By Robert Mullin

FERC has affirmed a previous ruling stating that evidence of price reporting deficiencies by power sellers during the Western Energy Crisis of 2000-2001 cannot constitute the sole basis for a finding of market manipulation during the event.

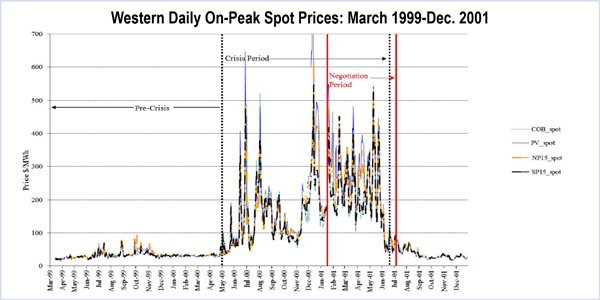

The commission’s Jan. 9 order clarified a key element of an October 2016 decision that gave credence to California’s contention that a failure of some power sellers to file compliant price reports with FERC may have helped conceal market manipulation, which in turn created a “pricing umbrella” under which California’s Department of Water Resources was compelled to sign overpriced contracts near the conclusion of the crisis (EL02-71). (See FERC to Consider Western Energy Crisis ‘Umbrella Pricing’ Theory.)

That decision opened the door for the California parties to the ongoing proceeding — which include the Public Utilities Commission, the state’s attorney general’s office, Pacific Gas and Electric and Southern California Edison — to introduce evidence of reporting deficiencies as part of the examination of factors that enabled sellers to charge the state exorbitant contract rates.

The October ruling prompted Shell Energy North America, TransCanada Energy and Hafslund Energy Trading, collectively referred to as the “indicated respondents,” to ask the commission to affirm a previous finding that “evidence supporting a pricing umbrella argument cannot in and of itself establish liability” for any sellers still involved in the energy crisis proceeding.

“Out of an abundance of caution, indicated respondents respectfully seek clarification and confirmation of the commission’s ruling,” the companies said in a November 2016 filing with the commission.

The three companies said that they assumed the commission would only permit the introduction of pricing umbrella evidence as a means to “provide greater context and depth to actual probative respondent-specific evidence regarding the California parties’ claims for remedies against respondents.”

Pricing umbrella evidence would not in and of itself represent such probative evidence, the companies contended.

“Therefore, for example, no pricing umbrella evidence can alleviate the California parties’ burden to establish that a reporting deficiency ‘masked an exercise of market power or other overt manipulation [by a respondent] in order to demonstrate the required nexus between an unlawful act and an unjust and unreasonable rate,’” the companies said, citing the commission’s previous finding.

FERC’s Jan. 9 order confirmed the companies’ understanding of how the pricing umbrella theory will be applied in the proceeding.

The order notes that the commission will “continue to find that evidence of a third party’s conduct [in filing deficient reports] is not relevant to this showing because the focus of the Mobile-Sierra inquiry [into the contracts] is the conduct of the seller and whether that conduct directly affected contract prices.”

That language echoed the commission’s previous determination that evidence of a reporting violation alone could not overcome the Mobile-Sierra presumption of the “justness and reasonableness” of a contract. Such a finding would require evidence of an actual intent to manipulate markets.

“We clarify that, while we will permit the introduction of pricing umbrella evidence solely for the purpose of providing greater context and depth for probative, seller-specific evidence, this evidence should not be treated as evidence that can be the basis of a finding of refund liability,” the commission said. “We thus affirm that pricing umbrella evidence is not an element upon which a finding of refund liability may be based in this proceeding.”