CARMEL, Ind. — MISO has come up with two possible responses to its Independent Market Monitor’s suggestion to apply its 50-MW physical withholding threshold to affiliated market participants collectively, rather than individually.

MISO told the Resource Adequacy Subcommittee on Nov. 30 that the withholding threshold should either use allocations based on load ratio share, or the fixed 50-MW limit should be scrapped in favor of a new threshold based on percentage of generation assets.

MISO’s Cliff Risley said the downside to the load ratio share option is that market-sensitive information could be released inadvertently through how many megawatts each affiliate is awarded. Risley also said the percentage option could result in more allowed withholding overall and weaken capacity market efficiency.

MISO and the Monitor are proposing to set withholding limits on a company basis rather than the current market participant basis, which allows affiliates to hold back 50 MW apiece without overstepping the Planning Resource Auction withholding threshold. (See “MISO Takes 1st Steps in Monitor Recommendations,” MISO Resource Adequacy Subcommittee Briefs.)

Monitor David Patton said the two alternatives remove the “common incentive” for affiliates to withhold to boost prices for a sister company, but putting the 50 MW on a pro rata basis is “more draconian” than the current market rules.

“There are cases where withholding less than 50 MW is mitigated. You’ve now made the affiliation more stringent,” Patton said. He also said he didn’t know how the percentage method could be distributed fairly.

Some stakeholders argued that FERC Order 697 already prohibits coordination among affiliates that are franchised public utilities and the withholding proposal should only apply to affiliates not covered by the rule.

Risley asked for more stakeholder feedback before Dec. 14.

Projects Without GIA Counted in OMS-MISO Survey?

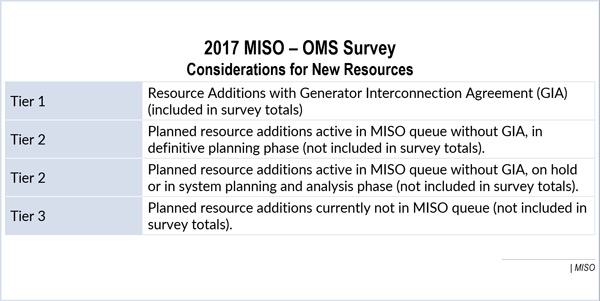

MISO’s Darrin Landstrom asked stakeholders if the RTO should include resources that have yet to secure a generator interconnection agreement in the annual OMS-MISO Survey.

Currently, MISO only includes Tier 1 resources — those that have a signed generator interconnection agreement — into the survey’s regional and zonal weighted averages. The RTO is asking if it should include Tier 2 resources — projects still in the interconnection queue — into the survey totals, or create a separate survey category for them. RASC Chair Gary Mathis asked if MISO could use historical data to calculate the likelihood of projects being completed after they enter the final stage of the queue. Landstrom said the option could be explored.

Laura Rauch, MISO’s manager of resource adequacy coordination, reminded stakeholders that MISO’s ongoing effort to revise its queue rules could complicate the suggestions, as the queue’s stages and restudy periods could be changed.

Landstrom asked for input on the issue by Dec. 15.

IMM Clears Up Market Mitigation Application

The Monitor is proposing a Tariff change to make clear which resources are subject to PRA market mitigation measures.

IMM staffer Michael Chiasson said market mitigation will apply to “generation resources, including behind-the-meter generation, that are internal to or are pseudo-tied into MISO.”

Chiasson said MISO’s Tariff is currently unclear as to what resources are answerable to the Monitor; the edits would be made to Module D.

Demand resources, energy efficiency resources and external resources will be exempted from market mitigation measures, Chiasson said. He asked for stakeholder feedback by Dec. 14.

— Amanda Durish Cook