By Amanda Durish Cook

MISO’s proposed three-year forward auction in its retail-choice areas attracted more than 40 comments and protests, with critics calling the proposal costly and ill-conceived.

Executive Director of Market Services Jeff Bladen has said the proposal, which would take effect in the 2018/19 planning year, is designed to provide equally valued capacity from both merchant generators and regulated utilities (ER17-284). The comment period on the FERC filing closed last week; MISO expects a decision from the commission by March. (See MISO Files Forward Capacity Auction Plan with FERC.)

Among critics of the plan are MISO’s Market Monitor, which says the auction, with a sloped demand curve for competitive retail areas, will not accurately represent the marginal value of capacity. “The proposal is highly likely to result in unstable prices that are either too low to retain existing supply that is needed or excessively high, attracting new resources that are not needed,” Monitor David Patton said.

In his protest, Patton included a proposal for a two-stage prompt auction for FERC consideration. Competitive retail supply would still use a sloped demand curve and regulated utilities would use a vertical demand curve.

Premature?

The Illinois Office of Attorney General objected to the bifurcation of the capacity market. “By separating Illinois from the rest of MISO through the use of a three-year forward auction, as opposed to the prompt auction applicable to the remaining 90% of MISO load, Illinois consumers would pay higher prices for capacity,” the office said.

Watchdog group Public Citizen said MISO did not have enough conversations with state lawmakers on their resource adequacy plans before making the filing, which he said will increase the cost to ratepayers. “This whole filing is a solution in search of a problem,” Tyson Slocum, the group’s energy program director, said in an interview. “That’s the whole problem with holding stakeholder meetings, it’s whoever shows up.”

“At a minimum, FERC should suspend issuing an order in this docket until the legislative actions of Illinois and Michigan to address long-term resource adequacy can be independently analyzed and incorporated into this docket,” Public Citizen wrote, referring to Illinois’ financial support for Exelon’s Clinton and Quad Cities nuclear plants and energy legislation approved by Michigan last week. (See Illinois Lawmakers Clear Nuke Subsidy and related story Michigan House Passes Energy Bill, Preserves RPS, 10% Retail Choice Cap.)

‘Blind Faith’

The Coalition of MISO Transmission Customers and the Illinois Industrial Energy Consumers filed a joint protest asking FERC to reject the filing because MISO did not fully include the results of The Brattle Group’s study, which the RTO relied on to justify the forward auction. The filing instead contained a MISO description of the study, demand curve diagrams, presentations made to MISO stakeholders by Brattle and testimony from three Brattle employees.

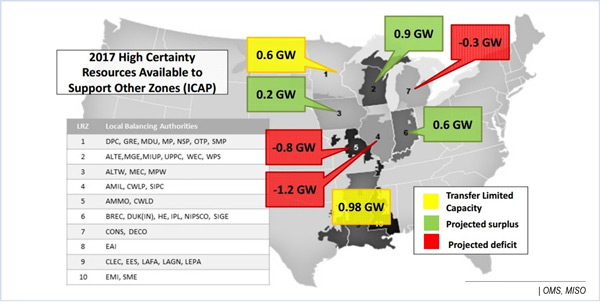

“The commission should not accept, on blind faith, that the Brattle study appropriately supports MISO’s endeavors,” the groups said. They also challenged Brattle’s analysis as biased. Alliant Energy and others challenged MISO’s reliance on the results of the OMS/MISO survey, which forecasts generation shortfalls in 2018. The company said the survey is not a “complete reflection of the future capacity needs in the MISO region.”

A group of transmission-dependent utilities in the Midwest — Madison Gas and Electric, Missouri Joint Municipal Electric Utility Commission, Midwest Municipal Transmission Group, Missouri River Energy Services and WPPI Energy — argued the proposal is “fraught with inconsistencies, errors and ambiguities” that could cause the provisions of the forward market to bleed into noncompetitive areas. The group asked FERC to reject it.

Interference

Power marketer Direct Energy, which offers competitive natural gas plans for Michigan ratepayers in Consumers Energy and DTE Energy territory, objected to MISO’s Tariff revisions to allow retail-choice states to opt out of capacity provisions via the auction design’s prevailing state compensation mechanism. The company is challenging the filing on the basis it “impermissibly” interferes with wholesale markets.

Ron Carrier, Direct Energy’s director of government and regulatory affairs, said he isn’t sure if the limited amount of participating generation and load from retail choice areas would make the forward auction economic, although he said forward auctions in general “allow some price certainty into the future.”

“Our main concern is the state shouldn’t be granted authority over something FERC should have authority over,” Carrier said.

MISO Transmission Owners said they had no opinion on the filing, but they asked FERC to make sure the RTO does not intrude on state jurisdiction over resource adequacy. They also asked FERC to require MISO to give annual reports that analyze the impact of the forward auction on the entire footprint for the next three years.

The Organization of MISO States also argued for protecting state jurisdiction, but the group took a step further, asking FERC to reaffirm the stance it took in a 2012 order that capacity markets are not necessary in vertically integrated areas (ER11-4081-001). “The [competitive retail solution] should not be viewed as the default means to maintain [resource adequacy] within retail-choice areas. It is imperative that state regulators maintain maximum flexibility and authority over the resource adequacy decisions within their jurisdiction,” OMS wrote.