By Robert Mullin

FERC denied Berkshire Hathaway Energy’s request to rehear a ruling prohibiting the company’s subsidiaries from selling electricity at market-based rates in four neighboring balancing authority areas in the West.

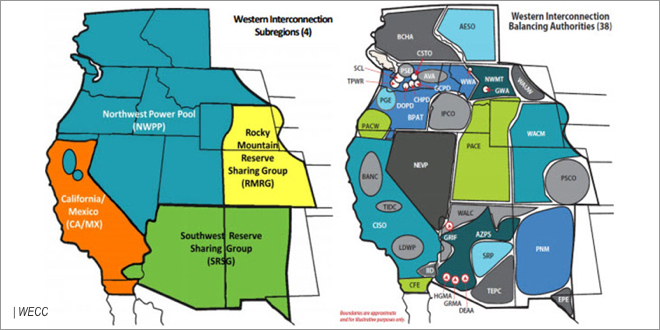

The commission’s June 9 decision restricted Berkshire-owned utilities PacifiCorp and NV Energy and 19 other affiliates from offering power at market rates in the PacifiCorp East (PACE), PacifiCorp West (PACW), Idaho Power and NorthWestern Energy areas based on concerns about horizontal market power. (See Berkshire Market-Based Rate Sales Restricted in 4 BAAs.)

In its Dec. 21 order, the commission rejected Berkshire’s contention that the June ruling had denied the company due process because of FERC’s failure to convey “newly announced standards for determining market power” ahead of the company’s initial “change in status” filing, which was triggered by the 2013 acquisition of NV Energy (ER10-2475, et al.).

“We clarify that the June 9 order did not create new criteria for obtaining or retaining market-based rate authority,” the commission said. “Rather, in the June 9 order, the commission identified areas where the [Berkshire companies’] analysis fell short of existing requirements and, where appropriate, provided suggestions for meeting the requirements.”

The commission did approve the Berkshire subsidiaries’ revised market-based rate tariffs filed in compliance with the June order and clarified that the companies are entitled to propose new cost-based rates for making sales into the four areas, rather than being limited to relying on default cost-based rates.

The commission also terminated the Section 206 proceeding on the matter.

In its June 9 order revoking market-based rate authority, the commission found that the Berkshire companies failed to provide reliable delivered price test (DPT) analyses rebutting the presumption of market power in the four balancing authorities.

FERC policy allows companies to submit a DPT after failing the indicative “pivotal supplier” and “wholesale market power” screens for initially assessing horizontal market power within a balancing area.

The DPT offers a company the chance to provide more granular market power assessment that factors in native load commitments to determine a supplier’s “available economic capacity” — energy available for offer in the open market.

The commission’s decision to revoke Berkshire’s market-based rate authority ultimately rested on what the commission called a “flawed” DPT analysis from the company. The commission pointed to Berkshire’s failure to calculate unique season and load levels for each of the four areas, instead relying on assumptions based on data for only the PACE area.

In its July 11 request for rehearing, Berkshire countered the commission’s findings by arguing that each of its 57 “unique” DPT analyses “was prepared in accordance with the commission’s previously announced requirements and each was similar in form and substance to” analyses the commission had previously approved. (See Berkshire Contests Market-Based Sales Restriction in West.)

“The [Berkshire companies] failed to provide any historical transmission data, eTag or otherwise, to corroborate the results of their DPTs as required by section 33.3(c)(6) of the commission’s regulations,” the commission responded in its Dec. 21 order. Furthermore, based on its own review of transmission data, the commission said it was unable to corroborate the DPTs.

The commission also noted its longstanding policy of requiring companies to compare actual trade patterns with DPT results.

“This is not a new standard or a higher threshold test; it is the obligation the commission has required for DPTs since 1997,” the commission said.

The commission also rejected Berkshire’s contention that it had failed to follow past practice by not allowing the company opportunity to correct mistakes in its original submittal.

“The [Berkshire companies] were given many opportunities to correct errors in their DPT,” the commission said, citing a Dec. 9, 2014, order describing “multiple deficiencies” in the supporting data for the tests. The commission pointed out that FERC staff met the Berkshire representatives to discuss that order.

The commission additionally dismissed Berkshire’s claim that the commission failed to make a “definitive finding” that the company possesses market power in all four regions before revoking market-based rate authority, as required under FERC Order 697. After failing the initial market power screens, Berkshire, not FERC, had the burden of proof, the commission said.

“If the commission cannot revoke market-based rate authority in areas where sellers fail to rebut the presumption of market power created by a failure of the indicative screens, then sellers could deliberately submit inadequate evidence for the commission to analyze and thus be allowed to keep their market-based rate authority in perpetuity,” the commission said.