By William Opalka

RENSSELAER, N.Y. — Over objections by generators, the NYISO Management Committee on Wednesday approved a temporary rule change to partially insulate consumers from sharply higher capacity prices as a result of exports from constrained zones.

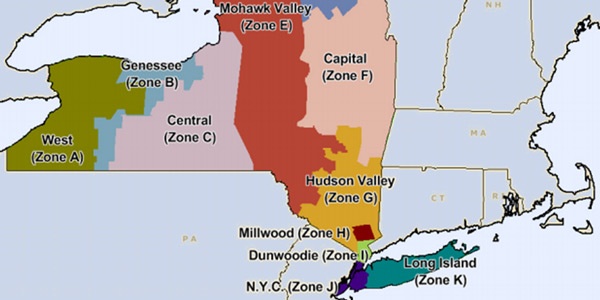

NYISO Zone Map | NYISO

The committee approved its interim solution with 63% of the vote.

The proposed rule change is in response to FERC Sides with ISO-NE in Capacity Dispute with NYISO.)

FERC’s ruling allows Castleton Commodities International’s 1,242-MW Roseton 1 generator, located 43 miles north of New York City in NYISO’s capacity import-constrained G-J locality, to supply 511 MW of its capacity to ISO-NE beginning next June for the 2017/18 delivery year.

Current New York rules treat exported capacity the same as if the plant supplying it had been retired or mothballed.

“The NYISO’s objective in formulating our proposed market design has been to eliminate inefficient pricing outcomes due to exports from import-constrained localities,” Emilie Nelson, vice president of market operations, said at the meeting. “Our overarching goal is to send effective short- and long-term market signals that incent investment and retain resources where they are needed without imposing undue consumer impacts.”

Generators at the meeting complained that the changes endorsed by the committee — particularly an amendment offered by transmission owners — cap capacity prices without justification. In an amended motion approved by the committee, those payments have been capped at 20% of what the generators would be paid under a formula devised by NYISO staff.

“I see this just as a vote for lower prices because I see no technological background behind it,” said Mark Younger, who represents several generators.

Supporters of the interim rule change did not challenge that characterization. “While this is not a perfect solution, this gets us to where we need to be in the short term,” said Kevin Hunt, who represents large industrial customers and New York City.

ISO officials said they will promise in their Section 205 filing seeking FERC approval of the rule change to continue work on the issue in its stakeholder groups.

Under a complex formula by NYISO staff based on power flow analysis, for each megawatt committed to New England, capacity prices in the constrained zones in the Lower Hudson Valley would go up by almost 48%.

The “locality exchange factor” incorporates base case data from the most recent reliability planning process to determine the amount of generation from the “Rest of State” areas outside of the constrained Hudson Valley that can be brought into the constraint area. The LE factors will be calculated annually.

The LE factor for the coming year is 47.8%, which means a price signal to replace 52.2% of the exports to ISO-NE is efficient, NYISO says. In other words, 52.2% of the exports can be replaced by resources from within the same locality, but 47.8% must be replaced by capacity resources from the Rest of State.

Under the amendment offered by TOs, the capacity cost increase borne by consumers would be capped at only 20% of the cost the LE factor would have imposed.

NYISO estimates that while prices will still rise for in-state customers because of the exports, the rule change will reduce the increase by at least $144 million.

Independent Market Monitor David Patton had identified the problem in his 2015 State of the Market report, recommending that NYISO act quickly to recognize the reliability value of generators in import-constrained zones to avoid a rise in capacity prices.