VALLEY FORGE, Pa. — PJM’s proposed timeline for reviewing tie-line requests will need another round of revisions before members are comfortable with endorsing it.

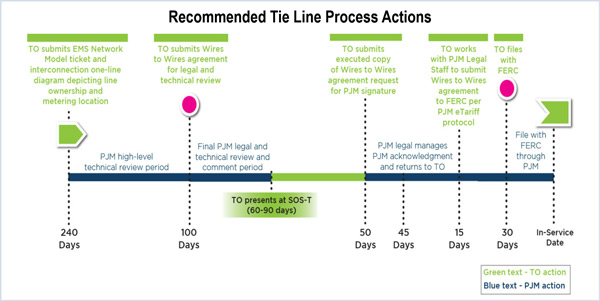

Two clarifications precluded members from bringing it to an endorsement vote at last week’s Planning Committee meeting. The first concern was an implication that the applicant must present their request at a meeting of the System Operations Subcommittee’s transmission owners group (SOS-T) following PJM’s legal and technical review. The second issue was the timeline’s awkward construction, in which it counts down to a FERC filing date and then counts down again to an in-service date.

“We thought it was valuable, but if it’s causing issues, we can remove it,” PJM’s Sue Glatz said. She went on to request an endorsement vote with the understanding that the clarifications will be made.

Stakeholders questioned PJM’s pressure to secure approval despite reservations.

“It’s essential that these documents be clear and concise. I’m not wishing this on anyone, but there is the possibility that some of us might not be around to interpret them,” American Municipal Power’s Ed Tatum said.

PJM’s Paul McGlynn countered that the process has been going on for quite some time. “We’ve been at it for four months now,” he said.

Project-Selection Guidelines Criticized as Too Subjective

PJM unveiled guidelines for how it will select market efficiency projects, noting a “bright line” criterion that it must relieve at least one economic (capacity or energy) constraint. Projects also must clear a benefit/cost ratio of 1.25:1 and proposals with estimated costs of more than $50 million will be subject to an independent review.

John Farber of the Delaware Public Service Commission questioned what he called PJM’s “market efficiency at any cost” metrics and asked that it increase its focus on gathering “objective data to move this from a subjective to an objective process” going forward. He said PJM’s analysis is subjective and that cost containment caps are not a “panacea.”

PJM’s Asanga Perera said congestion created by any outages needed to complete a proposed project would be factored into decisions if it’s useful, but that it’s “tough” to include short-term factors and a “one-time thing” like an outage into a 15-year analysis.

“I think what we’re suggesting with some of these slides is that a project without outage congestion might be a better choice,” McGlynn said.

PJM will publish the guidelines, which will be effective for the 2016/17 transmission planning cycle, on the market efficiency web page.

New Forecast Sees Further Load-Growth Reductions

PJM is again reducing its load growth projections due to the economic outlook and increased efficiency.

In its preliminary 2017 forecast, expected summer load for 2020 dropped 2.1% compared to last year’s forecast, while that for 2022 was down 2.9%. The winter 2020/21 forecast dropped 2.6% and 2022/23 was down 3.5%. 2020 was chosen for comparison because it’s the next year for the Base Residual Auction; 2022 is the year used in the Regional Transmission Expansion Plan study.

Analysis Needed to Answer Winter Resource Adequacy PS

PJM’s Tom Falin said the first step to addressing a problem statement approved last month on winter resource adequacy and capacity requirements will be to ensure PJM’s winter model is accurate. (See PJM Stakeholders Reject CP Rule Changes, OK Additional Study.)

Work is being done to assess how well it processes all factors, including how to quantify the operational risks of activities such as transmission outages and generator maintenance.

“Our suggestion is going to be that PJM take the next two or three months to assess internally,” he said.

He expected to have more information for March’s Planning Committee meeting.

‘Immediate Need’ Designations Questioned

At the meeting of the Transmission Expansion Advisory Committee, stakeholders questioned PJM’s determination of “immediate need” for several transmission reliability projects and criticized the decision not to open them to competitive bidding.

In particular, an American Electric Power project in northeastern Indiana raised eyebrows. The company says an outage of its South Butler-Collingwood 345-kV line would result in the loss of more 300 MW of load.

One fix, estimated at $76.5 million, would involve a new 345-kV switching station and a new double-circuit 345-KV line of 17 miles. PJM said it favors an alternative proposal from AEP estimated at $107.7 million because it would also address aging-infrastructure concerns.

PJM’s recommendation rankled some members, who felt the project could have been identified earlier to allow for competitive bidding. Some also questioned including costs for local infrastructure that they said shouldn’t be allocated throughout the RTO.

Five transmission towers along the route are in immediate need of replacement, 79 will need to be addressed within three years and another 22 will need to be fixed soon thereafter, according to AEP’s assessment.

Sharon Segner of LS Power questioned PJM’s findings on two projects it plans to award to Dominion, the incumbent transmission owner, based on immediate need. According to Dominion’s proposal, the projects aren’t slated to be completed until 2021, which is beyond PJM’s definition for an “immediate need” project, Segner said. She suggested opening a 30-day window for competitive transmission developers like her company to propose alternatives.

“Right now, the incumbent transmission owner cannot meet it in three years. Therefore, it would seem to me the right thing to do would be to see if anyone can meet it in the proposal window,” she said.

PJM’s Steve Herling said that would create months of analysis and third-party verification for PJM that would only delay AEP from completing the project.

“We’ve already considered all of these factors, and what we have here is our decision. If you take exception to our decision, you can communicate it to the board,” he said.

PJM staff also pointed out that a recent FERC docket offered stakeholders the opportunity to raise these concerns. The commission’s July order in that case made clear that the definition is based on the date of need, not the in-service date (ER16-736, EL16-96). (See FERC Rejects PJM Cost Allocation on Dominion Project.)

PJM Review of Artificial Island Bid Elements Completed

Installing optical ground wire (OPGW) and new relays won’t resolve reliability issues at Artificial Island as originally expected, PJM’s analysis has found. (See PJM Board Halts Artificial Island Project, Orders Staff Analysis.)

“There may be benefits to installing the optical ground wire and new relay, but that scope of work would not directly address the operational performance issue,” McGlynn explained.

An OPGW serves as both a ground and a telecommunications link. PJM determined that although high-speed relaying using such wires would improve the clearing times for line faults, some bus-fault clearing times were more limiting. “Since the timing is not improved by the OPGW and line relay changes, they will not improve the stability margin,” PJM said.

One of the preliminary recommendations from PJM’s analysis is to remove the ground wire and relay upgrades from the project scope, McGlynn said.

Stakeholders asked whether, based on the scope changes, PJM plans to re-evaluate submitted proposals, but Herling said that was not possible.

“Realistically, we’re only looking at the finalists … in the context that things have changed. … We’re not going to go back to the most expensive projects that were eliminated,” he said. “We’re still working our way through the cost issues and the constructability issues. … Obviously, we still have a lot of work to do.”

– Rory D. Sweeney