By Robert Mullin

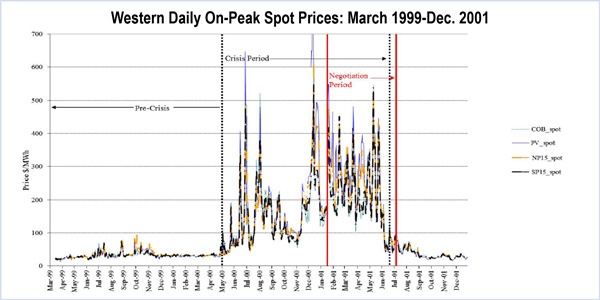

FERC last week agreed to consider whether the failure of some power sellers to file compliant price reports contributed to unreasonably high rates for long-term electricity contracts filed during the Western Energy Crisis of 2000-2001 (EL02-71-052).

The case, which involves Shell Energy North America, TransCanada Energy, Koch Energy Trading, Allegheny Energy Supply, Merrill Lynch Capital Services and other sellers of energy and ancillary services into the CAISO market during the crisis period, was remanded to FERC last year by the 9th U.S. Circuit Court of Appeals (12-71958).

FERC’s decision breathes life into California’s contention that reporting deficiencies may have helped conceal market manipulation and create a “pricing umbrella” under which California’s Department of Water Resources was compelled to sign overpriced contracts near the conclusion of the crisis.

“We agree with California parties that evidence regarding a pricing umbrella theory could be relevant to the 9th Circuit’s instructions on remand to examine the nexus between reporting deficiencies, market power and market outcomes, including evidence of how reporting deficiencies may have masked manipulative behavior by sellers,” the commission wrote.

The California parties — which include the Public Utilities Commission, Attorney General Kamala Harris, Pacific Gas and Electric and Southern California Edison — asserted that the sellers’ quarterly reports did not meet requirements during the crisis period because they contained no hourly transaction detail or any information on the timing or location of the trades. The reports provided only aggregate quarterly or monthly sales data along with a range of prices, the parties contended.

As a result, FERC will allow California to introduce relevant evidence at a future hearing — evidence that could “provide greater context and depth” into the examination of factors that enabled sellers to charge the state exorbitant rates.

Mobile-Sierra Caveat

Embedded in FERC’s ruling, however, was one important qualification: that the commission disagreed with the state’s contention that evidence of a reporting violation alone could overcome the Mobile-Sierra presumption of the “justness and reasonableness” of any of the bilateral contracts at issue.

“The Mobile-Sierra analysis requires more than just an unlawful act,” the commission said.

In support of that determination, the commission cited the Supreme Court’s 2008 decision in Morgan Stanley Capital Group Inc. v. Public Utility District No. 1 of Snohomish County, which stated that a contracting party’s engagement in unlawful activity in the spot market does not automatically strip its forward contracts of Mobile-Sierra protections.

“We find that the California parties’ argument, if accepted, would require us to abrogate the contracts at issue based solely on an unlawful act itself (i.e., the misreporting), without the required causal connection between an unlawful act and an unjust and unreasonable rate, as required by the Supreme Court,” the commission wrote.

In the words of the 9th Circuit, the commission concluded, the purpose of the remand is to determine whether “reporting deficiencies fostered the subtle accumulation of market power and resulted in an excessive rate.”