implemented. The simulations begin in 2018, thelatest that compliance plans can be submitted if the rule survives.

Impact of Gas Prices

The study found that continued low natural gas prices — assuming they remain in the $3 to $4/MMBtu range (in 2018 dollars) over the 20-year study period — “has a greater effect on emissions levels, the retirement of fossil steam resources and new entry of natural gas combined cycle resources than even the most stringent of the studied compliance pathways that also regulate the CO2 emissions of new natural gas combined cycle resources.”

“Because of accelerated [coal] retirements, there would be no cost to achieve compliance, and the resulting emissions would be below the final Clean Power Plan targets, even without the Clean Power Plan,” PJM said.

Challenges for Nuclear, Boon for Renewables

Compared to the reference and mass-based options, PJM found that rate-based compliance would create lower energy market prices because subsidies for renewable resources would allow them to submit offers below production costs. This would increase capacity prices, however, as resources seek to replace lost energy revenue.

This would drive growth in renewables — which would earn more revenue from emissions rate credits than from the increase in energy market revenues under mass-based compliance — but “results in increased economic challenges for existing nuclear resources,” PJM said.

Mass-based plans, on the other hand, would increase energy market prices by adding costs for allowances. They would allow low-emission resources to depend less on non-market revenue and provide no incentive to price generation below cost. They would also make nuclear facilities more viable by pricing their low-emissions status.

The analysis also evaluated the impact of different time horizons on the nuclear and coal fleets.

If generation owners make retirement decisions based on a five-year horizon from 2018 through 2022 before initial compliance targets take effect, the study predicted up to 6 GW of nuclear retirements (in addition to the already-announced decommissioning of the Oyster Creek nuclear plant) and less than 1 GW of incremental coal-fired retirements. Gas prices would drive the reductions in the short run, but the study found nuclear plants become viable again in 2026 under CPP.

“What the analysis shows is that over a 20-year horizon, the existing nuclear fleet can become economic, but in this near term, they face a lot of stress given the low gas prices and current market prices,” PJM’s Muhsin Abdur-Rahman said during a media briefing on the report Thursday.

The analysis found congestion will decline by 2025 under every compliance pathway compared to the reference scenario. Congestion related to historical west-to-east flows drops because of coal retirements in western PJM, although it is accompanied by more localized congestion.

Energy Efficiency

Rate-based plans would also require precise measurement and verification of energy efficiency to earn emission rate credits. A sensitivity that assumed states can convert only 50% of energy efficiency included in load forecasts into credits resulted in cost increases that were more than double the cost of trade-ready mass-based compliance, although still less than $1.50/MWh.