By Robert Mullin

CAISO is seeking stakeholder input on how to respond to a solar eclipse that will significantly curtail output from California’s growing solar generation portfolio next August.

“It will not be a total eclipse [in California], but it will affect what solar production we have in California,” Jim Blatchford, an ISO senior advisor for short-term forecasting, said during a Oct. 20 call to discuss the issue.

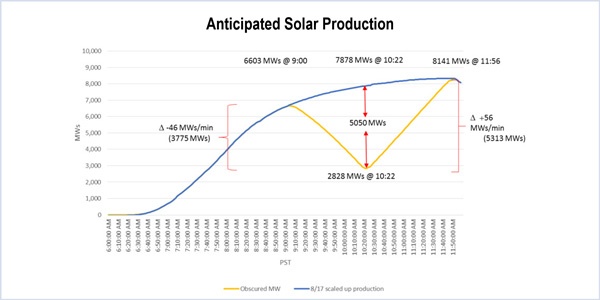

The state will begin experiencing the effects of the Aug. 21, 2017, eclipse at about 9 a.m. PT, just as solar output is ramping up to its mid-day peak.

CAISO expects output to drop at an average rate of 46 MW/minute, from 6,603 MW to 2,828 MW at 10:22 a.m., when the eclipse reaches its totality.

“This is just for large-scale utility solar — not behind-the-meter,” Amber Motley, manager of short-term forecasting at the ISO, pointed out.

By that time, the sun will be completely obscured south of Portland, Ore., while California’s San Juaquin and Coachella valleys — both key solar producing regions — will see coverage of around 76% and 62%, respectively. Utility-scale solar output is forecast to be about 5,050 MW below what it would otherwise be without the eclipse.

The loss of output will require steady ramping from other generation sources to cover the 3,775-MW difference between the 9 a.m. peak and the 10:22 a.m. trough.

As the eclipse begins to pass, solar output is projected to increase at a rate of 56 MW/minute until noon — nearly four times the norm for that time of day. That will require a sharp downward ramp of other resources.

Motley noted that the ISO has not calculated the eclipse’s effect on California’s rooftop solar — currently estimated to be at about 5,000 MW — but expects that variable will be factored into the load rather than generation forecast.

CAISO must also focus on the impact of the eclipse on the Western Energy Imbalance Market. Arizona Public Service, NV Energy and PacifiCorp have a combined 3,270 MW in utility-scale solar and 816 MW in rooftop installations.

Arizona and Nevada will not be as affected as PacifiCorp’s sprawling territory, Blatchford noted. Utah alone will experience a 70% reduction in radiance.

The ISO is looking for advice from European electricity planners, who experienced a similar event last year. The planners increased reserves, made strategic use of pumped storage, limited planned outages and reduced DC line capacities between different regions. Germany procured twice its normal level of regulation reserves, while Italy curtailed PV production ahead of the eclipse.

“They were going to lose 90 GW, so they had a lot riding on this,” Blatchford said. “They did a very good job there, I thought.”

In light of Europe’s success, CAISO is hoping to develop a plan that encompasses the West at large. The effort would take up several possible mitigation measures, including cooperation with the Western Electricity Coordinating Council, gas-electric coordination, use of flexible ramping and hydroelectric resources, EIM transfer capability, reserve procurement and development of special operating procedures for the event.

“I think we have a lot of market products that we can use … and help with the coordination of this event,” Motley said.

Stakeholders are asked to provide feedback on potential measures by Nov. 3. The ISO expects to develop an eclipse mitigation procedure early next year, with publication of a final plan targeted for March.

“This is a unique event that we don’t get to deal with on a day-to-day basis,” Motley said.