By Rory D. Sweeney

VALLEY FORGE, Pa. — PJM is considering giving demand response participants injection rights in its effort to expand distributed energy resources’ access to wholesale markets.

The effort is being overseen through special Markets and Reliability Committee sessions that began in April. At the most recent session last week, PJM officials discussed what they called “demand response with injections,” a practice ISO-NE has been using since last year.

DR resources eligible to inject past their meters would have to do so without creating problems for the distribution system. To avoid double counting, DR resources would not receive payments for regulation or synchronized reserves if they are reducing their energy bills through net energy metering (NEM).

Accounting, Jurisdictional Questions

Allowing DR injections raises jurisdictional and accounting questions, PJM said. If DR is treated as a non-wholesale energy injection akin to NEM, “does the DR resource get paid LMP and keep the NEM credit? Does PJM adjust the energy payment to the DR resource to reflect NEM credit? Does the [load-serving entity] keep the cost reduction?”

PJM’s Aaron Berner also reviewed the small generator interconnection process and whether the alternate queue for small projects should be eliminated or modified. The proposals, presented by Berner, included an alternative queue process designed to reduce the study and review times as well as a reorganization of grid-upgrade cost allocations for projects costing less than $5 million.

The sessions are in response to a problem statement brought by battery storage system designer A.F. Mensah, which was approved by stakeholders in February. (See “Faster Path to Market for Distributed Resources to be Studied,” PJM MRC & Members Committee Briefs.)

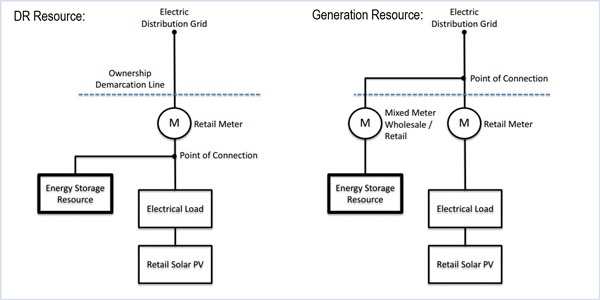

In the problem statement, A.F. Mensah outlined the limitations created by PJM’s current market participation rules that require battery systems to commit to a single purpose rather than provide multiple services. To participate in PJM’s markets, versatile resources like battery systems must choose to interconnect either as a generation resource through the RTO’s standard queue or as a DR resource.

Cost Prohibitive

The standard queue is cost prohibitive, requiring a long review and analysis process, along with requirements to install redundant equipment that increase each project’s complexity and cost. Additionally, that path limits storage systems to participating in the wholesale market, so retail customers with small-scale renewable systems, such as rooftop solar or residential-size wind turbines, have to account for each system separately and can’t store renewable power created now to offset demand later.

However, the DR pathway only allows resources to offset their owners’ current demand, which negates renewables’ ability to provide power to the grid when they are producing more than the system owner needs.

“Distributed resources are often installed as part of a wider behind-the-meter system, which includes solar panels that produce more power than consumed by the load on an instantaneous basis,” A.F. Mensah wrote in the problem statement. “The provision limits the DR value opportunity based on the amount of instantaneous load, which therefore severely limits the value the DR resource can provide to the market.”

PJM’s issue charge set up the special MRC sessions in acknowledgement of no other cross-committee forum existing to address the topic.

‘Next Wave’

“I can see DER participating in PJM as the next wave of a resource that at some point is going to reach critical mass,” said Dave Pratzon, who consults for generators and energy marketers. “It’s going to have to be dispatchable. PJM’s going to have to know its output. I think that part of the work of this group has to be forward looking.”

PJM also presented its initial considerations on the topic, suggesting there could be a hybrid rule. Calling it “demand response with injections,” PJM’s Andy Levitt said ISO-NE instituted a similar rule in 2015 that allows load to “go negative” — i.e., inject excess generation into the grid. This model would necessitate changes to accounting and settlement procedures to ensure participants are paid appropriately.

PJM staff asked if stakeholders would allow them to focus on one issue, such as allow DR injections for ancillary services, so as to not overload the committee and “boil the ocean,” as MRC secretary Dave Anders put it. Stakeholders, however, didn’t want the other issues to be forgotten and said ancillary services might be one of the harder issues to address.

“I don’t think this is a quick one that we can overlook in a hurry,” FirstEnergy’s Bruce Remmel said. “It complicates itself quickly.”

PJM staff are analyzing the feedback from the meeting and will be presenting recommendations on how to proceed. The next meeting on the issue is scheduled for 9 a.m. Nov. 22 at PJM’s Conference and Training Center.