By Tom Kleckner

Fifteen years after it first opened, ERCOT’s competitive electric market is pretty much running on cruise control. It has ample low-cost electricity to meet Texas’ growing demand and continues to add renewable resources. And 2016 will go on record as having the lowest prices ever.

Sure, protocols always need tweaking, the ISO’s reliability-must-run practices still draw stakeholder complaints and there are congestion concerns in Houston, West Texas and the Rio Grande Valley. But otherwise, ERCOT enters 2017 with a grid those in power see as the envy of others.

“Nobody has a competitive market like ours,” Texas Public Utility Commission Chair Donna Nelson said during a July meeting. The PUC has regulatory oversight of ERCOT, and Nelson often trades quips during open meetings with her two fellow commissioners over the market’s success.

Load-weighted average wholesale prices for 2016 were less than $25/MWh, far below the 2008 high of $77.19/MWh. Average prices have stayed below $41/MWh in seven of the last eight years. Not surprisingly, customer complaints to the PUC fell to 4,835 complaints, down from 6,973 the previous year, according to the Texas Coalition for Affordable Power.

The ISO, which boasts more than 18,000 MW of installed wind capacity, set a new record for wind energy production Christmas morning with 16,022 MW.

With 7 million smart meters, the Texas Interconnection is also one of the more advanced grids around. “We’ve got a retail market that offers customers choice in a way that’s more mature and more fulfilled than any other retail market in the world,” ERCOT CEO Bill Magness said in November.

DER Focus

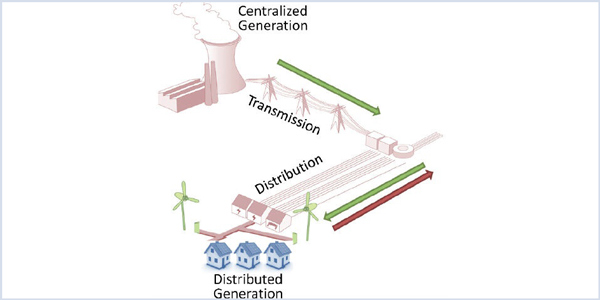

Much of the focus in 2017 will be on accommodating distributed energy resources and determining how those smaller power sources can be aggregated to predictably meet demand.

In preparation for the new year, ERCOT staff have been working to map the system’s smaller (greater than 1 MW that inject to the grid) registered distributed generation units and on a white paper addressing DER’s reliability. Both efforts are picking up on the work of the Distributed Resource Energy and Ancillaries Market (DREAM) Task Force, a two-year effort that ended last year with a report that made eight recommendations.

The ISO estimates it has 900 MW of DG in its competitive areas (which doesn’t include the cities of Austin or San Antonio). It expects DG to grow at 10% annually, which is why staff wants to account for the DER on the system in both competitive and noncompetitive areas.

“With an 80,000-MW system, that’s not a huge penetration at this point,” Magness said. “These resources don’t raise a long-term reliability issue — they’re not waving a red flag — but we expect to see a lot more, whether for environmental reasons or people wanting energy independence. If you don’t know you have a large cluster of DG, your load forecasts are not going to be right.”

Magness likes to joke about the Austin moving company that has the motto, “If we can get it loose, we can move it.”

“If we can see it, we can integrate it,” he says.

Ancillary Services

ERCOT is also looking to improve its visibility into ancillary services and inertia data. Its existing ancillary services framework was lifted from a market design developed in the 1990s, and staff and stakeholders have been working since 2013 to unbundle the services and improve the market’s ability to handle DG, fast-acting storage devices, smart-grid technologies and other new developments.

A staff proposal to separate responsive reserve service into fast-frequency response, primary frequency response and contingency reserve service categories did not receive sufficient stakeholder support to move forward. A Brattle Group report on these “future” ancillary services determined they would offer economic benefits “on the order of 10 times the [estimated $12 million to $15 million in] implementation costs.”

ERCOT currently spends about $500 million annually on these services.

The ISO could also face an RMR rulemaking (Project No. 46369) in 2017 from the PUC. The commission held a workshop on the practice in December, gathering feedback from market participants on how it might limit a practice that even Magness has acknowledged can be a “blunt instrument.”

Reliant Energy’s Bill Barnes, who failed to gain enough support this summer for a protocol change that would price RMR units at the end of the dispatch queue, said during the workshop that the process “indicates the market has failed to retain and attract sufficient resources to meet ERCOT’s reliability criteria. The best solution to RMR is to not have any.” (See “Board Rejects RMR Mitigated-Offer Appeal, Lets Stakeholder Process Move Forward,” ERCOT Board of Directors Briefs.)

Barnes, the PUC staff and other stakeholders discussed modifying the RMR-evaluation timeline, the ERCOT board’s approval of RMR agreements potential changes to the review methodology.

Currently, RMR units are subject to the same offer mitigation as other units.

The ISO this year should complete much of its technology “refresh,” a four-year, $48 million initiative updating its computer technology. The final three of the 11 refresh projects — remote access and two telecom efforts — are scheduled to begin in 2017. By the end of 2017, ERCOT will have updated its database servers and core network.

The project has already spent 40% of its budget, Magness said in December, and it is expected to come in under or at the $48 million target.