By Rory D. Sweeney

PJM’s capacity and regulation market results were “generally competitive” in the first nine months of 2016 but remain vulnerable to stress, according to the Independent Market Monitor’s third-quarter State of the Market Report.

The report by Monitoring Analytics added five new or modified recommendations on uplift, the capacity market and demand response.

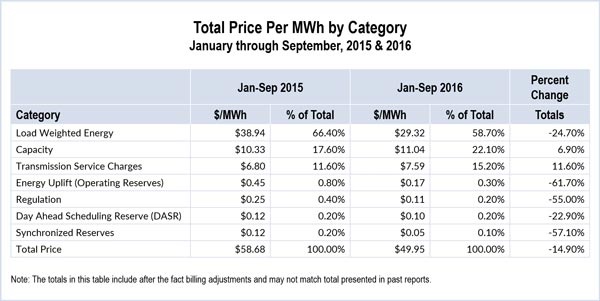

The load-weighted average real-time LMP was $29.32/MWh in the first nine months of 2016, lower than for any corresponding period since 2000, reflecting both lower fuel prices and lower demand. It was 25% lower than the first nine months last year.

If all things, including fuel and emissions costs, had remained constant in 2016 from 2015, the load-weighted LMP would have been $31.67/MWh, still below the 2015 mark of $38.94/MWh. PJM’s average real-time load in the first nine months of 2016 decreased by 1.4% from the first nine months of 2015, to 90,599 MW.

The structures for all but the aggregate energy, day-ahead schedule reserve and financial transmission rights markets were uncompetitive, the report said. The PJM region and all locational deliverability areas in almost every market have failed the three pivotal supplier market power test for almost every auction since at least 2007.

Market design received a “mixed” evaluation. Although the Reliability Pricing Model design and Capacity Performance modifications have “many positive features,” the report said, several features “still threaten competitive outcomes.” Among them: the definition of DR, which allows “inferior” products to substitute for capacity; the definition of unit offer parameters; and the inclusion of imports as substitutes for internal capacity resources.

The Monitor also raised concerns over replacement capacity, recommending against allowing retroactive replacement capacity transactions.

Market performance and participant behavior during high-demand hours raised several concerns, the report said, including potential economic withholding.

“In particular, there are issues related to aggregate market power, or the ability to increase markups substantially in tight market conditions, to the uncertainties about the pricing and availability of natural gas, and to the lack of adequate incentives for unit owners to take all necessary actions to acquire fuel and generate power rather than take an outage,” it explained.

In addition to its suggestion on replacement capacity, the Monitor added four other new or amended recommendations.

First, it recommended that PJM initiate a stakeholder process if it plans to modify its price-setting logic — a software change the RTO made in 2014 to reduce uplift by selecting as marginal any unit committed by PJM to provide reactive services, black start or transmission constraint relief if that unit would otherwise run with an incremental offer greater than the LMP.

The recommendation was one of several that the Monitor said could have reduced the uplift rate paid by decrement bids in the Eastern Region by 93% — to $0.032/MWh instead of $0.446/MWh — in the first nine months of 2016.

The Monitor also recommended that capacity released by PJM in incremental auctions should be offered at the Base Residual Auction clearing price or not have the offer price revealed at all to avoid suppressing the IA price. (See “Proposal Chosen for Capacity Release,” PJM Markets and Reliability and Members Committees Briefs.)

Energy efficiency resources shouldn’t be included on the supply side of the capacity market, the Monitor concluded. “PJM’s load forecasts now account for future EE, but did not when EE was first added to the capacity market. If EE is not included on the supply side, there is no reason to have an add back mechanism,” the Monitor said. “If EE remains on the supply side, the implementation of the EE add-back mechanism should be modified to ensure that market clearing prices are not affected.”

Finally, the Monitor also recommended not removing any defined subzones and maintaining a public record of all created and removed subzones.